To reach a goal, one must sometimes make sacrifices. France's new Prime Minister, Sebastien Lecornu, concluded that short-term political stability is more important than pushing forward with pension reform. He agreed to postpone raising the retirement age from 62 to 64, effectively protecting himself from a no-confidence vote. As a result, the Socialist Party no longer intends to vote for his removal. The yield spread between French and German bonds plunged, and EUR/USD launched a counterattack.

Pension reform has long been a cornerstone of Emmanuel Macron's policy agenda. However, the president recognizes that another prime minister's resignation would bring France closer to snap elections—outcomes that would likely favor the left or right, but not his centrist allies. Thus, choosing the lesser of two evils became the logical decision.

France's political drama may be approaching its end. If Lecornu successfully survives the no-confidence vote, the storm will pass. The newly proposed budget sets a deficit of 4.7%, although the prime minister is giving parliament the flexibility to increase it, so long as it does not exceed 5%.

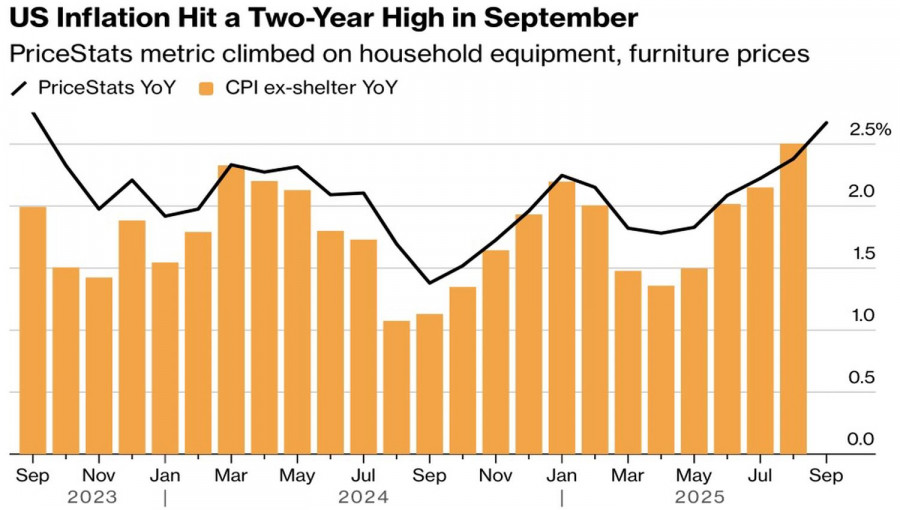

The stabilization of the political situation in France is a clear positive for EUR/USD. However, the euro is in no rush to rise and is instead awaiting U.S. inflation data. An acceleration in consumer price growth could provide a formal justification for FOMC hawks to argue in favor of keeping interest rates unchanged in October. In reality, though, policymakers are likely to view any jump in CPI, potentially caused by tariffs, as a temporary phenomenon. As long as inflation expectations remain anchored, the recent rise in prices is viewed as transitory.

The futures market currently assigns a 98% probability to Federal Reserve easing in October and a 95% chance of a rate cut in December. Jerome Powell, while careful not to issue direct signals, stated that a slowing labor market will eventually lead to rising unemployment. Investors interpreted this as a dovish cue, triggering renewed bullish interest in the EUR/USD pair.

Adding to this sentiment are concerns over rising trade tensions between Washington and Beijing. Donald Trump pledged to stop buying vegetable oil from China in retaliation for Beijing's suspension of U.S. soybean purchases. According to the president, the United States "does not wish harm" on China's economy, only good. But if tariffs are what he considers benevolence, then apparently 100% might not be enough.

The growing risk of renewed trade war escalation puts significant pressure on the U.S. dollar. There's no guarantee the already-strained U.S. economy—facing a slowing labor market, declining industrial production, and rising prices—can withstand such a blow.

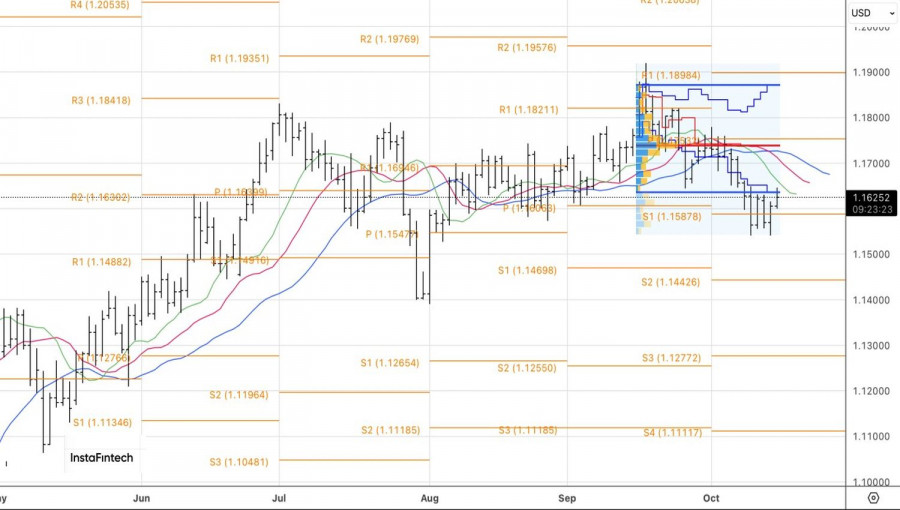

From a technical perspective, the probability is increasing that EUR/USD's corrective movement within the broader uptrend is nearing completion. Traders should prepare to re-enter long positions on the euro. A potential signal for such a move would be a renewed breakout against the lower boundary of the fair value range at 1.1635–1.1870.