The UK labor market report for August showed no indication that inflationary pressure is likely to ease. Average wages, including bonuses, rose by 5% year-over-year over the last three months, significantly higher than the previous reading of 4.7%. At the same time, unemployment increased, as did the number of jobless claims. Adjusted for inflation, the real annual growth in total wages increased by 1.2%, which is also higher than for the previous three-month period.

On a broader scale, there has been no change in the inflation outlook. In September, the National Institute of Economic and Social Research (NIESR) published calculations from its own inflation forecasting model, which incorporates key real-economy indicators such as GDP, producer prices, and 10-year bond yields. The model indicated a high probability that consumer inflation will remain in the 3.7% to 4.0% range through April 2026. If certain price-suppressing factors are excluded from the model, it even projects a peak near 6% by June 2026.

This suggests that the downward trend in inflation is nearly absent at this stage. As a result, the Bank of England will likely remain in a difficult position for an extended period. There is no basis to lower the interest rate, while maintaining a high interest rate exerts a strong negative effect on the UK economy.

For the pound, this environment implies bullish potential, as a high interest rate translates into a higher yield. The risk factor lies in the economic slowdown. However, the next GDP report is still some time away, and the threat of recession remains speculative for now.

At present, the pound is declining, but this is largely a consequence of broad U.S. dollar strength across the global currency market. The pound is moving in step with worldwide trends. If the dollar fails to sustain its bullish trend, there is a strong likelihood that the pound will return to an upward trajectory in the long term.

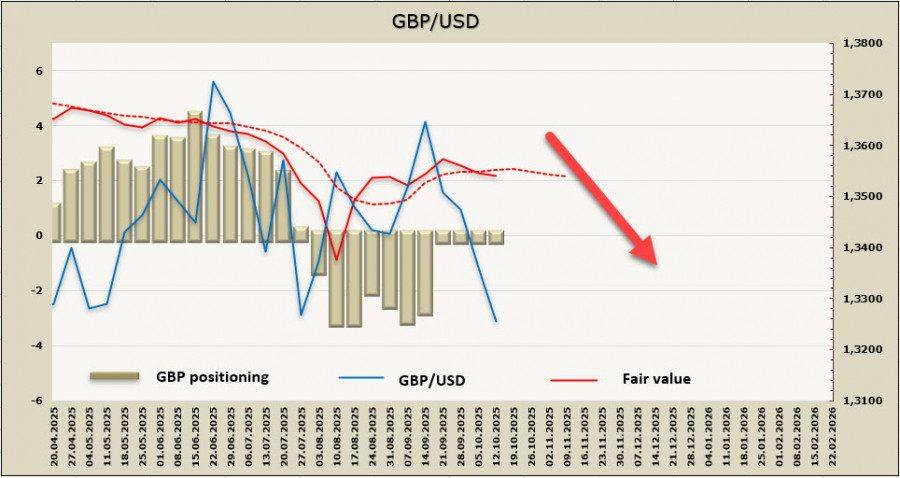

The fair value has dropped below the long-term average.

As long as GBP/USD remains above the support level at 1.3140, the pair is trading within a broader range, and the probability of remaining within this range remains high. At the same time, more and more signals point to a potential downward reversal. Notably, the local top from September 17 formed below the 1.3877 level, and the turn downward in the fair value suggests that fundamental factors now increasingly support continued decline. A test of 1.3140 is expected, and a breakout could strengthen bearish momentum.

It is important to note that the bearish impulse is currently short-term in nature, and it is still too early to speak of a transition into a long-term downtrend.

فوری رابطے