Many novice traders in the forex market deem tracking the news flow and economic data enough to see if they should buy or sell against dollar. However, this approach falls short.

Even so, Thursday saw a surge in risk appetite, primarily as a response to news that US Congress approved an increase in the debt ceiling. Extremely strong data on the number of new jobs also emerged, with the ADP reporting a jump to 278,000 against a forecast of 170,000. This number allows markets to anticipate that the promised recession in the US will not occur.

If compared to the past movements in the market, risk appetite should have dipped as year-on-year inflation fell from 7.0% to 6.1% and the month-on-month data for May remained unchanged. This did not happen, which shows that market players focus more on the events unfolding in the US, even despite ongoing tectonic geopolitical changes occurring worldwide, which do not favor the region.

Dollar may receive local support today if the employment figures from the US Treasury Department indicate an increase in the number of new jobs by 160,000. An increase in the unemployment rate from 3.4% to 3.5% will give a similar effect. However, much more feasible is a continued decline, including against euro, as investors will understand that the likelihood of a recession may weaken. A rise in the stock market may follow this scenario.

Forecasts for today:

EUR/USD

The pair is trading above 1.0760. Growing risk appetite will push the quote to 1.0845.

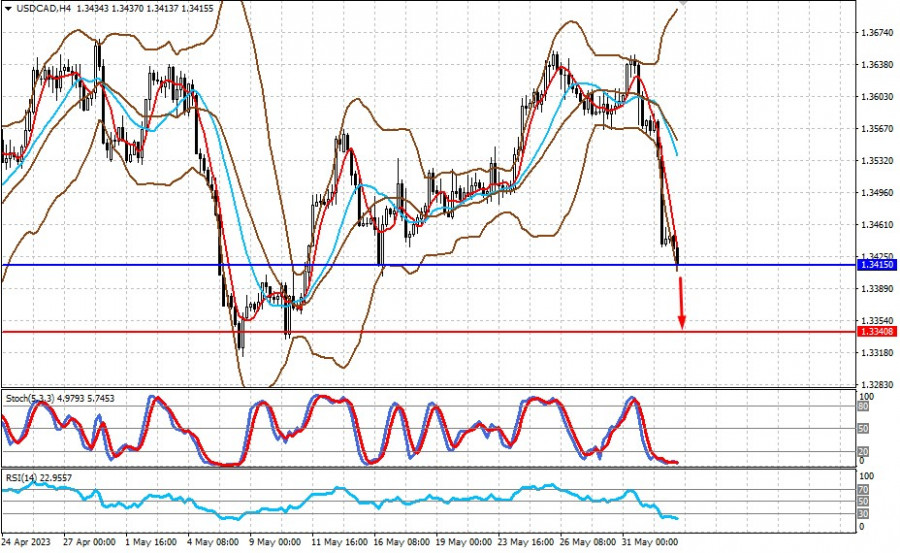

USD/CAD

The pair is trading at 1.3415. An increase in crude oil prices, together with positive market sentiment, could pressure on the pair and lead to a decline to 1.3340.

QUICK LINKS