Praha – Zavedení eura v nejbližším možném termínu, zavedení daně ze slazených nápojů či zřízení ministra pro inovace, vědu a vysoké školy od roku 2027 prosazují ve svém programu pro podzimní volby do Sněmovny vládní Starostové a nezávislí (STAN). Program představili na svém sněmu v Praze. V oblasti bezpečnosti se chce hnutí soustředit i na posilování odolnosti společnosti, strategickou komunikaci či duševní zdraví občanů.

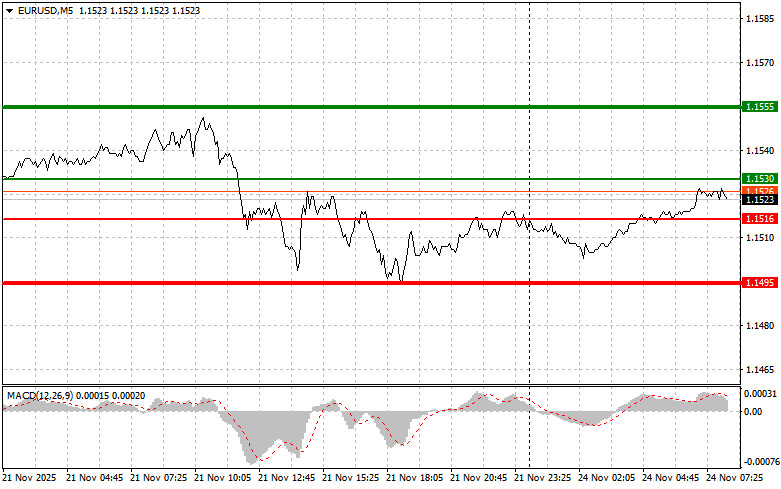

The test of the price at 1.1506 occurred when the MACD indicator had moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the euro.

Despite the decline in the U.S. manufacturing PMI, the rise in the services sector mitigated the negative effect, supporting the U.S. dollar. However, even considering the positive data from the services sector, the overall situation remains contradictory. Inflation, while showing signs of slowing, is still significantly above the Federal Reserve's target level of 2%, creating a complex task for the central bank to balance between suppressing inflation and risking economic growth slowdown. Consequently, the upcoming Fed meeting will be a key factor in shaping the dollar's future dynamics.

This morning, data from the German IFO business climate index will be published, including current conditions and economic expectations. Following that, speeches are scheduled from European Central Bank President Christine Lagarde and Bundesbank President Joachim Nagel. Markets will pay particular attention to the German IFO indicators as they reflect confidence in the leading Eurozone economy. Positive data exceeding forecasts could indicate resilience in German industry against current global challenges, which, in turn, would support the euro.

Simultaneously, the speeches by Lagarde and Nagel will be analyzed for signals on the ECB's future policy. Investors will look for hints about the ECB's willingness to proceed cautiously, which would positively impact the European currency.

Regarding the intraday strategy, I will primarily rely on the implementation of scenarios #1 and #2.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

PAUTAN SEGERA