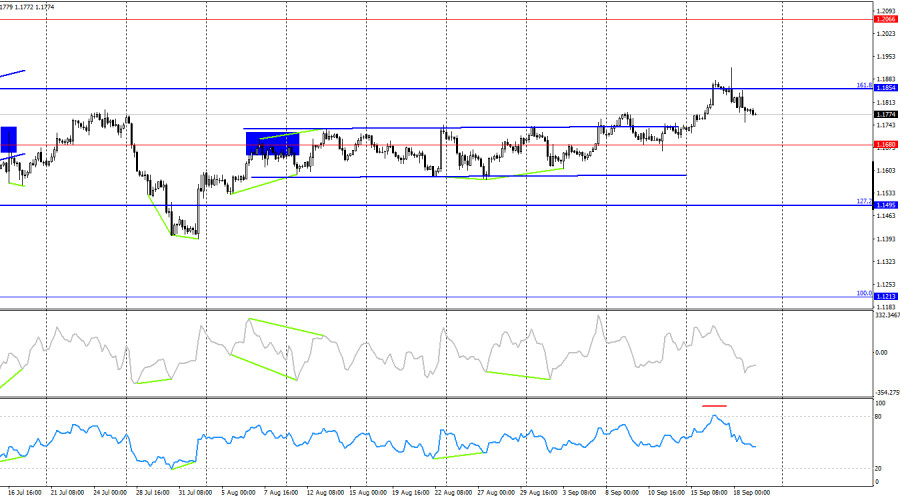

On Thursday, the EUR/USD pair consolidated below the 1.1789–1.1802 level by the end of the day. Thus, the decline may continue toward the next Fibonacci level of 76.4% – 1.1695. A consolidation above the 1.1789–1.1802 zone will work in favor of the euro and a resumption of growth toward the 127.2% retracement level – 1.1896.

The wave situation on the hourly chart remains simple and clear. The last upward wave broke the previous wave's peak, while the last completed downward wave did not break the previous low. Thus, the trend remains "bullish" for now. The latest labor market data and the changed prospects for the Fed's monetary policy support only the bulls, while the bears remain without much to rely on. For the trend to shift to "bearish," the pair needs to fall to the support level of 1.1637–1.1645.

On Thursday, traders were still "digesting" the FOMC meeting on Wednesday evening, while also reacting to the Bank of England meeting. But step by step. Jerome Powell did not rule out the possibility of a rate cut at the remaining two meetings in 2025, and this is essentially the key point. Previously, traders expected two cuts in total before year-end, now three. So why is the dollar rising if "dovish" sentiment has strengthened? That is a paradox — at least from my perspective. There was nothing "hawkish" in Powell's speech. He hinted that the Fed remains apolitical, but traders were not expecting an immediate sharp rate cut due to the arrival of new FOMC member Stephen Miran. Thus, I believe the bears' attacks will remain very weak. The news background for the US currency is still very weak and tends to worsen over time. Therefore, I expect new buy signals. A hypothetical decline can certainly be traded if there are good signals, but I am more inclined toward buying. It is very difficult for the dollar to find positives right now.

On the 4-hour chart, the pair consolidated above the horizontal channel, which allows traders to expect further growth. A rebound from the 161.8% Fibonacci level – 1.1854 – worked in favor of the US dollar and some decline toward 1.1680. A consolidation above 1.1854 will allow traders to expect continued growth toward 1.2066. No emerging divergences are observed today on any indicator.

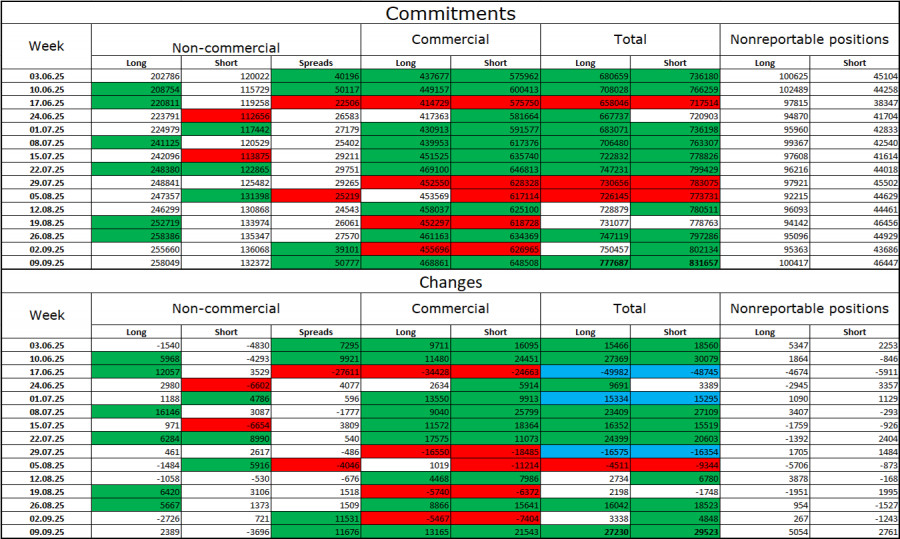

Commitments of Traders (COT) report:

During the last reporting week, professional players opened 2,389 long positions and closed 3,696 short positions. The sentiment of the "Non-commercial" group remains "bullish" thanks to Donald Trump and continues to strengthen over time. The total number of long positions held by speculators now stands at 258,000, compared to 132,000 short positions. The gap is effectively twofold. In addition, note the number of green cells in the table above: they reflect strong position increases in the euro. In most cases, interest in the euro continues to grow, while interest in the dollar declines.

For thirty-one consecutive weeks, large players have been reducing shorts and adding longs. Donald Trump's policy remains the most significant factor for traders, as it could cause numerous long-term, structural problems for the United States. Despite the signing of several key trade agreements, many major economic indicators continue to show declines.

News calendar for the US and the EU:

On September 19, the economic calendar contains no notable entries. The news background will not influence market sentiment on Friday.

EUR/USD forecast and trader tips:

Sales of the pair could be considered on a rebound from 1.1896 on the hourly chart with a target at 1.1802. That target was achieved. New sales were possible on a close below the 1.1789–1.1802 zone with a target at 1.1695. Today, these trades can remain open until a buy signal appears. Purchases will become possible today on a close above the 1.1789–1.1802 zone with a target at 1.1896.

The Fibonacci grids are built from 1.1789–1.1392 on the hourly chart and from 1.1214–1.0179 on the 4-hour chart.

QUICK LINKS