Společnost ExxonMobil má ambiciózní plán, jak se dostat do ještě silnější pozice na trhu.

Tato ropná společnost plánuje do roku 2030 zvýšit své zisky o 20 miliard dolarů a cash flow o 30 miliard dolarů. Tento plán představuje významný krok k dalšímu růstu a zajištění dominance na trhu, což by mohlo přinést obrovské výhody pro investory.

ExxonMobil bude v příštích letech usilovat o organický růst a investice do svých silných aktiv. Společnost plánuje, že její kapitálové výdaje se letos budou pohybovat mezi 27 a 29 miliardami dolarů a mezi lety 2026 a 2030 se zvýší na 28 až 33 miliard dolarů ročně. Tento rozpočet bude zaměřen na aktiva s nízkými náklady a nízkými emisemi uhlíku, což je v souladu s celosvětovými ekologickými snahami. ExxonMobil očekává, že do roku 2030 zvýší svou těžbu ropy a zemního plynu na 5,4 milionu barelů ropného ekvivalentu denně (BOE/d), což je nárůst oproti loňským 4,6 milionu BOE/d.

Zhruba 60 % této produkce by mělo pocházet z výhodných aktiv, jako je oblast Permian, Guyana a LNG, což je nárůst oproti loňskému podílu 50 %. Exxon se rovněž soustředí na růst v oblasti produkčních řešení, jako je rafinace a chemie, přičemž zaměřuje své investice na produkty s vyšší přidanou hodnotou.

ExxonMobil (XOM) se také zaměřuje na strukturální úspory nákladů. Cílem je do roku 2030 snížit náklady o dalších 7 miliard dolarů, což se připojí k úsporám 11 miliard dolarů, které společnost dosáhla od roku 2019. Tyto úspory budou dosaženy zjednodušením obchodních procesů, optimalizací dodavatelských řetězců a modernizací technologií. Tyto kroky pomohou společnosti udržet její konkurenční výhodu a zároveň zvyšovat efektivitu jejího podnikání.

ExxonMobil odhaduje, že do roku 2030 investuje do velkých projektů, včetně těch v oblasti Permské oblasti, přibližně 140 miliard dolarů. Díky těmto investicím by měla společnost zvýšit své cash flow z loňských 55 miliard dolarů na více než 80 miliard dolarů ročně do roku 2030, což představuje složité roční tempo růstu o 8 %. To znamená, že Exxon bude v příštích letech generovat velké množství přebytečné hotovosti, kterou může vrátit akcionářům.

Pokud bude cena ropy kolem 65 dolarů za barel, ExxonMobil očekává, že do roku 2030 vytvoří přebytečný peněžní tok ve výši přibližně 165 miliard dolarů. Tento přebytek bude využit k zpětnému odkupu akcií a výplatám dividend, což je pro investory velmi atraktivní, protože to znamená stabilní a rostoucí výnosy.

ExxonMobil se proslavila svou dlouhou historií pravidelných zvýšení dividend, které trvají již 42 let v řadě. Tento krok je výjimečný, protože pouze 4 % společností v indexu S&P 500 dosáhly takovéto kontinuity v zvyšování výplaty dividend. V roce 2024 vyplatila ExxonMobil akcionářům 16,7 miliardy dolarů na dividendách a nedávno zvýšila výplatu o 4 %. To dělá ExxonMobil atraktivní volbou pro investory hledající stabilitu a růst.

Kromě dividend se ExxonMobil soustředí i na zpětný odkup akcií, který v roce 2024 činil 19,3 miliardy dolarů. Tento krok zvýšil výnos pro akcionáře, přičemž se společnosti podařilo vygenerovat 36 miliard dolarů v hotovosti, což je více než všechny společnosti v S&P 500, kromě pěti největších. V současnosti Exxon plánuje odkoupit 20 miliard dolarů svých akcií v roce 2025 a 20 miliard dolarů v roce 2026. Tento trend by mohl pokračovat, pokud ceny ropy vzrostou, což by ještě více podpořilo růst pro akcionáře.

ExxonMobil se aktuálně nachází v silné pozici jako lídr v těžbě ropy a generování peněžních toků. Společnost dosáhla v loňském roce nejlepších zisků v odvětví a zároveň nejlepších peněžních toků z provozní činnosti. V příštích pěti letech očekává, že tento růst bude pokračovat, přičemž bude těžit z investic do výhodných aktiv a snahy o optimalizaci nákladů.

Tato strategie umožní společnosti ExxonMobil pokračovat v tvorbě přebytečné hotovosti, kterou může využít k navýšení dividend a zpětným odkupům akcií, což poskytne investorům stabilní a rostoucí výnosy. Vzhledem k těmto faktorům je ExxonMobil považována za jednu z nejzajímavějších dlouhodobých investičních příležitostí na trhu.

ExxonMobil má jasně definovaný plán pro růst v příštích pěti letech a sází na silné investice do svých výhodných aktiv a snížení strukturálních nákladů. Tento plán jí umožní generovat přebytečný cash flow, který bude vrácen akcionářům prostřednictvím dividend a zpětných odkupů akcií. S tímto přístupem se ExxonMobil zdá být solidní volbou pro investory hledající stabilitu, růst a dobrý výnos v dlouhodobém horizontu.

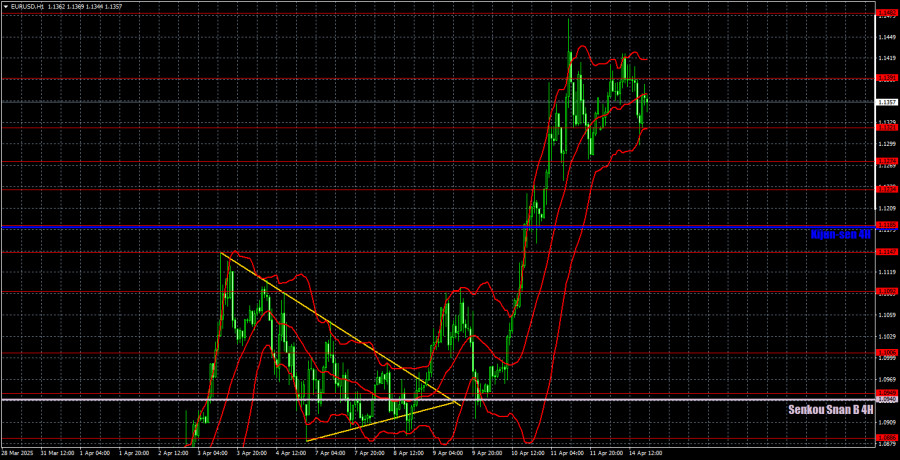

The EUR/USD currency pair attempted to extend its growth during Monday's session but eventually pulled back in the second half of the day. In essence, we didn't see any substantial gains for the U.S. dollar again — because Donald Trump, even when he's not imposing new tariffs, still ends up imposing new tariffs. Just over the weekend, Trump announced that certain electronics would be exempt from import duties, but on Monday, the U.S. president reversed that decision. In addition, he stated that the U.S. is preparing to impose tariffs on all semiconductors. Thus, we can again talk about a new escalation in the trade war — but not the opposite.

From a technical point of view, the picture remains unchanged in the 1-hour timeframe. There is no clear trendline or channel that can be drawn at this time. There were no significant events or reports in the Eurozone or the U.S. on Monday, yet the pair still showed high volatility and several intraday reversals. That's why we hold this perspective: market movements are erratic right now, and any strong trading signal is more of a coincidence than a rule.

In the 5-minute timeframe, we did not identify any trade signals again. This is because the price ignored all levels throughout the day, and the Ichimoku indicator lines are well below current price levels. The price movement has been extremely chaotic, as we've mentioned before. Today, if Trump introduces new tariffs — the dollar will continue plunging into the abyss.

The latest COT report is dated April 8. As shown in the chart above, the net position of non-commercial traders remained in bullish territory for a long time. The bears barely managed to take control, but now bulls have regained the initiative. The bears' advantage has diminished since Trump took office, and the dollar has begun to fall.

We can't say with certainty that the dollar will continue to decline, and COT reports reflect the sentiment of large players, which can shift very quickly in the current circumstances.

We still don't see any fundamental factors supporting euro strength, but a major factor is now contributing to dollar weakness. The pair may correct for several more weeks or months, but a 16-year downward trend doesn't reverse overnight.

The red and blue lines have now crossed again, signaling a bullish trend. During the last reporting week, the number of long positions held by the "non-commercial" group increased by 7,000, while short positions dropped by 1,100—resulting in a net increase of 8,100 contracts.

In the hourly timeframe, the EUR/USD pair resumed its upward movement as soon as Trump announced new tariffs. We believe the downtrend will resume in the medium term; however, it's impossible to say how long the market will continue to price in the "Trump factor" — or where the pair will be by then. Right now, the market is ruled by panic and chaos. If we previously avoided forecasting price action even a week ahead, it is even more unrealistic now. Our only advice is to wait for the "crisis" to pass or stick to intraday trading only.

For April 15, the key trading levels are 1.0757, 1.0797, 1.0823, 1.0886, 1.0949, 1.1006, 1.1092, 1.1147, 1.1185, 1.1234, 1.1274, 1.1323, 1.1391, 1.1482, as well as the Senkou Span B line (1.0940) and the Kijun-sen line (1.1182). Remember that Ichimoku indicator lines may shift throughout the day, which should be considered when interpreting trading signals. Don't forget to set a Stop Loss to breakeven once the price moves 15 pips in the right direction. This will protect you from possible losses if the signal is false.

Looking ahead to Tuesday, the day's most important reports will be the ZEW Economic Sentiment Indices for the Eurozone and Germany and Eurozone industrial production. But it hardly needs repeating: these reports currently hold little to no weight. Even if they trigger some market reaction, the overall direction of movement is unlikely to change.

QUICK LINKS