OAK BROOK, Ill. – Společnost TreeHouse Foods (NYSE:THS), Inc. v pátek oznámila zisk za čtvrté čtvrtletí, který zaostal za očekáváním analytiků, a zároveň poskytla výhled na fiskální rok 2025 pod konsensuálními odhady.

Výrobce potravin privátních značek vykázal za 4. čtvrtletí upravený zisk na akcii ve výši 0,95 USD, čímž zaostal za odhadem analytiků ve výši 0,97 USD. Tržby dosáhly 905,7 milionu USD, což je mírně pod konsensuálním odhadem 907,72 milionu USD.

Za celý rok 2024 TreeHouse vykázal čisté tržby ve výši 3,35 miliardy USD a čistý zisk z pokračujících činností ve výši 26,9 milionu USD. Upravená EBITDA za celý rok činila 337,4 milionu USD.

Při pohledu do budoucna společnost vydala předběžný výhled na fiskální rok 2025, v němž předpokládá upravené čisté tržby v rozmezí 3,34 až 3,4 miliardy USD. Tento výhled zaostává za očekáváním analytiků ve výši 3,42 miliardy dolarů. TreeHouse předpokládá, že upravený zisk EBITDA se bude v tomto roce pohybovat mezi 345 a 375 miliony USD.

The GBP/USD currency pair experienced a significant decline on Wednesday, dropping sharply as if a stone had fallen from a nine-story building. This situation seems to echo past trends. Over the previous few days, we've seen the pound closely follow the euro, much like a dog on a leash. However, unlike the euro, which had specific reasons for its market movements, the pound did not have any clear justification. By the beginning of the U.S. trading session on Wednesday, the British pound had already lost 170 pips. What does this indicate? There were no economic reports in the UK, no important speeches, and no major events to account for this decline. Meanwhile, all key macroeconomic reports for the day in the U.S. were scheduled for the American trading session, further highlighting the lack of apparent reasons for the pound's fall.

There were indeed reasons for the current situation, which we have been discussing daily. The pound is currently overvalued compared to the dollar. The Federal Reserve is implementing monetary easing at a much slower pace than the market had anticipated, while the Bank of England has yet to fully initiate its rate reductions. From 2022 to 2024, the market primarily focused on U.S. policy easing, overlooking the fact that the BoE would also cut rates. It was reasonable to assume, even last year, that once this process concluded, the dollar would begin to strengthen since there would be no remaining factors to keep it down. The dollar's rise started right after the Federal Reserve meeting on September 18, when they officially began lowering interest rates. Additionally, the U.S. economy is growing at approximately 3% per quarter, whereas the UK economy has been stagnant for the past couple of years.

Currently, there have been no changes in the market. When we consider the global downtrend on the weekly timeframe alongside the factors mentioned above, there is little reason to expect an uptick in the British currency. Naturally, every downtrend includes periods of correction, which are instances of growth. However, these corrections are often used by large market players to accumulate positions in line with the prevailing trend, after which the trend typically resumes.

This week provided a classic example of this behavior. Both the euro and the pound began to rise, leading many to believe the downtrend had ended and prompting them to make purchases. However, on Wednesday, without any apparent justification, both currency pairs experienced a sharp decline. The pound fell even more significantly than the euro, which is entirely justified given its higher volatility and relatively lesser depreciation compared to the euro in recent months.

Even a weak ADP report on U.S. private sector employment failed to halt the dollar's upward trajectory. As noted earlier, this report is not particularly significant and did not sway trader sentiment. The market is currently awaiting the unemployment rate and Nonfarm Payrolls. Should those reports prove weak, we might witness another correction. On the weekly timeframe, the British currency still has ample room for further decline.

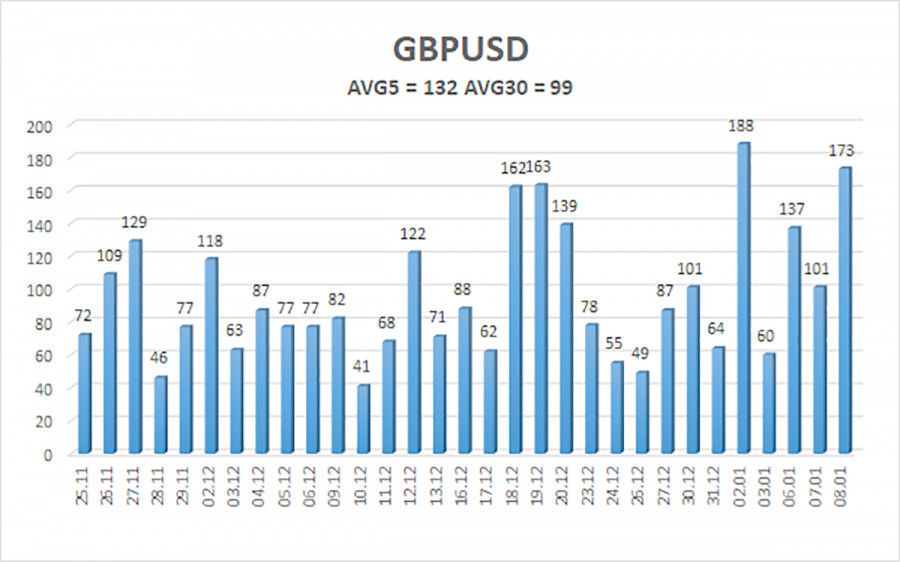

The average volatility of the GBP/USD pair over the last five trading days is 132 pips, which is classified as "high" for this pair. On Thursday, January 9, we expect the pair to trade within a range limited by the levels of 1.2209 and 1.2473. The higher linear regression channel remains directed downward, signaling a continuing downtrend. The CCI indicator has again entered the oversold zone, but oversold conditions in a downtrend are merely signals for potential corrections. A bullish divergence on this indicator also warned of a correction already completed.

Nearest Support Levels:

Nearest Resistance Levels:

The GBP/USD currency pair continues to trend downward. We are not considering long positions at this time, as we believe that all potential growth factors for the British currency have already been fully priced into the market, and no new factors have emerged. If you are trading based purely on technical analysis, long positions could be considered if the price moves above the moving average line, with targets set at 1.2573 and 1.2695. However, sell orders are much more relevant right now, with targets at 1.2207 and 1.2085.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

SZYBKIE LINKI