Last Friday, US equity indices closed higher, with the S&P 500 up 0.49% and the Nasdaq 100 gaining 0.72%. The Dow Jones Industrial Average rose 0.47%.

Asian indices moved higher, following the rally on Wall Street, while Japanese stocks advanced after concerns eased about the Bank of Japan's plans to divest its large ETF holdings. The regional MSCI equity index rose 0.2%, and the Nikkei 225 jumped 1.6%. The yen weakened against the dollar, typically benefiting exporters.

The dollar advanced 0.1%, marking a fourth consecutive day of gains. US Treasuries eased slightly, with the 10-year yield up one basis point to 4.14%. Oil climbed 0.6% after last week's small decline, while silver reached its highest level since 2011. S&P 500 index futures slipped 0.1%, while European equity futures were little changed.

With earnings season approaching, expectations for American corporate profit growth are improving, suggesting the rally may continue. Sentiment was also boosted after President Donald Trump announced progress on China-related issues and said he will meet with Xi Jinping following a call between the two leaders.

Market optimism is supported not only by macroeconomic signals but also by microeconomic factors such as corporate financial stability and innovative potential. Investors are closely monitoring earnings data to gauge whether companies can sustain cash flow and adapt to changing market conditions.

Geopolitical developments also play a key role. Trump's comments on progress in trade negotiations with China are fostering hopes of easing tensions and greater global economic stability. Nevertheless, concerns remain over the possibility of unexpected policy shifts, which could add volatility to the markets.

Trump said he will meet Xi Jinping at the upcoming Asia-Pacific Economic Cooperation summit. The US president welcomed progress on the agreement to keep TikTok operational in the United States. While Chinese officials struck a cautious note in the phone call, Xi Jinping expressed confidence that Washington and Beijing can resolve their differences.

This week, traders will analyze a range of data, including economic activity in Europe and the inflation gauge preferred by the Fed. Fed Chair Jerome Powell is also scheduled to speak Tuesday on the economic outlook, after pushing back last week against expectations for rapid rate cuts.

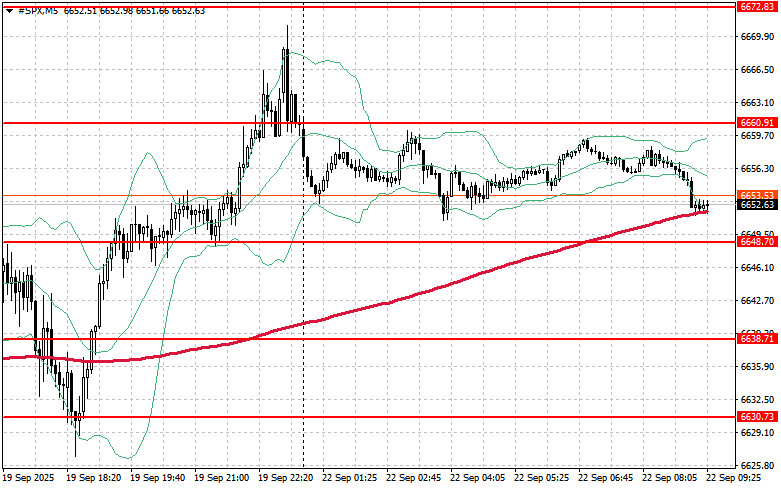

From a technical perspective, the key objective for S&P 500 buyers today will be to break through the closest resistance at $6,660. Clearing this level would pave the way for a move to $6,672. Maintaining control above $6,682 is just as important, as it would further strengthen the bulls' position. On any downside move due to waning risk appetite, buyers will need to defend $6,648. A break below this support would quickly send the index back to $6,638 and open the way to $6,630.

RÁPIDOS ENLACES