The GBP/USD currency pair traded quite calmly on Thursday, after showing impressive growth the day before. Recall that on this day, the US dollar received yet another verdict in the form of the ADP report. As a result, the number of private-sector employees in the US decreased by 32,000 in November, rendering all other data virtually meaningless for the American currency. The ISM Services PMI rose? Good, but it does not save the dollar from a decrease in the Federal Reserve's key rate next week.

However! The euro rose by 50 pips, and the British pound by more than 100. Why? There are two obvious answers to this question. First, the British currency is historically more volatile than the euro. Second, in recent months, the British pound has depreciated against the dollar much more than its European counterpart. It is worth noting that over the past five months, the euro has been in a flat range on the daily timeframe, and the British pound initially also "showed" a flat. But at the final stage, the GBP/USD pair fell below what it should have, turning the flat into a classic correction consisting of three waves. But were there grounds for the pound to decline more significantly?

In our opinion, no. In about half of the cases, the British pound depreciated due to the same issue regarding the UK budget for 2026, and in the other half of the cases, it was without cause. The macroeconomic background in Great Britain disappointed last month, but can the news flow from the US really please anyone right now? Thus, we continue to believe that we observed a technical correction, the magnitude of which was significantly larger than the logical and fair size. Therefore, the British pound is currently catching up. That is why it is rising stronger than the European currency.

Some traders may argue that the Bank of England is likely to lower the key rate in December as well. And they would be right. In this case, there seems to be no reason for the dollar to fall. However, let us return to October and November, when the market simply ignored a whole layer of news: the "shutdown" in the US, new tariffs from Donald Trump, and two cuts in the Fed's key rate. This is by no means a complete list, just the main points. Thus, in any case, the GBP/USD pair has fallen too much.

On the daily timeframe, an upward trend persists. Yes, we saw a five-month correction, but the trend has not been canceled or changed. Therefore, as long as the trend is not canceled, we should only expect growth. Yesterday, the Senkou Span B line was reached on the daily timeframe, and its breach will open the way for the British currency to reach yearly highs around the 38 level. As before, we expect movement only in the upward direction.

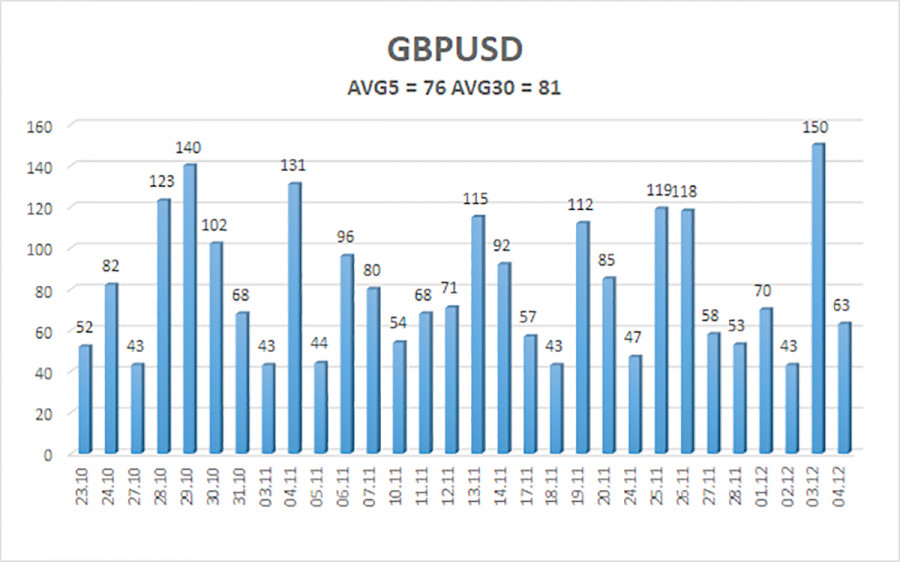

The average volatility of the GBP/USD pair over the last five trading days is 76 pips. For the pound/dollar pair, this value is "average." On Friday, December 5, we therefore expect movement within a range limited by the levels 1.3274 and 1.3426. The upper linear regression channel is directed downwards, but only because of a technical correction on higher timeframes. The CCI indicator has entered the oversold area six times over the past months and has formed another "bullish" divergence, which constantly warned of a resumption of the upward trend.

The GBP/USD currency pair is attempting to resume the 2025 upward trend, and its long-term prospects have not changed. Donald Trump's policies will continue to exert pressure on the dollar, so we do not expect the American currency to appreciate. Thus, long positions with targets of 1.3428 and 1.3489 remain relevant in the near future as long as the price is above the moving average. If the price is below the moving average line, small short positions with a target of 1.3184 can be considered on technical grounds. From time to time, the American currency shows corrections (globally), but for a robust trend strengthening, it needs signs of an end to the trade war or other positive global factors.

QUICK LINKS