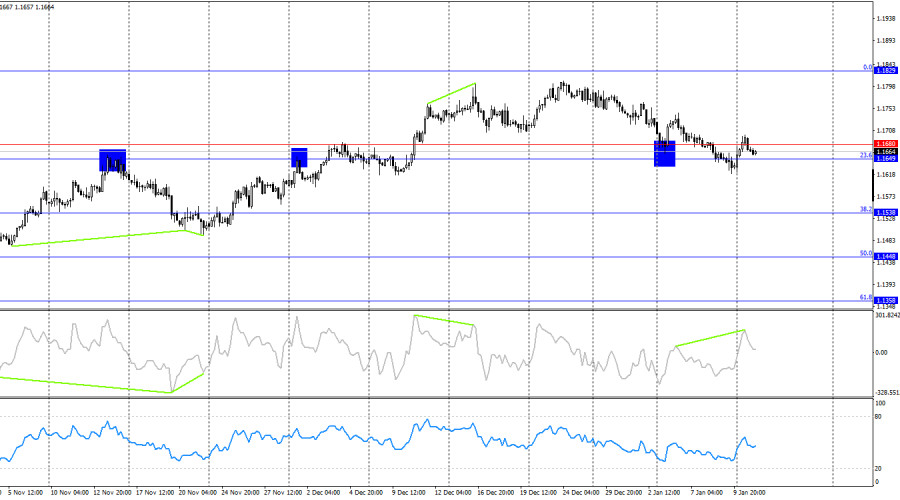

On Monday, the EUR/USD pair reversed in favor of the European currency and returned to the 38.2% Fibonacci retracement level at 1.1686. A rebound from this level worked in favor of the US dollar, leading to a modest decline toward the support zone at 1.1645–1.1648. A rebound from this area today would bring bulls back into the market, opening the way for an advance toward the 23.6% Fibonacci level at 1.1731. A close below this zone would increase the likelihood of a continued decline toward the support level at 1.1607–1.1612.

The wave structure on the hourly chart remains straightforward. The most recent completed upward wave failed to break above the previous peak, while the latest downward wave broke the prior low. As a result, the trend remains bearish. In my view, the decline is unlikely to be prolonged or deep, but a breakdown of the current bearish trend is now required before a bullish move can be expected. Based on the current chart structure, such a reversal would occur above the resistance level at 1.1795–1.1802 or after two consecutive bullish waves.

On Friday, bullish traders were presented with another strong opportunity to launch an attack, and this time they took advantage of it. Overnight, it emerged that criminal proceedings had been initiated against FOMC Chair Jerome Powell in connection with the renovation of the Federal Reserve headquarters. In an official statement, Powell said the charges were brought in an attempt to force the regulator to cut interest rates. The White House stated that Powell had misled the US Congress during discussions of the renovation budget, which, in its view, warrants a judicial investigation and verdict.

In my opinion, Powell's version of events raises little doubt. At the very least, the market's reaction yesterday—selling the US dollar—made it clear that traders do not trust Trump. The dollar's decline was not sharp, but it could intensify as the situation surrounding Powell develops. Investors are unlikely to place confidence in the currency of a country where the president, lacking the authority to do so, openly interferes with the work of the central bank and allegedly manufactures criminal cases to remove undesirable officials.

On the 4-hour chart, the pair has returned to the support level at 1.1649–1.1680. Another rebound from this area would favor the euro and a moderate rise toward the 0.0% retracement level at 1.1829. A sustained move below the 1.1649–1.1680 support level would increase the chances of continued decline toward the next 38.2% Fibonacci level at 1.1538. A bearish divergence has formed on the CCI indicator, suggesting the potential for another downward move.

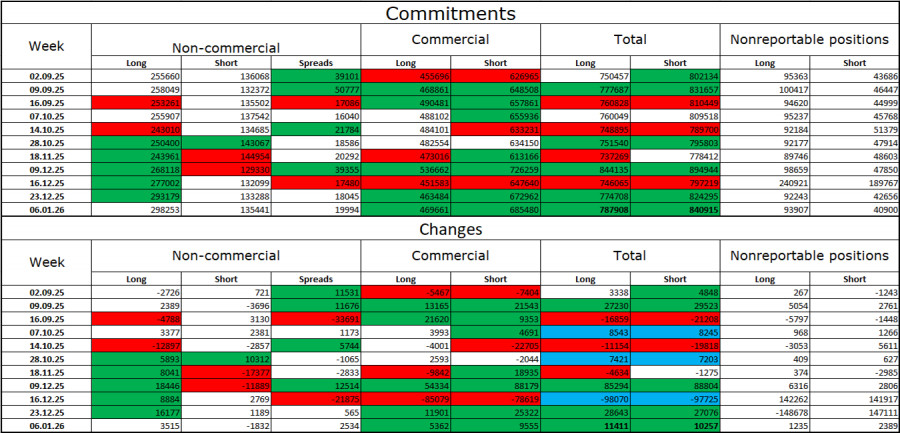

Commitments of Traders (COT) Report

During the latest reporting week, professional market participants opened 3,515 long positions and closed 1,832 short positions. Sentiment among non-commercial traders remains bullish, largely due to Donald Trump and his policies, and continues to strengthen over time. The total number of long positions held by speculators now stands at 298,000, while short positions amount to 135,000—giving bulls a more than twofold advantage.

For thirty-three consecutive weeks, large players were reducing short positions and increasing long positions. This was followed by the government shutdown, and now we are seeing the same pattern again: professional traders continue to build long positions. Donald Trump's policies remain the most significant factor for traders, as they generate numerous problems that are likely to have long-term and structural consequences for the US economy—such as deterioration in the labor market. Traders fear a loss of Federal Reserve independence in 2026 under pressure from Trump, especially amid the potential resignation of Jerome Powell.

Economic Calendar: United States and Eurozone

On January 13, the economic calendar contains two noteworthy releases. The impact of the news flow on market sentiment is expected in the second half of the day.

EUR/USD Forecast and Trading Recommendations

Selling opportunities emerged after the rebound from the 1.1686 level on the hourly chart, with targets at 1.1648 and 1.1612. These positions may be kept open today. Buying opportunities appeared after a consolidation above the 1.1645–1.1648 level on the hourly chart, with targets at 1.1686 and 1.1731; the first target has already been reached. New long positions may be considered on a rebound from the 1.1645–1.1648 level.

Fibonacci grids are drawn from 1.1492 to 1.1805 on the hourly chart and from 1.1066 to 1.1829 on the 4-hour chart.

RÁPIDOS ENLACES