Scheduled Maintenance

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

As of yesterday, US stock indices closed higher. The S&P 500 rose by 0.14%, while the Nasdaq 100 added 0.27%. The industrial Dow Jones strengthened by 0.20%.

Today, futures on stock indices continued to rise. Yesterday, Nvidia Corporation announced the resumption of certain chip sales to China, which triggered investor purchases in hopes of a weakening US–China trade war. Today, investors are eagerly awaiting US inflation data to assess the consequences of President Donald Trump's trade war.

Futures contracts on the Nasdaq 100 index rose by 0.5%, while contracts on the S&P 500 and European stocks added 0.3%. Asian indices rose by 0.4%, while mainland China indices fell by 0.2%. Although China's economic growth exceeded expectations due to strong exports, domestic consumer demand remained weak. Gold increased, while US Treasuries and the US dollar remained stable. Bitcoin fell by 2.5% to approximately 117,200 dollars. The yield on 10-year Japanese government bonds reached its highest level since 2008 amid concerns about fiscal spending. Oil is falling for the second trading session due to Trump's new plan to pressure Russia, which threatens 100% tariffs.

Markets remain generally cautious, as the US consumer price index to be released this evening may bring significant shifts in the balance of power. Investors are on pause, assessing the potential impact of macroeconomic data on the future trajectory of the Federal Reserve's monetary policy. Stock market volatility reflects this uncertainty. On one hand, a strong inflation report may provoke more aggressive policy, which would negatively affect risk assets. On the other hand, signs of inflation slowing may give the Fed room to maneuver and support the markets. The oil market is also closely watching the situation. Maintaining high interest rates may slow economic growth and reduce oil demand, putting pressure on prices. However, geopolitical factors may offset this effect.

According to Citigroup Inc., options market participants are betting that the S&P 500 index will deviate by 0.6% in either direction after the release of the consumer price index. This corresponds to implied fluctuations over the past two months, although it is below the average realized fluctuation of 0.9% over the past year.

Corporate America is also preparing for the weakest earnings season since mid-2023. Major US financial companies begin publishing their reports today, and economists note that modest profit expectations create conditions for continuing their impressive performance. LPL Financial noted that while earnings growth is slowing, tariffs are starting to have an impact, and geopolitical risks remain elevated, stock prices continue to reflect significant optimism.

As for Nvidia, it plans to resume sales of its H20 artificial intelligence chips in China after receiving assurances from Washington that such supplies would be approved. This marks a sharp shift from the previous stance of the Trump administration. US government officials informed Nvidia that licenses for the export of the H20 AI accelerator would be issued, according to a company blog post.

This news is certainly positive not only for the company but also for the entire AI-based semiconductor supply chain, as well as for Chinese tech platforms that are developing AI capabilities.

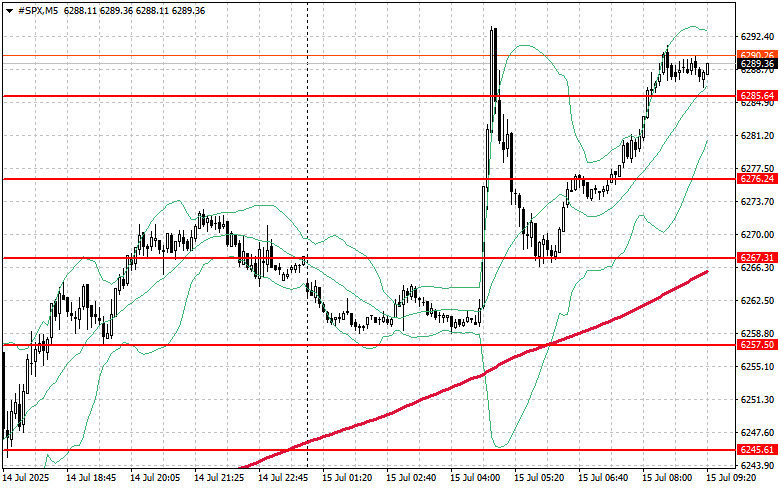

As for the technical picture of the S&P 500, the main task for buyers today will be to overcome the nearest resistance at $6,296. This will help demonstrate growth and open the way for a breakout to the new level of $6,308. Equally important for the bulls will be control over $6,320, which will strengthen buyers' positions. In the event of a downward move amid weakening risk appetite, buyers must assert themselves around $6,285. A breakout would quickly push the trading instrument back to $6,276 and open the path to $6,267.

Scheduled maintenance will be performed on the server in the near future.

We apologize in advance if the site becomes temporarily unavailable.

فوری رابطے