(Reuters) – Hlavní inženýr a technologický ředitel společnosti Spirit AeroSystems (NYSE:SPR) Sean Black povede závod společnosti ve Wichitě v Kansasu poté, co výrobce letadel Boeing (NYSE:BA) letos dokončí akvizici společnosti Spirit, uvádí se v úterním dopise zaměstnancům, do kterého agentura Reuters nahlédla.

Podle dopisu generálního ředitele společnosti Spirit Aero Pata Shanahana bude Black zastávat funkci generálního ředitele společnosti Boeing Wichita a bude mít na starosti také závod v Tulse ve státě Oklahoma a části závodů ve skotském Prestwicku a severoirském Belfastu.

Společnost Boeing loni oznámila, že dosáhla dohody o převzetí tohoto leteckého gigantu, který vyčlenila v roce 2005, v rámci transakce, která by měla být uzavřena někdy v letošním roce.

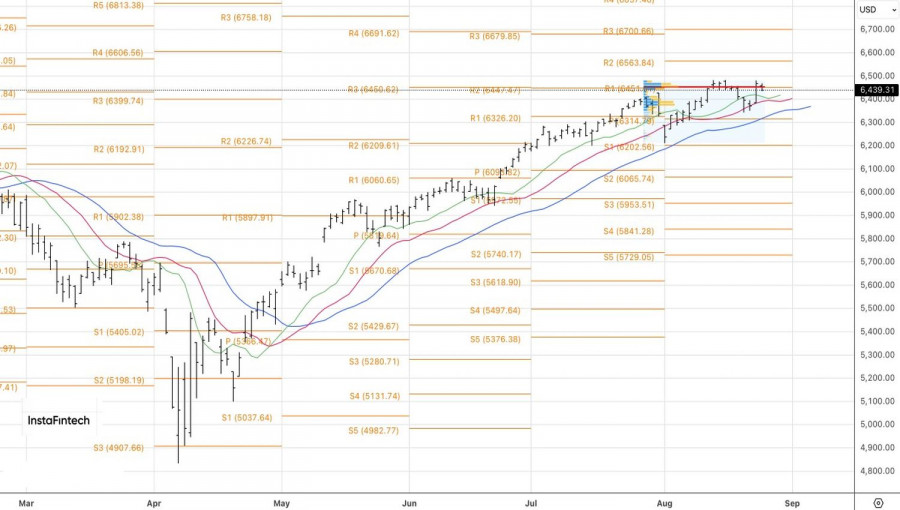

Markets welcomed Jerome Powell's Jackson Hole speech. But every barrel of honey has its spoonful of tar. What if the Federal Reserve Chair is wrong about the temporary nature of tariff-driven inflation? Back in 2022, he also considered inflation to be transitory for too long and delayed rate hikes. Could the central bank step on the same rake again? Reassessment of views, concerns about a tech-stock bubble, and threats to the Fed's independence forced the S&P 500 to take a step back.

What Powell thinks is one thing, but what actually happens is another. Investors are bracing for four of the most important days spanning late August through September with enormous tension. NVIDIA's earnings, labor market data, inflation statistics, and finally the September FOMC meeting are all capable of rocking the S&P 500 by at least 0.7% in either direction. That's the view of the derivatives market, and expectations of higher volatility are holding back equity bulls.

NVIDIA will need to work very hard to convince investors that the tech bubble isn't real. Over the last seven trading sessions, the S&P 500 has closed in the red six times due to sector rotation. Investors bought almost anything else while selling off AI-related stocks. Only a strong earnings report from the chipmaker can breathe new life into the old FOMO narrative around tech giants.

Additional pressure on the S&P 500 came from new tariff threats and the President's attacks on the Fed. Donald Trump promised fresh tariffs against countries applying digital taxes to U.S. companies. He also launched an investigation into furniture imports into the United States, aiming to impose duties. But what truly rattled the market was the Lisa Cook affair.

The White House sent a dismissal letter to the first Black woman serving on the FOMC, citing a reason for the decision, as reported by the Washington Post. However, Lisa Cook has no intention of resigning. According to her lawyer, dismissing a Fed official is beyond the President's authority. Investors are bracing for a court battle. If Trump prevails, it will set a precedent. Replacing FOMC members could then lead to lower rates and a weaker dollar.

Meanwhile, yields on 30-year Treasuries rose on fears of higher future inflation. This became another reason for the decline in the broad stock index.

Technically, on the daily chart, the S&P 500 faces the risk of forming a reversal Double Bottom pattern. However, a return of quotes above fair value and the inside bar high at 6,463 would justify adding to previously established long positions. The odds of restoring the S&P 500's upward trend remain high.

QUICK LINKS