Gold is back in the spotlight of financial markets, and the reasons are much deeper than just another reaction to news. At the end of November 2025, the metal rose to its highest level in more than a week—and although there was a slight correction afterwards, the overall dynamics suggest the market is entering a phase where even moderate signals from the Federal Reserve can shift sentiment by dozens of dollars per session.

An interesting situation is unfolding: amid discussions of potential U.S. rate cuts, gold is rising despite a strong dollar. A major new player—Tether—has emerged on the market, quietly but steadily becoming the largest holder of gold outside of central banks. All of this occurs as the global economy closely monitors postponed macro data from the U.S., which could set the tone for the markets for months to come.

Recent comments from Federal Reserve officials have become the primary catalyst for gold's rise. Statements from Christopher Waller and John Williams were softer than markets expected: both officials conceded that rate cuts could happen in the "near future," with Waller specifically noting that the labor market has cooled enough to warrant an additional rate cut.

For gold, this is a direct positive signal: the value of bars increases as yields fall and real rates weaken.

When investors expect Fed easing, gold benefits for two reasons:

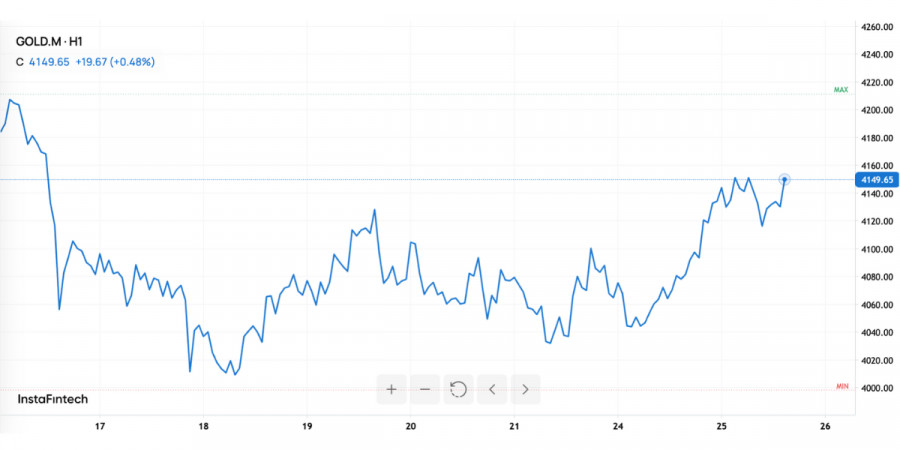

This logic was confirmed in quotes: earlier in the day, gold surged over 2%, hitting a new high since November 14. A slight correction followed, but market interest remained high, as evidenced by the futures market, which remained in positive territory.

Typically, a strong dollar is a headwind for gold. The metal becomes more expensive for holders of other currencies, which traditionally puts downward pressure on the price. Currently, the dollar remains near a six-month high; however, gold still remains strong. This is an important point: such divergence indicates a structural change in demand.

Such periods often precede medium-term gold rallies.

Arguably, one of the most underestimated yet significant developments is the sharp increase in demand for gold from Tether. The company has already acquired about 116 tons of the metal, making it the largest buyer outside central banks. This is a rare occurrence where the cryptocurrency business becomes a structural player in the commodities market.

Why is this important?

This scenario creates a "domino effect": when one major player publicly increases reserves, it encourages other institutional investors to reconsider their portfolios in favor of gold.

Recent sessions have been characterized by increased volatility, primarily because the publication of important U.S. economic reports has been delayed. Investors are anticipating retail sales figures and producer price index data, which will help clarify the likelihood of a rate cut in December.

According to market expectations:

Such figures inevitably push gold higher, and even current fluctuations do not alter the overall trend.

From a technical perspective, gold is experiencing a normal correction after a sharp jump.

Current Levels:

Current supports are forming near the $4,050–$4,080 zone, while resistances are around $4,160–$4,200. As long as the price holds above the local low, the bullish scenario remains preferred. The market indicates that buyers are ready to enter on dips, and short corrections are an opportunity to build positions rather than panic.

Some analysts are already claiming that structural dollar weakness could push gold to $4,700 per ounce by 2026. While this sounds ambitious, it seems realistic considering:

Global funds have already begun reevaluating positions, once again including gold in long-term strategic portfolios.

Several scenarios exist, each supported by strong arguments:

The gold market is currently driven by several fundamental forces—a dovish Fed rhetoric, unexpected activity from major players like Tether, structural dollar weakness, and rising safe-haven demand. This creates a rare situation in which gold rises even amid a strong U.S. currency and high macro data uncertainty.

Such a combination typically leads to prolonged bullish phases, and all indicators suggest that 2025–2026 could be such a period.

فوری رابطے