The S&P 500 started strong but ended weak. After a 1.9% surge at the beginning of the trading session, driven by the positive results from NVIDIA for the third quarter, the broad stock index quickly reversed direction and closed in the red, down 1.6%. The reasons behind such a dramatic rollercoaster remain unclear.

Dynamics of US Stock Indices

NVIDIA's revenue and profits are indeed impressive, but one company alone cannot carry the weight. Even this largest company in the world is supported by other players in the tech sector spending colossal amounts on artificial intelligence, yet their results leave much to be desired. The bubble of tech giants is the main concern for investors, according to a Bank of America survey.

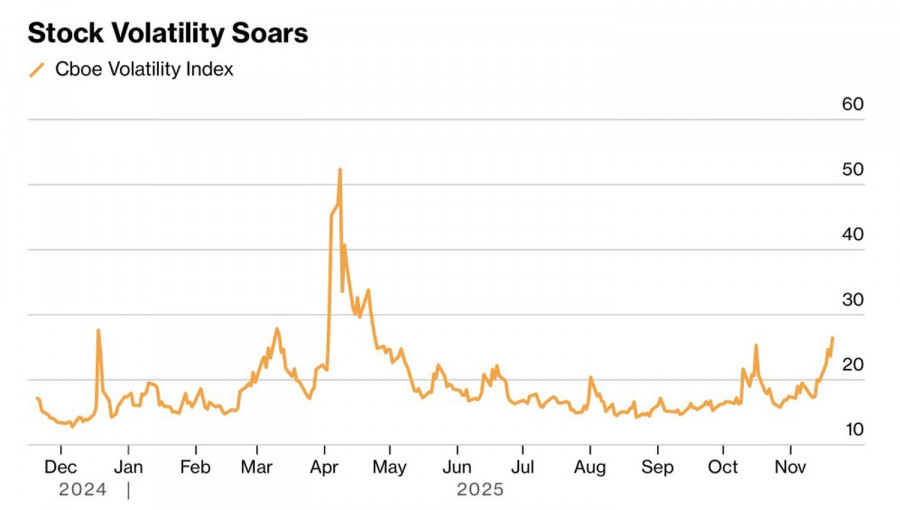

Signs of its emergence pushed the VIX volatility index up by 10% at the end of the trading session and by 50% in November. Greed in the stock market has given way to fear, and with the earnings season coming to an end and a nearly bare calendar for fresh data, institutional investors are taking profits, resulting in the S&P 500's pullback. The decline in the broad stock index is further fueled by the closing of momentum trades and retail investors. According to JP Morgan, they became net sellers of American stocks last week, offloading $728 million.

Dynamics of CBOE VIX Fear Index

When everyone is selling, there's a great opportunity to buy at a lower price. Executives of publicly registered companies, or so-called insiders, have been purchasing shares of their own firms at the fastest pace since May over the past 30 days. These are long-term investors who are using the panic surrounding artificial intelligence to load up on undervalued stocks.

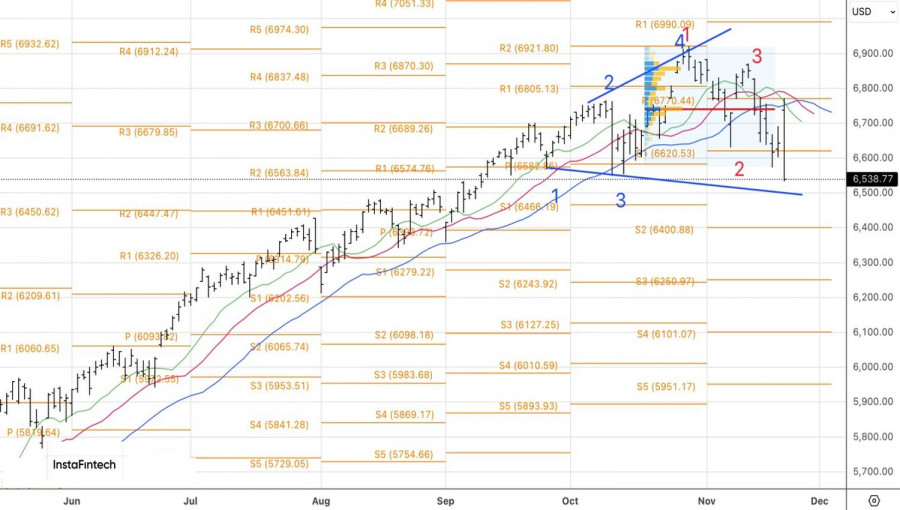

Despite the 5.5% pullback in the S&P 500 from record high levels, bulls remain optimistic. According to Citadel Securities, a healthy correction lays the groundwork for a recovery in the broad stock index. By 2025, thanks to high retail investor demand, strong results from NVIDIA, and seasonal factors, it is expected to rise to 7,000.

However, such statements currently seem unlikely. Bears find reasons to sell not only due to fear of an AI bubble or the Fed's reluctance to lower rates but also because of the rout in the cryptocurrency market. Bitcoin has long been perceived as a canary in the coal mine. Its decline serves as a reason to sell off the entire class of risky assets, including American stocks.

Technically, an Expanding Wedge pattern was formed on the daily chart of the S&P 500. Upward corrections should be used to build short positions opened below the fair value of 6,740. Target levels are set at 6,400 and 6,255.

RÁPIDOS ENLACES