The EUR/USD currency pair continued its upward movement on Thursday following the Federal Reserve's meeting on Wednesday evening. Recall that the results of the last Fed meeting of the year cannot be considered unequivocally "dovish," as the central bank lowered the rate but essentially announced a prolonged pause for the following year. Only one easing of monetary policy is planned for the entire next year, which is positive news for the dollar. However, this time the market traded as if the Fed announced plans for 4-5 more cuts. It's also worth noting that the last two Fed meetings ended with a rate cut, after which the dollar rose. Therefore, the current decline of the American currency is more related to the flat trend on the daily timeframe. The price turned around near the lower boundary of the sideways channel at 1.1400-1.1830, so an expectation of a rise to the upper boundary could have been anticipated without the Fed meeting. In the long term, we expect the resumption of the 2025 global trend, with a breakthrough of the 1.1800 level and further growth.

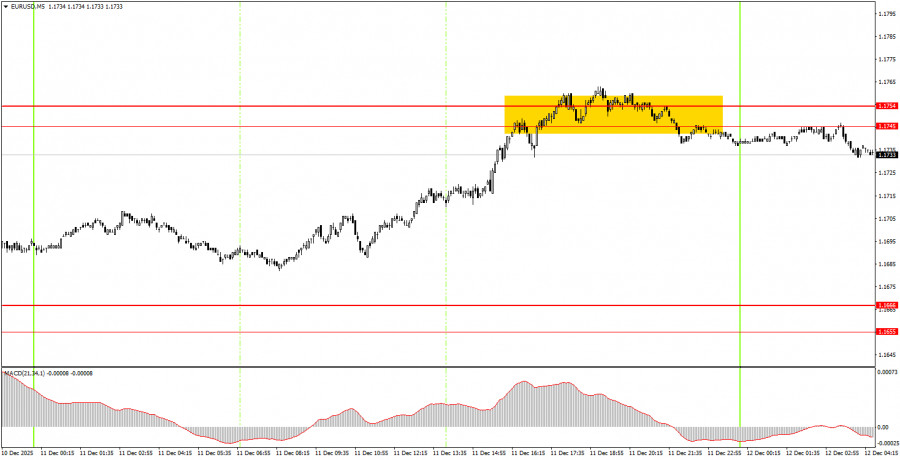

On the 5-minute timeframe, the first trading signal was formed during the US trading session yesterday. The price reached the resistance area of 1.1745-1.1754 but was unable to continue rising. As of Friday morning, the price has bounced off this area. The previous buy signal was formed on Wednesday evening. Traders who opened long positions based on this signal realized a profit of about 60 pips.

On the hourly timeframe, the EUR/USD pair continues to trend higher, though the price has breached the trend line this week. The overall fundamental and macroeconomic background remains very weak for the US dollar; therefore, we expect further growth. Even technical factors currently support the euro, as the flat trend on the daily timeframe persists, and after turning around near the lower boundary, it was reasonable to expect growth toward the upper boundary.

On Friday, beginner traders can trade from the area of 1.1745-1.1754. A price bounce from this area will allow opening short positions with a target of 1.1655-1.1666. A consolidation above this level will signal a long position, with a target at 1.1808.

On the 5-minute timeframe, levels to consider include 1.1354-1.1363, 1.1413, 1.1455-1.1474, 1.1527-1.1531, 1.1550, 1.1584-1.1591, 1.1655-1.1666, 1.1745-1.1754, 1.1808, 1.1851, 1.1908, 1.1970-1.1988. On Friday, there are no important events or reports scheduled in the Eurozone and the US. Only the second estimate of November inflation will be released in Germany. Thus, volatility today may drop to minimal levels, and trading will need to be performed based on technical analysis.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is important to understand that not every trade can be profitable. Developing a clear strategy and practicing money management are keys to long-term trading success.

QUICK LINKS