The economic outlook for the UK has recently come under scrutiny. According to Deloitte's quarterly survey of financial directors from the country's largest companies, hiring is expected to decline at the fastest pace since the COVID era. This comes alongside reduced investment due to the government's announced significant tax increases in the budget. As a result, business optimism has fallen to a two-year low. Recent data from the Office for National Statistics (ONS), published in December, revealed that the economy contracted for the second consecutive month in October and showed zero growth in the third quarter. Additionally, the National Institute of Economic and Social Research (NIESR) has forecasted a decline in GDP for December, which appears to be materializing and offers no support for the pound.

In 2024, inflation in the UK trended downward, prompting the Bank of England to implement two rate cuts. However, there was a rise in inflation during October and November, largely attributed to base effects from energy prices. This increase is expected to subside by spring, leading UK economists to suggest that this temporary spike in inflation should not be heavily weighted in future analyses. Interestingly, while energy prices have impacted countries worldwide, the UK is unique in identifying this as a primary driver of rising inflation. In contrast, inflation in the services sector has exceeded 5%, which is higher than in many other countries, and is only slightly related to energy prices. Despite this, there does not seem to be significant concern.

When it comes to possible changes in U.S. tariff policy, the UK is in a stronger position compared to the Eurozone, as its trade with the U.S. focuses primarily on services rather than goods.

BoE Governor Andrew Bailey noted late last year that if inflation continues to decline, four rate cuts could be anticipated in 2025. The upcoming December report, to be released on Wednesday, will provide clarity on whether inflation is indeed decreasing. Current mixed forecasts suggest that headline inflation may rise from 2.6% to 2.7% year-on-year, while the core inflation figure could drop from 3.5% to 3.4%. If these predictions hold true, the markets may view the results as bearish, aligning with the BoE's forecasts and increasing the likelihood of four rate cuts.

The bond market, typically quick to respond to changes in trends, is currently showing no clear direction. By October of last year, the yield on 10-year UK gilts exceeded that of comparable U.S. Treasuries, indicating a shift in sentiment that contributed to the sharp decline in GBP/USD. However, yields have since stabilized, reflecting skepticism towards the BoE's plans for four rate cuts this year. For now, the bond market remains cautious.

In addition to the inflation report, the pound will also be influenced by industrial production and GDP data scheduled for release on Thursday, along with retail sales figures on Friday. This consistent stream of data may lead to significant market movements, but it is likely that investors will hold off until Donald Trump's inauguration, as this event is anticipated to have a more substantial impact.

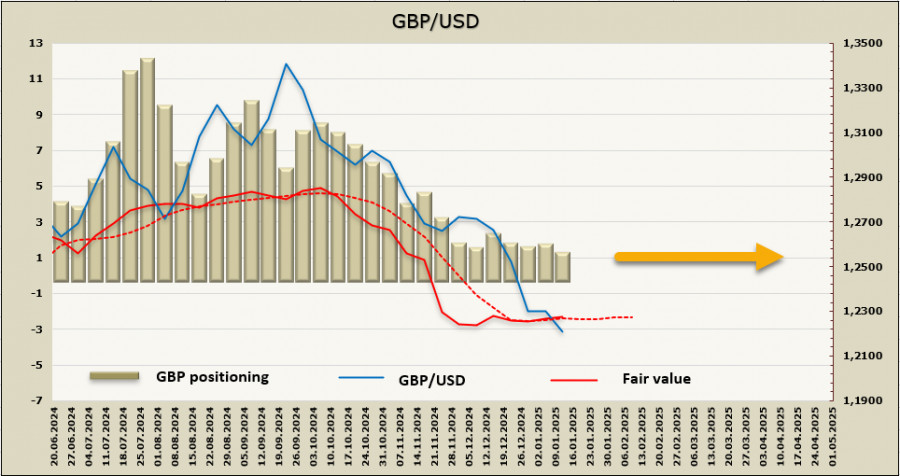

Currently, speculative positioning on the pound is neutral, with the calculated price losing momentum and lacking a clear direction.

The pound continues to be heavily sold, having slid further last week towards the support level of 1.2036. The outlook for the pound remains decidedly bearish; however, its clear oversold condition—indicated by the RSI being in the oversold zone on both daily and weekly charts—suggests a potential for a technical correction. If there is an attempt to rally, resistance is anticipated at 1.2295, where selling may resume. The primary target remains at 1.2036.

QUICK LINKS