The test of the 1.1639 level occurred when the MACD indicator had already moved significantly below zero, which limited the pair's downside potential. For this reason, I did not sell the euro. The second test of this level happened while the MACD was in the oversold area, which allowed Scenario #2 for buying to play out. As a result, the pair rose by 15 pips.

Soon, several economic reports will be released, including changes in the Eurozone's GDP for Q2, employment dynamics, German manufacturing orders, and Italian retail sales data. Of particular interest are the Eurozone GDP figures. Experts expect that, despite falling inflation, the region's economy will continue to show modest growth in the second quarter. The employment rate also plays a key role in determining the labor market's health and consumer confidence. Information about industrial orders in Germany, the Eurozone's largest economy, will help assess the state of industry and its contribution to overall economic growth. A decline in orders may signal a slowdown. Italian retail sales reflect the trend in consumer spending in the country. An increase in retail sales is usually seen as a positive economic sign, while a decrease can indicate worsening consumer confidence and declining purchasing power. Only very strong data will help fuel euro growth. Otherwise, everyone will be waiting for the US labor market data.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

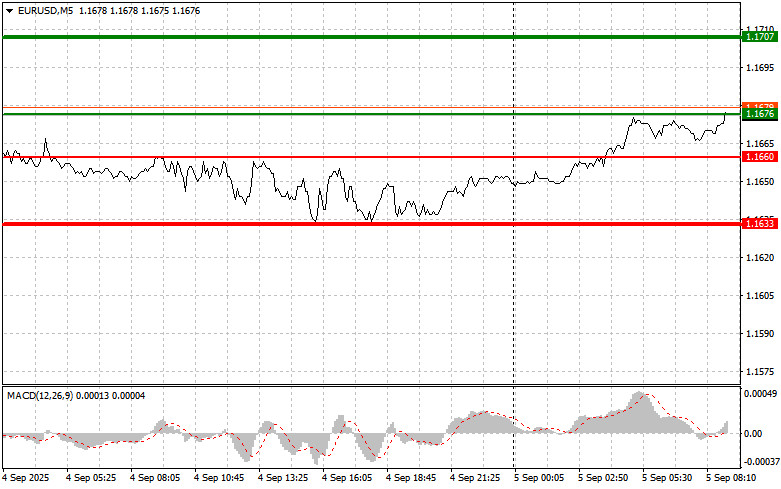

Scenario #1: Today, I plan to buy the euro when the price reaches around 1.1676 (green line on the chart), targeting a rise to 1.1707. At 1.1707, I plan to exit the market and sell euros in the opposite direction, aiming for a 30–35 pip move from the entry point. Euro growth is only to be expected after good data. Important! Before buying, make sure the MACD indicator is above zero and just starting to rise.

Scenario #2: I also plan to buy the euro today if there are two consecutive tests of the 1.1660 level while the MACD is in the oversold area. This will limit the pair's downside potential and is likely to reverse the market upward. A rise to the opposite levels of 1.1676 and 1.1707 can be expected.

Scenario #1: I plan to sell the euro after the price reaches the 1.1660 level (red line on the chart). The target will be 1.1633, where I will exit the market and immediately buy in the opposite direction (aiming for a 20–25 pip move the other way). Pressure on the pair will return today if the data is weak. Important! Before selling, ensure the MACD indicator is below zero and beginning to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of the 1.1676 level while the MACD is in the overbought area. This will limit the pair's upside potential and lead to a reversal downward. A decline to the opposite levels of 1.1660 and 1.1633 can be expected.

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

PAUTAN SEGERA