There are fewer than two days left before the Federal Reserve meeting, and the market expects a 25 basis point interest rate cut. The main intrigue, however, is Jerome Powell's speech. At the moment, it is safe to say - Powell did not bend to Donald Trump. No matter how much the Republican demanded that the Fed and Powell lower rates, no matter how many threats of layoffs and lawsuits were made, it was all in vain. Powell remains the small island of hope for investors, as they see the Fed maintaining its independence.

Based on this, I expect Powell's rhetoric on Wednesday night to be as simple as possible. The Fed President will surely reiterate that the central bank will make decisions from meeting to meeting, guided only by economic data and mindful of both of its mandates. Therefore, I do not expect Powell to hint at the next round of monetary easing, which may not be perceived correctly by the market.

Let me remind you that at this time, the futures markets are leaning towards the FOMC cutting rates three times before the end of the year. However, this scenario is different from the Fed's baseline scenario that has been broadcast since the beginning of the year. I believe it will be possible to make new rate predictions before the end of the year, following the September reports on the US labor market and unemployment. And also on inflation. If the labor market starts to recover, it will be limited to two rounds of easing. If the "cooling" continues, three rounds are possible.

For the US dollar, both scenarios are practically no different. In the first case, the dollar will fall strongly; in the second case, it will fall, albeit not as strongly. In general, I am satisfied with any scenario; I expect only a decline in the US currency under any circumstances. I do not believe that the US Supreme Court, which is 65% Republican judges, will overturn Trump's duties. Perhaps only the Fed will defeat the US President, but even that is reason enough to doubt. The dollar is susceptible to every new geopolitical and political event, so I don't see on what basis the market could suddenly be interested in the dollar.

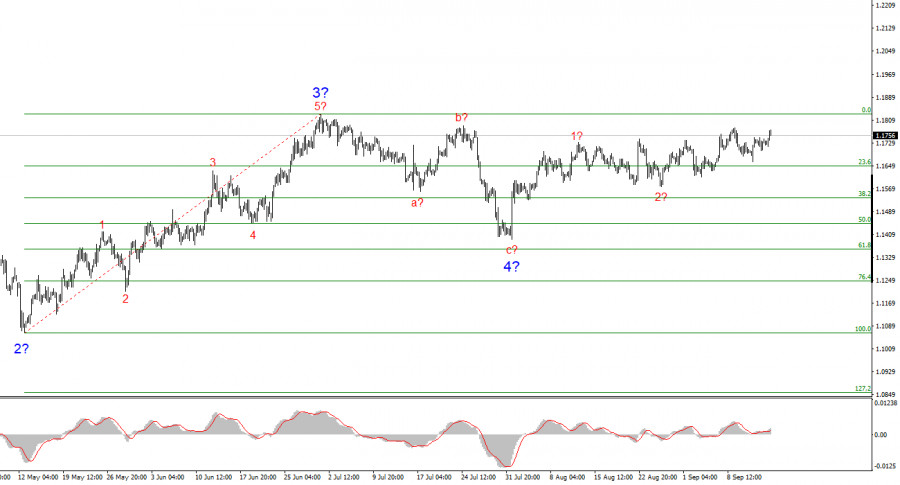

Based on the analysis of EUR/USD, the instrument continues to build a bullish section of the trend. The wave structure still entirely depends on the news background linked to Trump's decisions, as well as the foreign and domestic policy of the new Administration. Trend targets may extend as far as the 25th figure. With the news background following its course, I continue to consider buying with initial targets around 1.1875, equivalent to the 161.8% Fibonacci extension, and higher.

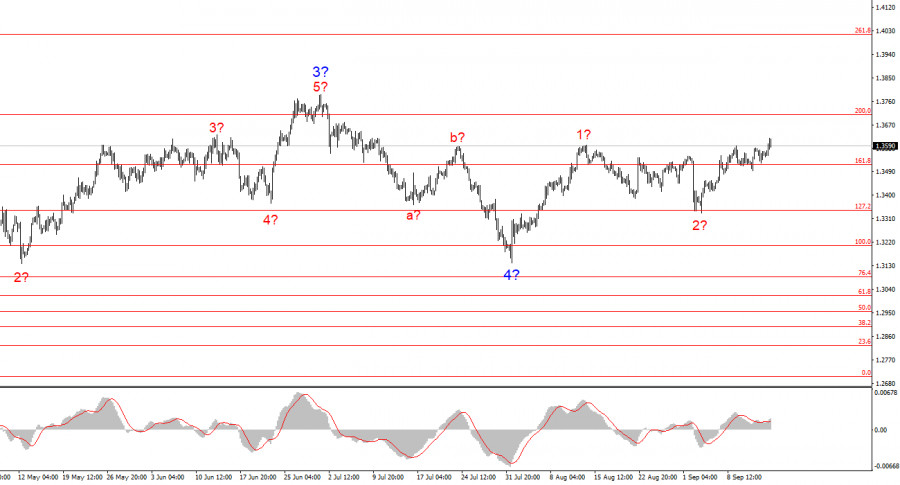

The wave structure for GBP/USD remains unchanged. We are dealing with a bullish, impulsive section of the trend. Under Trump, markets may face many more shocks and reversals that could significantly affect the wave structure. However, for now, the working scenario remains intact, and Trump's policy remains consistent. The targets of the bullish section of the trend are located around the 261.8% Fibonacci level. At this point, I expect further price increases within wave 3 of 5, with a target of 1.4017.

SZYBKIE LINKI