Only one macroeconomic report is scheduled for Tuesday — the US consumer price index for December. And this report is the most important one this week. We remind novice traders that the Fed makes monetary policy decisions based on three indicators: inflation, unemployment, and the labor market. We have already seen the last two reports last week and, in our view, they were not encouraging. Only inflation remains to be seen. A new slowdown in it (in November, a drop from 3% to 2.7% was recorded) will bring the Federal Reserve closer to a new cut in the key rate. In that case, the dollar may resume its decline. Otherwise, the US currency may receive some market support, but nothing will change fundamentally.

Several fundamental events are scheduled for Monday — speeches by Thomas Barkin and Alberto Musalem (Fed). Several members of the Fed's monetary committee have already given comments this year; those comments were practically meaningless in the context of Powell's December position and the Fed's monetary policy as a whole. Three indicators will influence the Fed's rate decisions in 2026: the labor market, unemployment, and inflation. Labor market reports last week showed no improvements. Although the unemployment rate has decreased, it remains at the highest level in the last 3 years. The inflation report will be released today, after which one can make assumptions about a possible Fed decision at the January meeting.

The market's focus is now on Donald Trump, who may soon give an order to carry out a military operation in Mexico and Greenland.

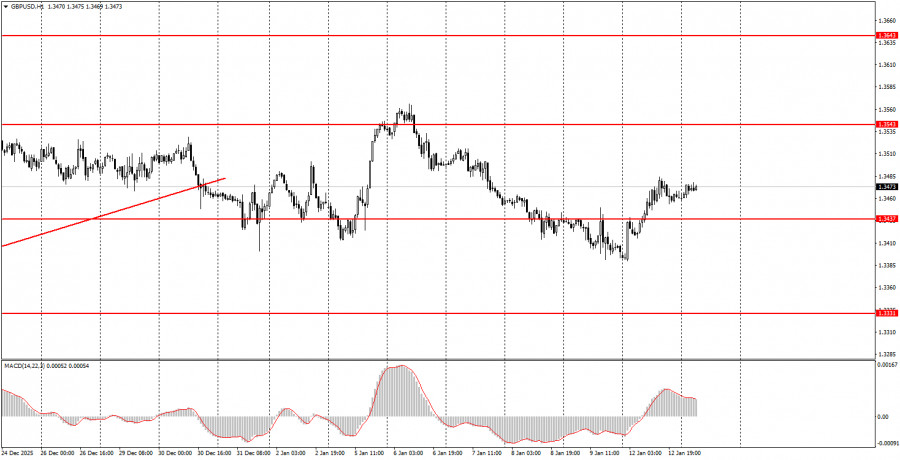

During the second trading day of the week, both currency pairs may continue to rise, but everything will depend on news from the White House and the inflation report. The euro can be traded today in the range 1.1655–1.1666, and the pound sterling — in the range 1.3437–1.3446. Buy signals were already formed yesterday; new ones may be formed today.

Support and resistance price levels — levels that serve as targets when opening buys or sells. Take Profit can be placed near them.

Red lines — channels or trendlines that reflect the current tendency and show which direction is preferable to trade now.

MACD indicator (14,22,3) — histogram and signal line — an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always listed in the news calendar) can strongly affect a currency pair's movement. Therefore, during their release, trading should be done with maximum caution, or positions should be closed, to avoid a sharp price reversal against the preceding move.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and effective money management are the keys to long-term trading success.

QUICK LINKS