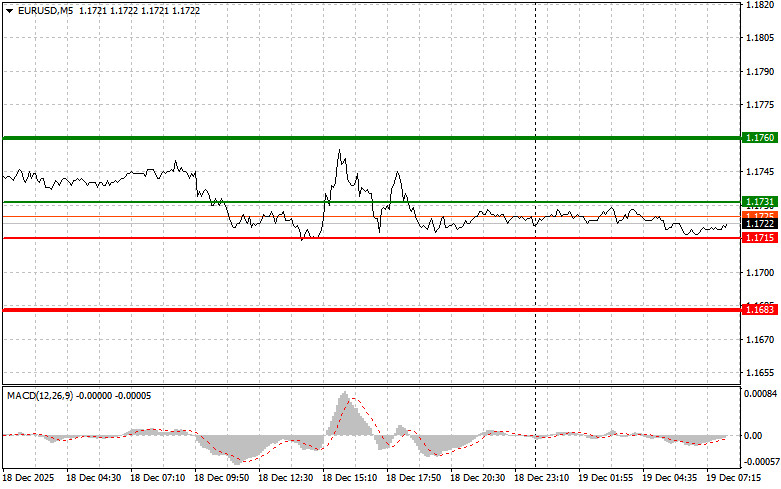

The test of the price at 1.1717 occurred when the MACD indicator had moved significantly below the zero line, limiting the pair's downward potential. For this reason, I did not sell the euro. The second test of 1.1717 triggered Buy Scenario #2, as the MACD was already in oversold territory, driving the pair up by more than 40 pips.

Yesterday, the European Central Bank decided not to change interest rates, clearly signaling the end of the easing phase of monetary policy. The upward revision of forecasts and positive changes in policymakers' plans indicate greater resilience in the eurozone economy than previously thought. However, despite the optimistic assessments, the ECB remains cautious. The accompanying statement to the interest rate decision emphasizes that economic instability persists, and the central bank is closely monitoring developments. Special attention will be paid to inflation, as keeping it at the target level of around 2% remains a priority for the ECB.

Today, key economic indicators will be published in the first half of the day: the GfK consumer sentiment barometer for Germany, the German producer price index, the ECB current account balance, and the eurozone consumer confidence indicator. This data will provide insights into the current state and the dynamics of development of the German and broader European economies. In particular, the GfK consumer climate index reflects German households' willingness to spend and their confidence in the future. Positive values indicate optimism and a likely increase in consumer spending, which is good for the economy and the euro. The German producer price index, on the other hand, is a significant measure of inflationary pressure in the industry. An increase in producer prices may also positively impact the euro in the future.

Regarding the intraday strategy, I will primarily focus on implementing Scenarios #1 and #2.

Important: Beginner traders in the Forex market should be very cautious when making entry decisions. It is best to avoid the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade in large volumes.

Remember that successful trading requires a clear trading plan, similar to the one presented above. Making spontaneous trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

QUICK LINKS