There are no macroeconomic reports scheduled for Friday. Therefore, market movements today are likely weak and non-trending. However, it's important to remember that Donald Trump remains the President of the United States. This means that a new tariff package could be announced at any moment, or the U.S. president could make another high-profile decision that forces the market to sell off the dollar. Just this week, Trump fired the head of the U.S. Bureau of Statistics because he disliked the latest labor market data.

There are no key fundamental events scheduled for Friday. However, earlier this week, Neel Kashkari and Mary Daly expressed dovish expectations regarding possible changes to the Federal Reserve's monetary policy in September. As such, the "dovish wing" within the Fed is growing stronger, which only suggests further potential decline for the dollar.

The primary concern for traders remains the trade war, which intensified further last week. We still believe that any trade agreement that maintains tariffs is essentially the same trade war, just "under a different label." For the United States, deals like those signed with the European Union or Japan are certainly beneficial. Therefore, each new similar agreement could trigger short-term growth in the U.S. dollar. However, from a broader and more fundamental perspective, the market is likely to remain focused on the new trade architecture and Donald Trump's protectionist policy.

This week, the U.S. president made several significant and controversial decisions, along with some high-impact statements. The flow of information from the White House may continue on Friday, so market participants should be prepared for anything. There is no reason to relax while Trump remains President of the United States.

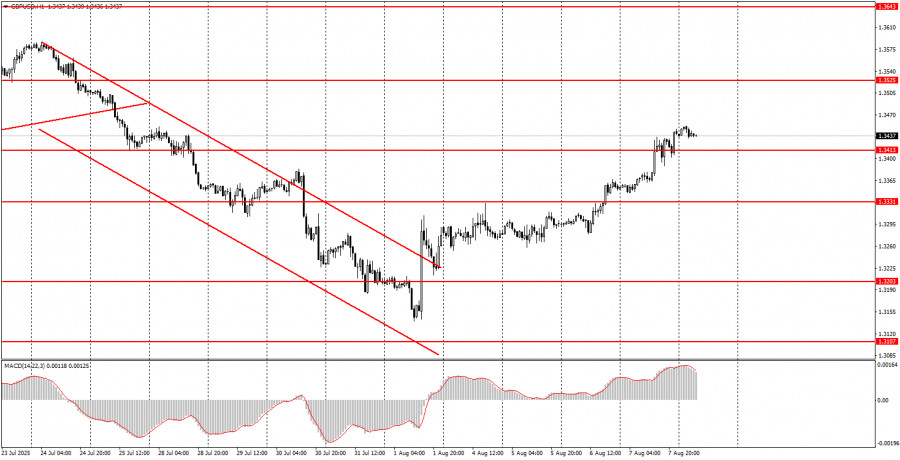

On the last trading day of the week, both currency pairs could continue the uptrend that began last Friday. In our view, there have been enough negative developments for the dollar — both last Friday and throughout this week — for the decline to persist. The euro may continue rising from the 1.1655–1.1666 area, and the British pound from the 1.3413–1.3421 area.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

QUICK LINKS