"Strong economies support strong currencies." This fundamental analysis principle remains valid. While tariffs and Donald Trump's hardline anti-immigration policies are expected to weigh on U.S. GDP in 2026, the "big and beautiful" tax cut legislation will only sugarcoat the damage. In contrast, Europe is set to benefit from rising defense spending and fiscal stimulus from Germany — factors supporting the ongoing uptrend in EUR/USD. That said, no trend exists without corrections.

From 2022 to 2024, the U.S. dollar dominated the Forex market, driven by the exceptional performance of the American economy and stock indexes, which considerably outshone their European counterparts. However, Trump's policies have since flipped the narrative. "Buy America" gave way to "Sell America." Still, foreign investors couldn't entirely abandon the most liquid and expansive stock market in the world — the 35% rally in the S&P 500 off the April lows is proof of that.

European equities significantly underperformed in Q2 and Q3, making it hard to argue that the rally in EUR/USD is primarily driven by capital flows from North America to Europe. Instead, foreign investors have been hedging dollar risks by selling the greenback. According to Nordea, this has been the main contributor to the euro's strength. The bank forecasts a continued euro rally toward $1.26 by 2027 — or possibly sooner if the Federal Reserve adopts an aggressively dovish monetary policy.

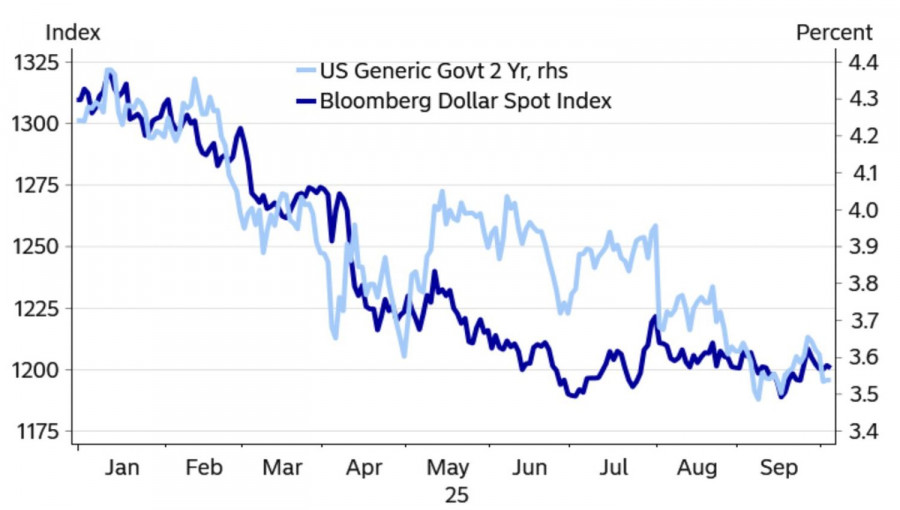

The U.S. dollar remains highly sensitive to changes in Fed funds rate expectations and corresponding moves in Treasury yields. While the current government shutdown has dulled that sensitivity to some degree, it hasn't removed it completely.

During Trump's first term, the government shutdown lasted 35 days. If history repeats itself, the Fed will go into the October meeting without seeing the September payrolls report — leaving the ADP stats as the only reference point. And the latest ADP figures suggest a sharp cooling in U.S. employment.

As for the so-called political crisis in France, it is largely a temporary concern. While investors are nervous about parliamentary elections, once scheduled, such a vote would reduce uncertainty — ultimately supporting EUR/USD. The National Rally party currently enjoys high popularity and is expected to win a majority in the reshaped National Assembly, potentially forming a stable government. That outcome would be favorable for the euro.

In other words, if you're afraid of wolves, don't go into the forest. The faster investors' fears materialize, the sooner the correction in EUR/USD will be over.

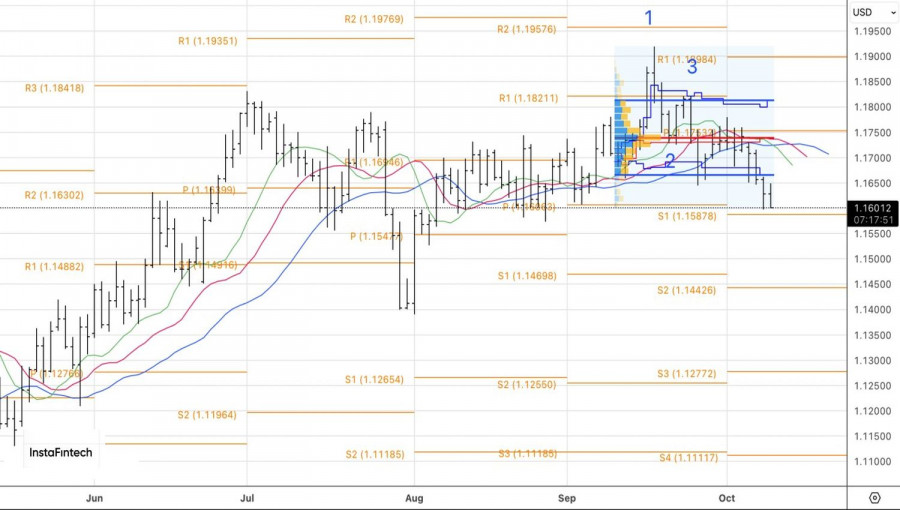

On the daily chart, EUR/USD has returned to the convergence zone between 1.0590 and 1.0605. A successful breakout below this zone would allow for an increase in short positions initiated from the 1.0710 level. A rebound, on the other hand, would provide grounds for renewed long positions.

PAUTAN SEGERA