Last week's market volatility was based on disagreements among Federal Reserve voting members as they debated whether to cut the interest rate hike at the December FOMC meeting. There is, of course, no consensus on future action regarding the pace and size at which the US central bank continues to raise its Fed Funds rate.

According to the CME FedWatch tool, there is a 96.5% chance that the Fed will raise its base rate by another 75 basis points in November. The FedWatch tool derives its probabilities based on the prices of federal funds futures contracts and has shown excellent results in previous forecasts.

A recent change has been in the likely size of the December rate hike, which has reversed dramatically over the past week. This indicator currently projects a 51.9% chance that the Fed's benchmark interest rate will be between 425 and 450 basis points, up from a mere 24.2% chance in the middle of last week.

At the same time, according to the FedWatch tool forecast: the likelihood that the federal funds rate will be between 450 and 475 basis points by the end of 2022 is 46.3%.

This is very different from the forecast from the middle of last week, which indicated a probability of 75.4%. What caused a sharp change in prices for futures contracts of federal funds over the past 24 hours. This has become a new speculation among Fed officials as to whether to start reducing the size of the December rate hike as well as the next year's rate hike.

The Wall Street Journal reported on Friday: "Fed officials are gearing up for another 0.75 percentage point rate hike at their November 1-2 meeting and are likely to discuss whether and how plans to approve a smaller increase in December."

The article also says that some officials have begun to voice their desire to slow down the pace of rate hikes in the near future and stop raising rates early next year.

The concern among the more dovish Fed officials is their desire to reduce risk. Those who oppose any change in their current hawkish pace of rate hikes say it is too early to have such discussions because inflation has taken root and is still persistent.

Fed chief Christopher Waller said earlier this month: "We will have a very thoughtful discussion on the pace of tightening at our next meeting." It makes it interesting that the Wall Street Journal article on Friday carried so much weight when it was common knowledge that the debate about the pace of monetary tightening was taking place.

All last week, analysts have been focusing on recent statements by the presidents of various Fed banks indicating a desire to bring the benchmark interest rate up to 450-475 basis points before making any decision. This can only happen if they raise rates by 75 basis points at the next two FOMC meetings.

That's why Friday's Wall Street Journal article titled "Fed to raise rates by 0.75 points and discuss the size of future hikes" had a huge impact. One possibility is that the Wall Street Journal also reported that "two Federal Reserve officials recently began to make the case for caution in raising interest rates."

Whatever caused this article to be published, the indisputable fact is that it played an important role in the sharp rise in the prices of gold and silver. It also had a strong impact on US equities, with the Dow up 748.97 points or 2.47%:

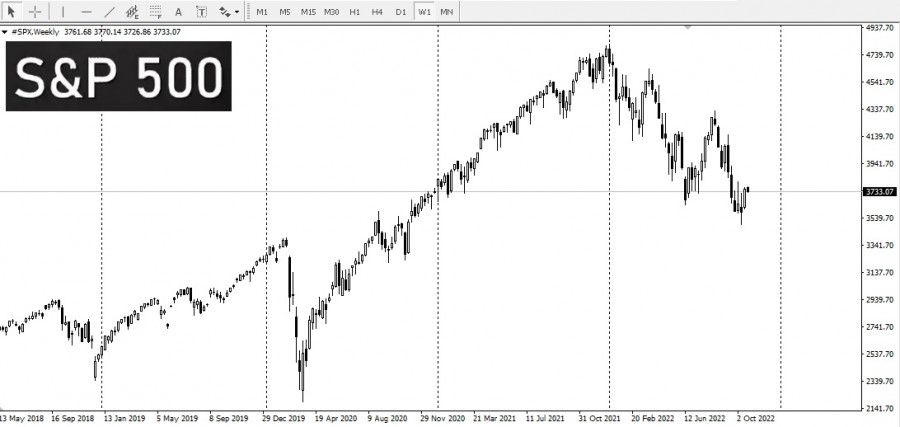

S&P 500 — 2,28%:

and the NASDAQ composite index is 2.89%:

Since a vote is required to raise the Fed funds rate, during which a majority of voting members will decide in favor of an increase, market participants will focus on the FOMC's November statement, as well as Fed Chairman Jerome Powell's statements at a press conference at the end of the November meeting.

ĐƯỜNG DẪN NHANH