He who does not change his views as circumstances change resembles a person who leaves the house in the same clothes in any weather, be it sun or snow. Goldman Sachs continues to insist on a bright future for the euro and forecasts an EUR/USD rally to 1.22 by the end of 2026, relying on the old drivers: lower US rates, Chinese stimulus, threats to the Federal Reserve's independence, a renewed demand for hedging the risks of buying US assets, and a narrowing of the GDP growth gap between the United States and the eurozone.

In some respects, Goldman Sachs is right. US 30-year mortgage rates have fallen to their lowest levels since September 2024. This is one of the lowest readings since 2022, which should support the housing sector and help accelerate GDP.

Nevertheless, mortgage costs in the US do not matter much for EUR/USD. Investors pay attention to other rates — the Fed's and those on the debt market. At the same time, in the derivatives market, there is growing interest in the possibility that the Fed will extend its pause in monetary tightening until the end of the year. Pushing back expectations for the resumption of easing from March–April to June, especially after December's US labour-market data, allows the US dollar to dominate Forex at the start of the year.

The threat to the Fed's independence, in the form of the Department of Justice filing a lawsuit against Jerome Powell, only temporarily scared the EUR/USD bears. The subsequent retracement of the major currency pair upward provided a reason to sell. Investors found a pattern in which the escalation of the conflict between Donald Trump and the Fed chair allows them to buy the dips in the USD index. After all, the central bank is not a one-man theatre. FOMC decisions are made collegially, and the White House will have to go to great lengths to convince the Committee to cut rates to 1%.

I doubt that demand for hedging investments in US equities will grow over time. Their attractiveness is falling as interest in AI technologies wanes. High rates make hedges expensive.

Gradually, the topic of narrowing the growth gap between the US and the eurozone is receding into the background. The World Bank was surprised by the resilience of the US economy and raised its forecasts for the US economy from 1.4% to 2.1% for 2025 and from 1.6% to 2.2% for 2026. By contrast, the start of 2026 brought many disappointments for the eurozone in macro data. As a result, the economic surprise index fell to its lowest level in months. It is not certain that the convergence story will play out.

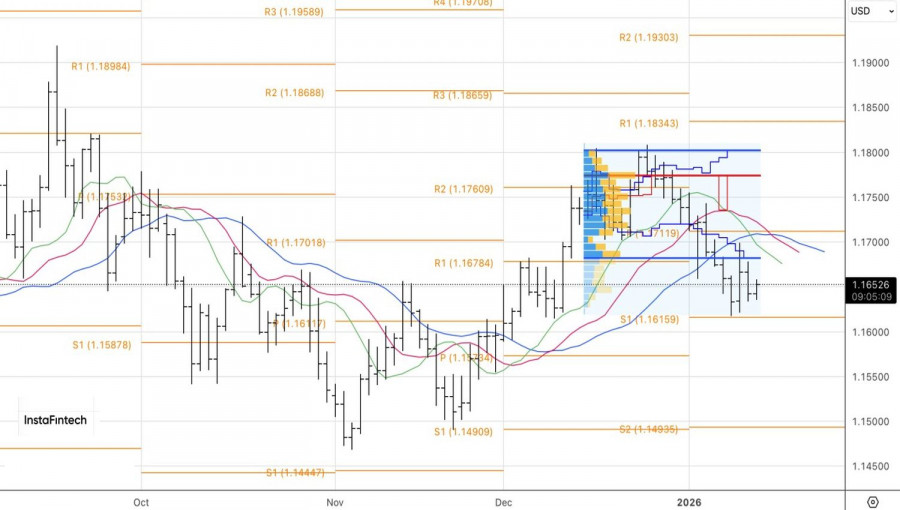

Technically, an inside bar has formed on the daily chart of EUR/USD. It is being played out by placing pending buy orders from 1.168 and sell orders from 1.163. Given the clear strengthening of the US dollar against major world currencies, the second option looks preferable.

QUICK LINKS