Příští zasedání Evropské centrální banky bude složité, protože tvůrci politiky budou muset vyvážit nejistotu ohledně inflačních rizik vyplývajících z amerických cel, uvedl guvernér nizozemské centrální banky Klaas Knot v rozhovoru pro nizozemský finanční deník FD.

„V krátkodobém horizontu je zcela jasné, že dominovat bude šok poptávky, takže inflace půjde dolů,“ řekl Knot v souvislosti s dopady cel uvalených americkým prezidentem Donaldem Trumpem.

„ECB však sleduje inflační rizika ve střednědobém až dlouhodobém horizontu. V delším horizontu jsou inflační rizika jednoznačně oboustranná. Myslím, že červnové zasedání bude opravdu složité.“

Tvůrci politik ECB jsou stále více přesvědčeni o snížení úrokových sazeb v červnu, protože inflace pokračuje v poklesu, ale podle šesti zdrojů, které minulý týden informovaly agenturu Reuters, není zájem o velký krok.

Mnoho guvernérů nyní vidí rostoucí šance na osmé snížení sazeb o čtvrt procentního bodu na zasedání 4. června, kdy ECB aktualizuje své ekonomické prognózy. ECB snížila svou referenční sazbu na 2,25 % na začátku tohoto měsíce.

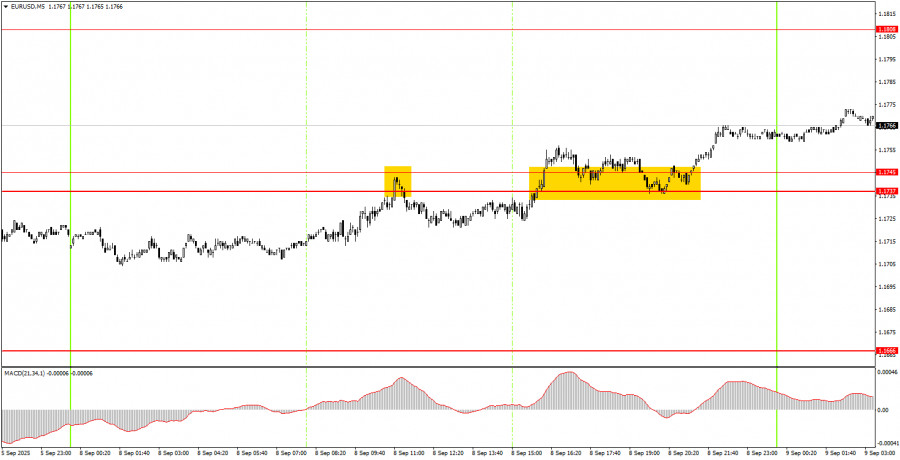

The EUR/USD currency pair traded higher on Monday, with no particular reasons given. The macroeconomic backdrop was essentially absent on Monday, except for a few reports from Germany, which aroused no interest among traders, as expected. However, we'd like to remind you that in recent weeks, while the pair was stuck in a clear flat trend, we repeatedly said we expected only the euro to rise and the dollar to fall. The fundamental background for the US currency remains downright disastrous, so nothing but further decline can be expected. Also, recall that the US labor market and unemployment data published on Friday failed spectacularly. This means the Fed will already take a dovish stance in September. Today, another NonFarm Payrolls report—the annual one—will be released. In our view, the dollar shouldn't expect anything positive from that report either. The price has consolidated above the sideways channel, so now is the best time to resume the upward trend of 2025.

On the 5-minute timeframe, two trading signals were formed on Monday. During the European session, the price bounced off the 1.1737–1.1745 area but failed to begin a new downswing within the flat range. In the US session, this area was breached, allowing traders to open long positions that can be safely held into Tuesday with a Stop Loss set to break-even or at the minimum value.

On the hourly timeframe, the EUR/USD pair has every chance to resume the uptrend that has been forming since the beginning of this year, and the flat can be considered over. The fundamental and macroeconomic backdrop for the US dollar remains dire, so we still do not expect any strengthening in the American currency. As before, we believe the dollar can only count on technical corrections.

On Tuesday, the EUR/USD pair may continue its upward movement since it exited the sideways channel the previous day, where it had been stuck for three consecutive weeks. Thus, the first target for the euro is now the 1.1808 level.

On the 5-minute timeframe, you should watch the levels: 1.1198–1.1218, 1.1267–1.1292, 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1737–1.1745, 1.1808, 1.1851, 1.1908. On Tuesday, the US will publish the annual NonFarm Payrolls report, which may have an even greater impact than Friday's monthly report. Most likely, the value will be negative, which may trigger a fresh collapse in the US dollar.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

QUICK LINKS