Nature loves cleanliness, but financial markets do not. The shutdown created a vacuum, sucking up all data on the state of the U.S. economy. As a result, volatility in the currency market declined, and investors displayed caution. The same situation occurred with the Federal Reserve. In August, Jerome Powell indicated that the labor market is more important to the central bank than inflation. The central bank makes decisions based on data, and if there is no employment data, how can there be a rate cut?

Since mid-October, the U.S. dollar has significantly strengthened against major global currencies amid the declining likelihood of the Fed easing monetary policy at the end of the year. While the odds exceeded 90% before the last FOMC meeting, they fell to 28% after the minutes from that meeting were released.

The euro has occasionally counterattacked amid positive developments in the Eurozone economy and assurances from European Central Bank officials that the rate-cut cycle for deposits has ended. However, the Fed's verdict at year-end was much more important for investors. As for other dollar competitors, they have shown signs of weakness even without the dollar's assistance. The yen is plunging due to governmental pressure on the Bank of Japan to maintain a pause in the normalization cycle. The pound is under pressure due to budget issues.

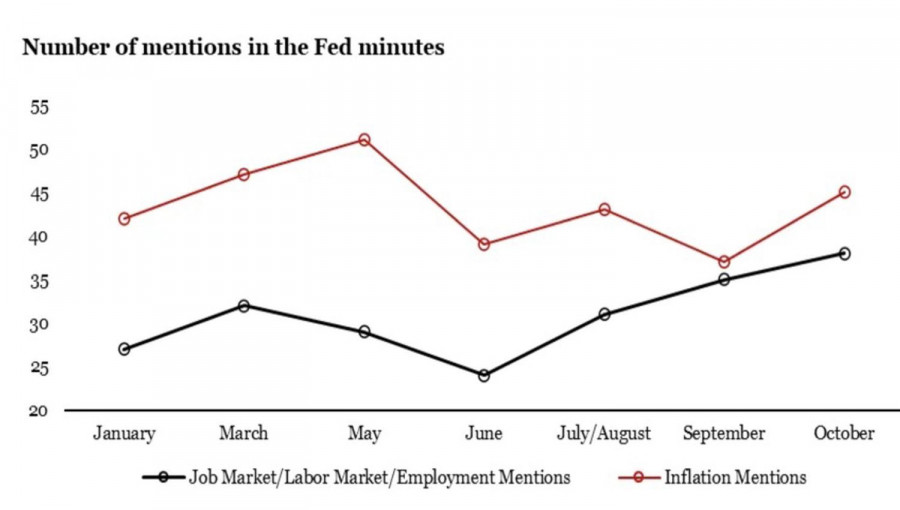

The U.S. dollar has risen amid the dominance of "hawkish" speeches by FOMC officials. Most were concerned about high prices that show no sign of falling. As a result, the gap between references to inflation and unemployment has begun to widen again. With the PCE nearing 3% instead of 2%, this is clearly a plus for the U.S. currency. High rates make dollar-denominated assets more attractive and encourage capital inflows into U.S. securities markets.

Unfortunately, in forex, everything changes at the speed of light. Those who are first today may be last tomorrow. In the minutes of the October FOMC meeting, there was resistance to a December rate cut, but readiness to continue easing monetary policy was evident. When? The futures market considers that there is a 65% probability that this will happen in January. Poor data from the U.S. economy and Donald Trump could accelerate monetary expansion.

The president jokingly stated that if the Fed does not lower rates, Scott Bessen would resign alongside Powell. However, in every joke, there is a grain of truth. The owner of the White House will stop at nothing to reduce borrowing costs to 1%. And that is an entirely different story—one that is unfortunate for the U.S. dollar.

Technically, the daily chart of EUR/USD shows a decline in quotes for the fifth consecutive day. However, a return above the low of the previous bar with a wide body near the 1.1520 mark will activate the 20-80 pattern and provide a basis for buying. Long positions can be increased on a breakout above the 1.1535 resistance level.

SZYBKIE LINKI