The Canadian dollar has risen this week, but the increase is primarily due to the U.S. dollar's weakening and an overall appetite for risk, rather than domestic economic factors.

The GDP growth for the third quarter outpaced expectations at 2.6% year-on-year, primarily explained by a rebound after a disappointing second quarter, which was revised from -1.6% year-on-year to -1.8%. Excluding external factors, the final domestic demand hardly changed, registering a -0.1% quarter-on-quarter decline, while the preliminary estimate for October showed a decrease of 0.3% month-on-month. Consumer spending contracted by 0.4% quarter-on-quarter compared to 4.2% in the second quarter, and GDP growth was driven by a sharp decline in imports of -8.6% quarter-on-quarter alongside weak export growth, contributing 3.1% to the overall GDP.

At the same time, U.S. data is increasingly disappointing. According to the ADP report, private-sector employment fell by 32,000. The ISM services index rose slightly from 52.4 to 52.6, while the employment sub-index remained in contraction territory; the new orders sub-index slowed, and the prices sub-index sharply declined, indicating reduced inflationary pressure. Together, the U.S. data convinces the market that the Federal Reserve will lower rates next week, and the dollar weakened across the currency market in the latter half of the day.

The Bank of Canada will hold its meeting on December 10, the same day as the Fed, and so far, there is nothing to shake market confidence that rates will remain unchanged at 2.25%. Tomorrow, the Canadian labor market report will be released, and the forecast only confirms pessimistic assessments of the overall state of the economy, with zero job growth expected.

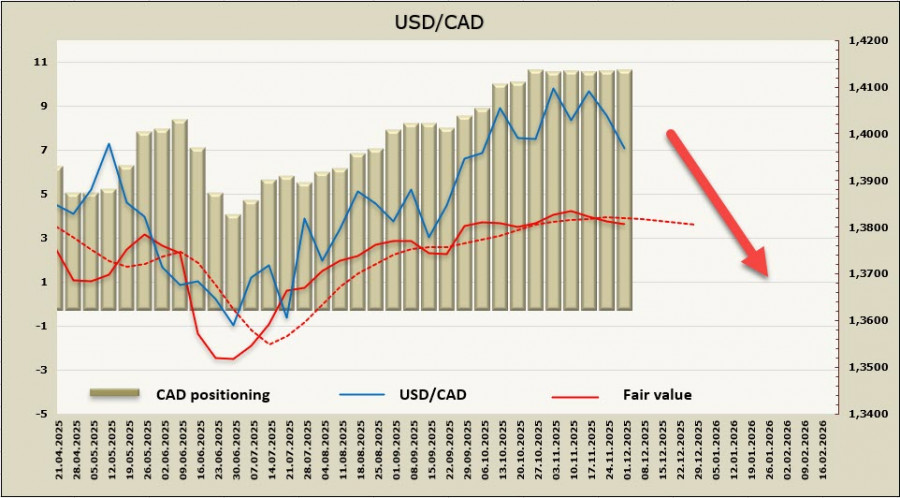

The calculated price is below the long-term average, suggesting further downward correction for USD/CAD.

Just a week ago, the main scenario envisioned a decline in USD/CAD to the support zone of 0.3930/40 under the fulfillment of two conditions. These conditions have materialized: the GDP report exceeded expectations, overall risk appetite remained stable, and the Canadian dollar ultimately strengthened. Currently, there are no new data, but if the Canadian labor market report on Friday is better than the forecasts, the decline may continue toward the lower boundary of the channel at 1.3000/10 with an attempt to breach below to 1.3887. Conversely, if the labor market report is disappointing, a pullback to the middle of the channel at 1.4030/50 is more likely.

QUICK LINKS