(Reuters) – Prezident Federálního rezervního systému Austan Goolsbee v neděli řekl, že doufá, že Spojené státy se neposouvají do prostředí, kde je zpochybňována schopnost centrální banky určovat měnovou politiku nezávisle na politických tlacích.

Goolsbee v odpovědi na otázku v pořadu „Fact the Nation“ televize CBS ohledně výpadů prezidenta Donalda Trumpa z minulého týdne proti předsedovi Fedu Jerome Powellovi uvedl, že ekonomové se shodují, že centrální banky, které mají možnost provádět měnovou politiku bez politických zásahů, mají lepší výsledky pro své ekonomiky.

What choice does Jerome Powell face, and what can influence it? The U.S. Consumer Price Index is rising. The growth is still moderate, but it is already almost one and a half times above the target level, while core inflation exceeds 3%. Therefore, according to all principles of economic theory, the interest rate should not be lowered. If borrowing costs decrease, credit activity will rise, investment in the economy will increase, spending will grow, demand will expand, and as a result, prices will climb.

At the same time, however, the labor market has "cooled" significantly over the past three months. To revive it, monetary policy easing is needed. And here Powell and his colleagues have not two, but three possible options.

The first option is to abandon price stability for the sake of supporting the labor market. In my view, achieving full or maximum employment is a more noble goal than price stability. But at the same time, all Americans will experience high inflation, with the least well-off groups being most affected. In other words, if the labor market cools, ordinary Americans who lose their jobs will suffer first. If inflation rises, ordinary Americans with low incomes will suffer. Contrary to popular belief, America is not a country populated only by millionaires.

The second option is to abandon support for the labor market and shift responsibility to Donald Trump. After all, it was Trump's policy that largely caused this "cooling." Why, then, should the FOMC have to solve this problem?

The third – try to sit on two chairs at once. On the one hand, it prevents the labor market from cooling further by cutting rates. On the other hand, avoid letting inflation run free by not lowering rates too aggressively.

I believe Powell and his team will choose the third option. The rate may be cut twice in 2025, but it should be remembered that every new inflation or payroll report can change expectations and forecasts. If the labor market shows strong results in August, the Fed could extend its pause in September. If the labor market continues to weaken, the rate could be lowered by as much as 50 basis points. In any case, the Fed will conduct easing. And demand for the U.S. dollar will likely continue to decline.

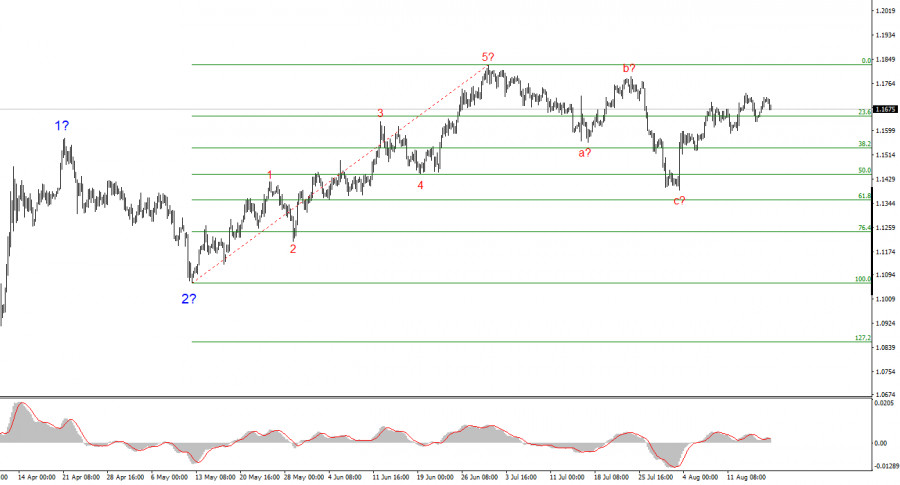

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward section of the trend. The wave pattern still depends entirely on the news background related to Trump's decisions and U.S. foreign policy. The targets of the upward trend may extend as far as the 1.25 level. Accordingly, I continue to consider long positions with targets around 1.1875, which corresponds to the 161.8% Fibonacci level, and above. I assume that wave 4 has been completed. Therefore, now is a good time for buying.

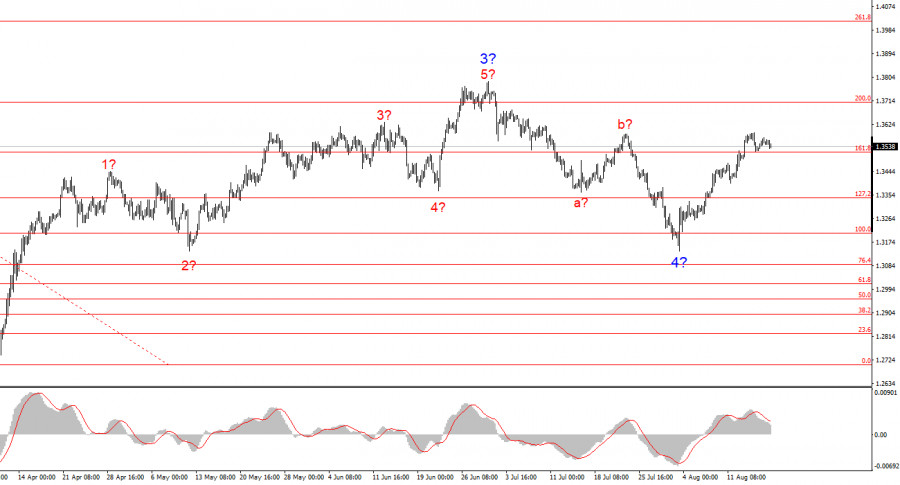

The wave pattern for GBP/USD remains unchanged. We are dealing with an upward, impulsive section of the trend. Under Trump, markets may face many more shocks and reversals that could seriously affect the wave pattern, but at present, the working scenario remains intact. The targets of the upward section of the trend are now located around 1.4017. At this point, I assume that the downward wave 4 has been completed. Therefore, I recommend buying with a target of 1.4017.

LINKS RÁPIDOS