Záhada kolem překvapivě defenzivního postoje Warrena Buffetta se o víkendu ještě prohloubila.

Čtyřiadevadesátiletý generální ředitel společnosti Berkshire Hathaway prodal v posledním čtvrtletí více akcií a ještě zvýšil rekordní hotovost na 334 miliard dolarů, ale ve svém očekávaném výročním dopise nevysvětlil, proč investor známý svými prozíravými nákupy akcií dlouhodobě zdánlivě šetří.

Místo toho Buffett uvedl, že tento postoj v žádném případě nepředstavuje odklon od jeho lásky k akciím.

„Navzdory tomu, co někteří komentátoři v současné době považují za mimořádnou hotovostní pozici v Berkshire, zůstává velká většina vašich peněz v akciích,“ napsal Buffett ve výročním dopise pro rok 2024, který byl zveřejněn v sobotu. „Tato preference se nezmění.“

Monstrózní vlastnictví hotovosti společností Berkshire vyvolává mezi akcionáři a pozorovateli otázky zejména v souvislosti s očekávaným poklesem úrokových sazeb z jejich mnohaletých maxim. Generální ředitel a předseda představenstva Berkshire v posledních letech vyjadřoval frustraci z drahého trhu a malého počtu nákupních příležitostí. Někteří investoři a analytici začali být netrpěliví z nedostatku akcí a hledali vysvětlení, proč tomu tak je.

At the end of 2024, many analysts were discussing the possibility of EUR/USD reaching parity. The U.S. economy was noticeably stronger than its European counterpart, with the Federal Reserve's December projections suggesting two rate cuts instead of four. Additionally, the derivatives market anticipated that the European Central Bank would lower its deposit rate by 100 basis points in 2025. The AI-driven rally had propelled U.S. stock indices well ahead of European equities. So, what else could the dollar do to weaken the euro further? It turns out that the situation is not that straightforward.

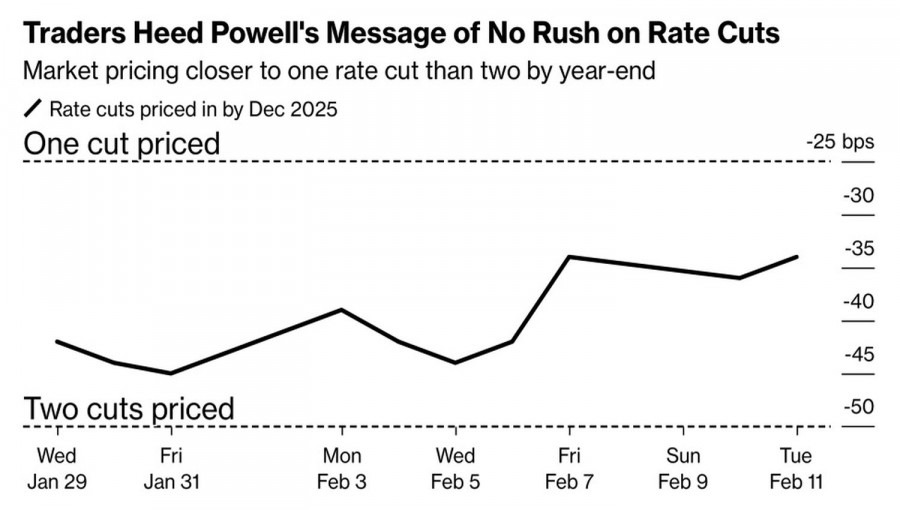

Markets thrive on expectations, reacting to dynamic conditions rather than static ones. It appeared that nearly all the bearish factors for EUR/USD had already been priced in, leading to a pullback and consolidation. However, this interpretation has nuances. The derivatives market is currently pricing in fewer Fed rate cuts than indicated in the December FOMC projections. Meanwhile, ECB derivatives still anticipate a total cut of 100 basis points by the end of the year, without even considering the 25-basis-point deposit rate cut anticipated in January.

At first glance, the divergence in monetary policy between the Fed and the ECB has widened. So why hasn't EUR/USD continued its downward trend? Several factors come into play. European economic activity is showing signs of improvement, as reflected in recent business sentiment data. European stock indices are performing better, driven by declining bond yields and expectations of continued monetary policy easing. Additionally, Donald Trump has not been as aggressive as many had feared.

Is there really a significant difference between 60% and 10% tariffs on China? What about the impact of 25% tariffs on Mexican and Canadian imports compared to their postponement? Or consider the difference between universal steel and aluminum tariffs versus exemptions for Australia. The U.S. president seems to be exercising more caution than anticipated. If the intention is to pressure other economies into submission, it appears to be executed with great restraint.

The decline of Trump-era trade policies, the diminishing dominance of the U.S. stock market—partially due to the DeepSeek controversy—and signs of economic recovery in the Eurozone have empowered EUR/USD bulls to make a comeback. The market is increasingly convinced that large-scale tariffs of 10-20% on all goods from the White House are unlikely, leading to a reassessment of expectations regarding imminent parity in this currency pair.

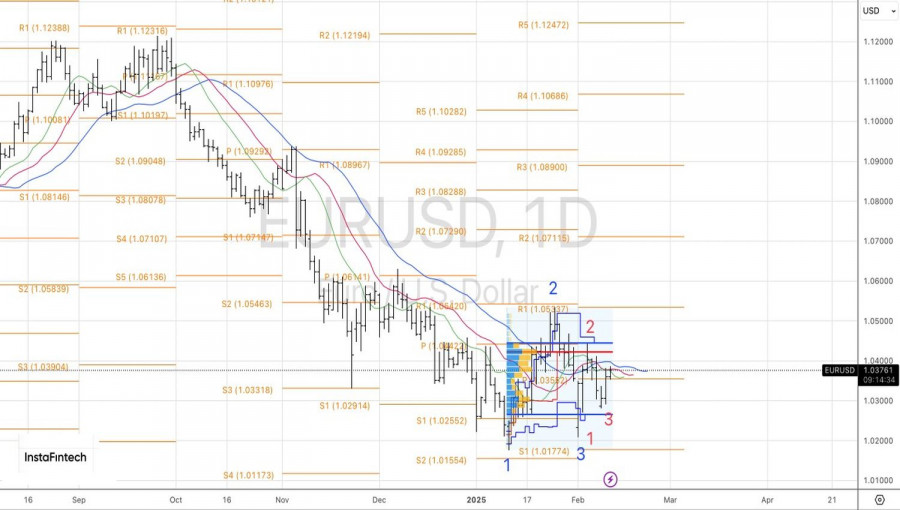

From a technical standpoint, the daily chart for EUR/USD reveals a pattern within a pattern, highlighting a combination of a parent and child 1-2-3 formation. If the bulls can break through the dynamic resistance of the moving averages around 1.040 and the fair value at 1.042, the chances of a rally toward 1.054 and beyond will increase. Does it make sense to consider buying the euro on a breakout?

LINKS RÁPIDOS