There are quite a few macroeconomic publications scheduled for Friday, and among them some will be important. We should start with the European reports on industrial production in Germany and retail sales in the EU. These reports are not extremely important but could theoretically affect the value of the euro.

However, we want to remind beginner traders that currently we are observing a technical decline of the EUR/USD pair from the upper boundary of the sideways channel toward the lower boundary, and the market reacts very reluctantly to macroeconomic data.

In the United States, data will be released that cannot simply be ignored. At the same time, we do not rule out that a strong reaction may not follow, as the market continues to trade very passively. Non-Farm Payrolls and the unemployment rate are reports that have a direct impact on the Fed's monetary policy. The dollar does not need extremely positive values to continue rising, but even neutral readings from these indicators are difficult to expect at this time.

Analysis of Fundamental Events

Several fundamental events are scheduled for Friday: speeches by Philip Lane, Neel Kashkari, and Thomas Barkin. This year, several members of the Federal Reserve's Monetary Committee have already made comments, but these comments are practically meaningless in the context of Powell's December position and the Fed as a whole, especially given the absence of new data on unemployment, inflation, and the labor market.

Labor market and unemployment data will be released today, but it is unlikely that Fed representatives will have enough time to analyze them and immediately comment. In any case, the Fed is not expected to cut the key rate in January, and the ECB is not expected to change the key rate during the first half of 2026.

Overall Conclusions

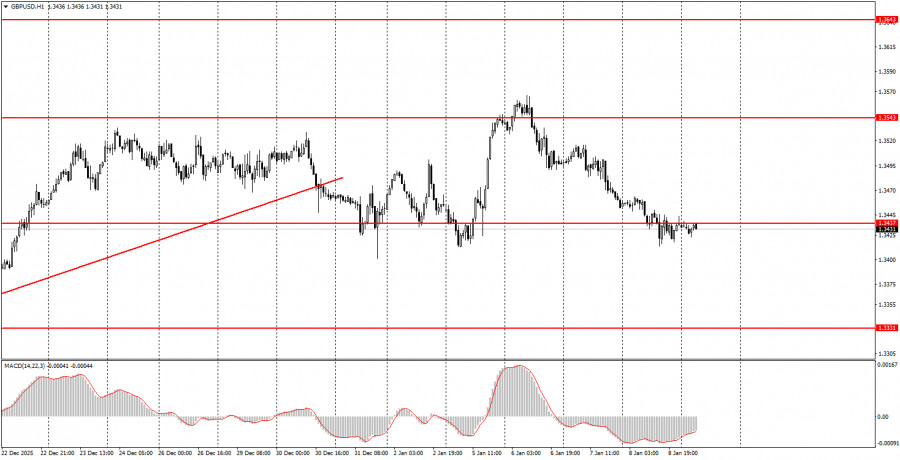

During the last trading day of the week, both currency pairs may continue to decline. The euro is within a downward trend, and the pound is moving along with it. However, today the American macroeconomic statistics will have a significant impact on market sentiment. Therefore, movements during the U.S. session can be unpredictable.

Basic Trading System Rules

What Is Shown on the Charts

Important speeches and reports (always listed in the economic calendar) can strongly influence the movement of a currency pair. Therefore, during their release, trading should be done with maximum caution or positions should be closed to avoid sharp price reversals against the prior trend.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and proper money management are the keys to long-term trading success.

QUICK LINKS