On Monday, the EUR/USD currency pair continued its upward movement in line with the prevailing trend. Despite the absence of any significant macroeconomic releases, the euro kept appreciating at a steady pace. Recall that over the past one and a half to two months, market volatility has sharply declined, which affects the quality of trades and signals. In simple terms, signals may be strong, but the lack of movement prevents traders from profiting from them. Yesterday's first speech by Christine Lagarde this week brought no new information for traders, as expected. The ECB laid out its plan last week, leaving no open questions. Rates may be raised if inflation starts moving above 2%. Rates may be lowered if inflation falls below 2%. Thus, the ECB's monetary policy is now entirely dependent on inflation. Since inflation is currently stable at around 2%, changes in rates should not be expected in the near term.

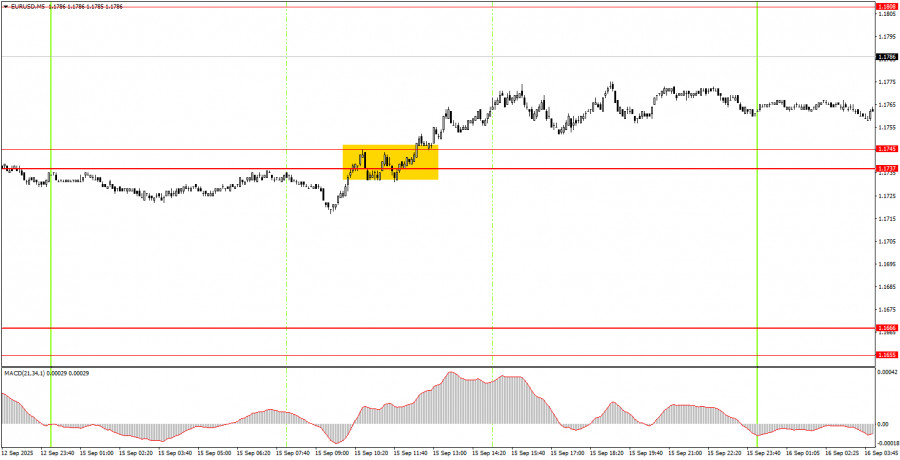

On the 5-minute timeframe, only one trading signal was formed on Monday. During the European session, the price broke through the 1.1737–1.1745 area, allowing traders to open long positions. Given the current low volatility, there was no need to close this trade in the evening. A Stop Loss could be moved to breakeven while waiting for the euro to continue rising.

On the hourly timeframe, EUR/USD has every chance to continue the uptrend that has been forming since the start of this year. The fundamental and macroeconomic backdrop remains negative for the U.S. dollar, so we still do not expect its strengthening. In our view, as before, the dollar can only rely on technical corrections. A consolidation below the trendline would signal the start of a new corrective decline.

On Tuesday, EUR/USD may continue its slow upward movement, as the trend remains bullish. For longs, breaking above the 1.1737–1.1745 area was required, with the next target now at 1.1808.

On the 5-minute timeframe, levels to consider are: 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1737–1.1745, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. On Tuesday, reports on economic expectations and industrial production will be released in the Eurozone. In the U.S., retail sales and industrial production are due. These reports may trigger a notable reaction only if actual values deviate significantly from forecasts.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

PAUTAN SEGERA