The euro and British pound have maintained strength and continued to rise against the US dollar. The Japanese yen has also regained all the losses observed at the beginning of the week.

The absence of reports from the US has allowed the euro and the pound to continue their gains against the dollar, as the likelihood of further interest rate cuts by the Federal Reserve has increased significantly. Traders have refocused on the prospects for monetary policy, assessing the latest key economic data and officials' comments. The lack of fresh data from the US has heightened concerns about a slowdown in the US economy, fueling expectations for a softer policy from the Fed. Meanwhile, positive signals from Europe and the UK, although not decisive, have still supported the euro.

Today, the German import price index is expected, unlikely to change the euro's positions. This indicator is not a significant measure of inflation processes and rarely impacts the exchange rate. A more substantial factor for the euro remains the overall economic situation in the Eurozone, as well as the European Central Bank's monetary policy.

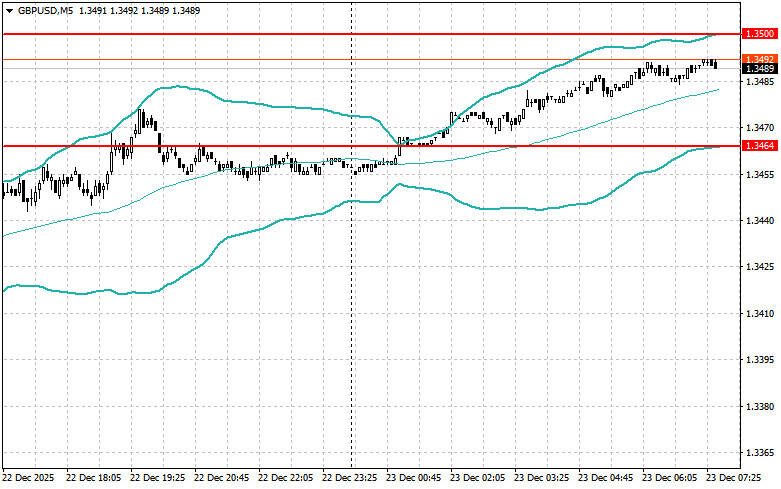

As for the pound, there are no reports scheduled for the UK today. The British pound, in the absence of internal catalysts, can obviously continue to move in a clearly defined direction. Without internal drivers in the first half of the day, traders' attention will also shift to external factors. This primarily concerns global trends, such as changes in risk sentiment and the monetary policy of other major central banks. The weakening of the US dollar, driven by expectations of Fed interest rate cuts, will continue to exert pressure on it against the pound.

If the data aligns with economists' expectations, it's advisable to act on the Mean Reversion strategy. If the data significantly exceeds or falls short of economists' expectations, it's best to use the Momentum strategy.

QUICK LINKS