TOKIO/OTTAWA (Reuters) – Společnost Honda uvedla, že neplánuje přesunout výrobu automobilů z Kanady a Mexika do USA, a reagovala tak na zprávu, že by mohla přesunout své provozy ve snaze vyhnout se potenciálně ničivým clům.

„V současné době se neuvažuje o žádných změnách,“ uvedla Honda (NYSE:HMC) Canada v e-mailovém prohlášení.

„Honda neučinila žádné rozhodnutí o výrobě, které by ovlivnilo provoz v Mexiku, ani se o něm v současné době neuvažuje,“ uvedla Honda Mexico v e-mailovém prohlášení.

Deník Nikkei již dříve uvedl, že Honda v reakci na nová americká cla na automobily zvažuje přesunout část výroby automobilů z Mexika a Kanady do Spojených států a usiluje o to, aby 90 % automobilů prodávaných v této zemi bylo vyráběno právě tam.

The Industrial Production Index rose by 1.7% m/m in June, marking the first increase in three months. This result contradicted market expectations (Bloomberg had forecast a decline of 0.8% m/m), but the positive figure should not be misleading — most indicators, except inventories, have still not returned to pre-COVID levels.

There is a close link between industrial output and export volumes, and here the problems are apparent. Japan concluded tariff negotiations with the U.S. at the end of July, making significant concessions. While this reduced uncertainty, high tariffs will continue to weigh on exports to the U.S. and are likely to reduce real production further. Domestic demand still appears stable but is also showing signs of weakening. The clear conclusion: despite the good figures for June, the overall outlook remains troubling and will likely lead to a further decline in output.

Japanese Prime Minister Shigeru Ishiba stated that the trade agreement reached is mutually beneficial for both countries, but implementing it could prove difficult. Among the key concerns, Ishiba highlighted the increase in auto tariffs from 2.5% to 27.5% — with the automotive sector accounting for about 10% of total output — as well as the 550 billion USD in investments expected to be made in the U.S. These investments are supposed to come from the private sector, which the government has no authority to compel. Public investment is entirely off the table given Japan's massive debt and budget deficit — the funds simply aren't available.

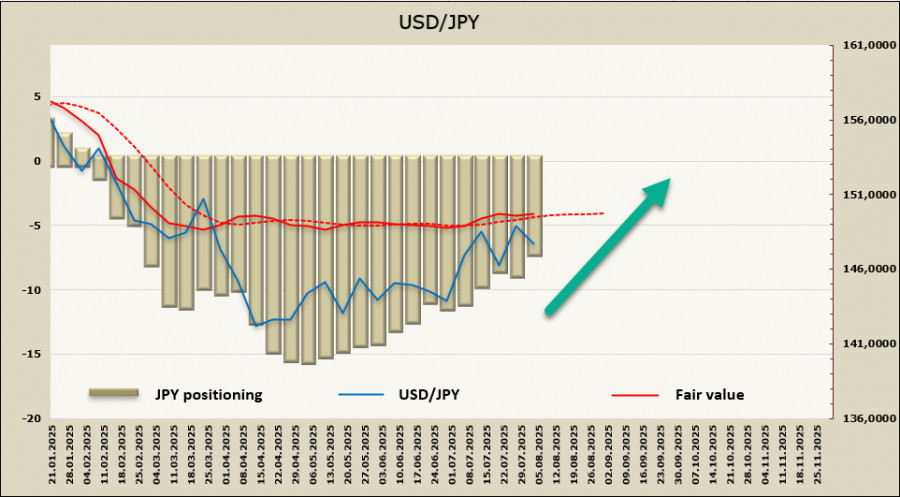

It is too early to determine whether Japan is heading into a recession, but optimism is limited. If economic growth were stable, one might expect the Bank of Japan to take more decisive action on interest rates. However, the current situation forces the BoJ to maintain its pause, even in the face of rising inflation. This, in turn, puts pressure on the yen and prevents it from regaining strength. The rise in USD/JPY on Friday before the weekly close should not be misinterpreted, as it was a reaction to a weak U.S. labor market report rather than any bullish developments in Japan.

According to the CFTC report published Friday, the reduction of long positions in the yen continues, while the estimated price remains above the long-term average, with no signs of a southward reversal.

The yen reached the 151.20/40 resistance zone, which we had previously identified as the next target, but failed to break higher due to the weak NonFarm Payrolls report triggering a broad U.S. dollar sell-off. We expect another attempt to test the 151.20/40 level and a potential breakout above. The main support is located at 144.90/145.20, though a move toward this level is currently considered unlikely.