Pražská burza dnes dál posílila, index PX stoupl o 1,11 procenta na 2047,58 bodu. Nahoru ho táhla především Erste Bank, jejíž akcie si polepšily zhruba o čtyři procenta. Se ziskem zakončily i Komerční banka, Moneta Money Bank či VIG, naopak energetický ČEZ oslabil. Vyplývá to z údajů burzovního webu.

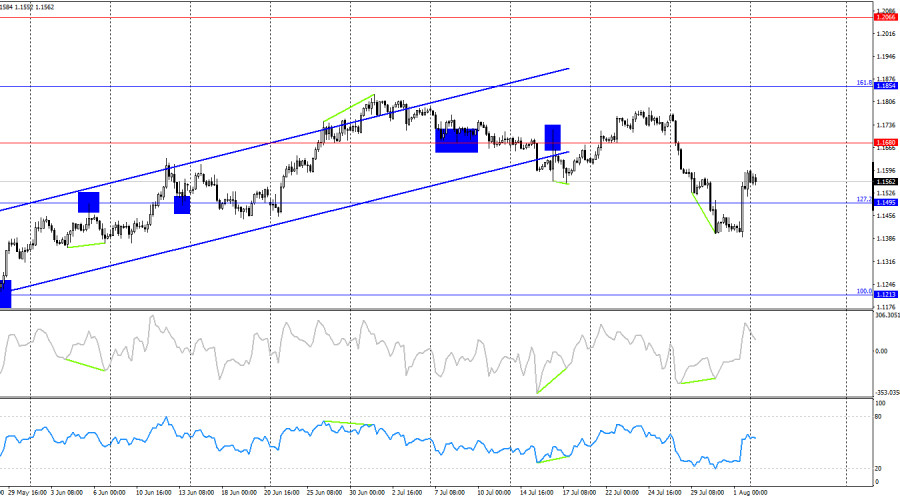

On Friday, the EUR/USD pair reversed near the 161.8% corrective level at 1.1416, turning in favor of the euro and surging sharply. The consolidation above the 100.0% Fibonacci level at 1.1558 opens the possibility for continued growth, but for now, the overall trend remains bearish. Therefore, a more likely scenario is consolidation below the 1.1558 level, which would signal a potential return to the downward movement toward 1.1416.

The wave structure on the hourly chart remains simple and clear. The most recent completed upward wave broke the previous peak, while the latest downward wave broke the prior low. As such, the trend can still be considered bearish, although it has recently been shifting frequently due to the news background. Donald Trump managed to sign several favorable trade deals, which gave strength to the bears, as did Jerome Powell's statements following the latest Fed meeting. However, the latest labor market data and the changing outlook for Fed monetary policy have now shifted momentum to the bulls.

Friday brought a shock to the bears, who had been steadily pushing the market downward in recent weeks. Many traders believed that the worst was behind the U.S. economy and the dollar. And why not, given that Donald Trump successfully struck excellent trade agreements with the EU, Japan, and several other countries, and the economy grew by 3% in Q2? It seemed Trump had been right in his predictions, and a new golden era was beginning after a short downturn. However, Friday's economic data forced many traders to rethink their stance on the dollar and the U.S. economy. It was revealed that the number of Nonfarm Payrolls jobs created in July was far below expectations, and—on top of that—data for June and May were revised downward. This is an unprecedented case; I can't recall the last time something similar happened. As a result, the bears had no choice but to flee, and whether they'll recover from this blow anytime soon is a big question.

On the 4-hour chart, the pair reversed in favor of the euro and consolidated above the 127.2% corrective level at 1.1495. This means the upward movement may continue toward the 1.1680 level. Traders should not be discouraged by the fact that the pair closed below the ascending trend channel—it doesn't guarantee the formation of a long-term bearish trend. In fact, the most recent news flow suggests another decline in the U.S. dollar is more likely.

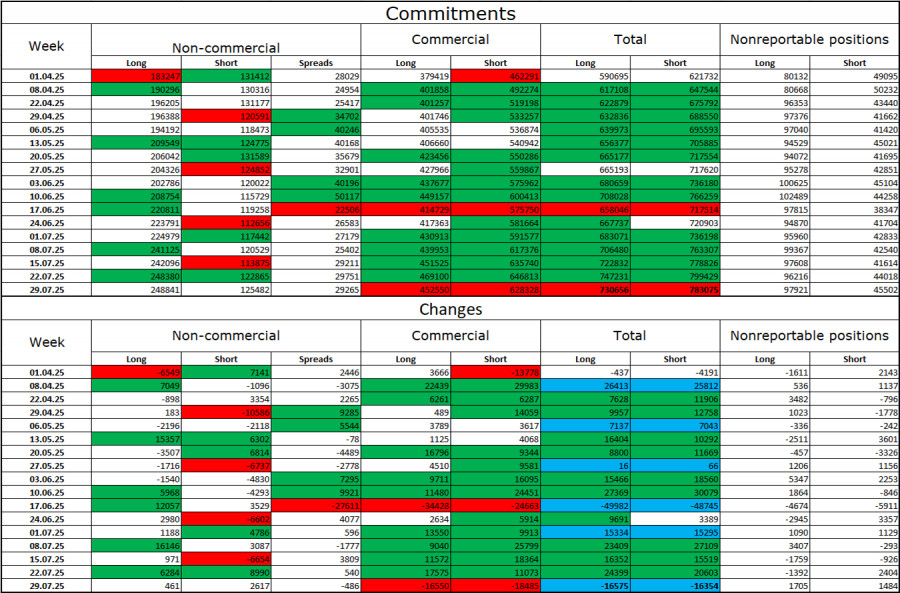

Commitments of Traders (COT) Report:

Over the last reporting week, professional players opened 461 long positions and 2,617 short positions. Sentiment among the "Non-commercial" group remains bullish, thanks to Donald Trump, and is strengthening over time. The total number of long positions held by speculators now stands at 248,000, compared to 125,000 short positions—more than a twofold difference. Also, note the number of green cells in the top table, which indicate a strong increase in euro positions. In most cases, interest in the euro continues to grow, which means interest in the dollar is falling.

For twenty-five consecutive weeks, large players have been reducing short positions and increasing longs. Donald Trump's policies remain the most significant factor for traders, as they may lead to many long-term and structural challenges for the U.S. economy. Despite several key trade deals being signed, some major economic indicators continue to show decline.

Economic Calendar for the U.S. and the Eurozone:

On August 4, the economic calendar contains no notable events. As a result, news background will have no impact on market sentiment during Monday's session.

EUR/USD Forecast and Trader Recommendations:

Selling the pair is possible today if it consolidates below the 1.1558 level, with targets at 1.1495 and 1.1416. Buying opportunities can be considered today on a rebound from the 1.1558 level, with targets at 1.1612 and 1.1645.

The Fibonacci grids are built from 1.1558–1.1789 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.

QUICK LINKS