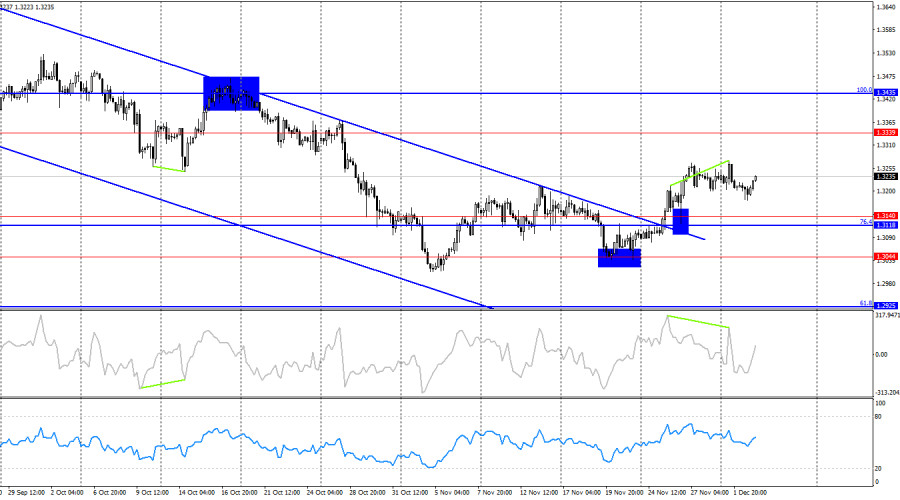

On the hourly chart, the GBP/USD pair has been trading horizontally over the past few days between price levels 1.3186 and 1.3270. Traders often ignore chart levels, and the pair remains in a sideways range. Yesterday, a rebound from the 38.2% retracement level at 1.3186 occurred, leading to a reversal in favor of the pound and a rise to the 50.0% Fibonacci level at 1.3240. Today, a rebound from this level would work in favor of the dollar and lead to a new decline toward 1.3186. A consolidation of the pair above 1.3240 would allow for continued growth toward the 61.8% retracement level at 1.3294.

The wave structure has turned "bullish." The last completed downward wave did not break the previous low, while the new upward wave broke the previous peak. Thus, the trend has officially become bullish. The news background for the pound has been weak in recent weeks, but the bears have fully priced it in, and the U.S. news background is also far from ideal.

There was no news background for either the pound or the dollar on Tuesday. The euro, meanwhile, had two interesting reports, but the market ignored them. As a result, the pound and dollar lost nothing. The overall upward movement continues ahead of the last FOMC meeting of 2025, but traders are still cautious, as there is still no up-to-date labor market or unemployment data in the U.S. As a reminder, due to the "shutdown," the Bureau of Statistics stopped working for a month and a half and still hasn't collected data for October and November. Therefore, there is no current information on labor market conditions. Without it, the Federal Reserve will again have to make its monetary policy decision essentially blind. The only report that may give the FOMC at least some guidance is the ADP report, which becomes available today. According to forecasts, the number of new jobs in November will be 5,000—much lower than October's figure of 42,000, which is already considered extremely low. Thus, the market has every reason to continue selling the dollar.

On the 4-hour chart, the pair consolidated above the downward trend channel and above the 1.3118–1.3140 level. Therefore, the upward movement may continue toward the 1.3339 level. A "bearish" divergence formed on the CCI indicator, which allowed for expectations of some decline, but that decline may already be over. No new divergences are forming today.

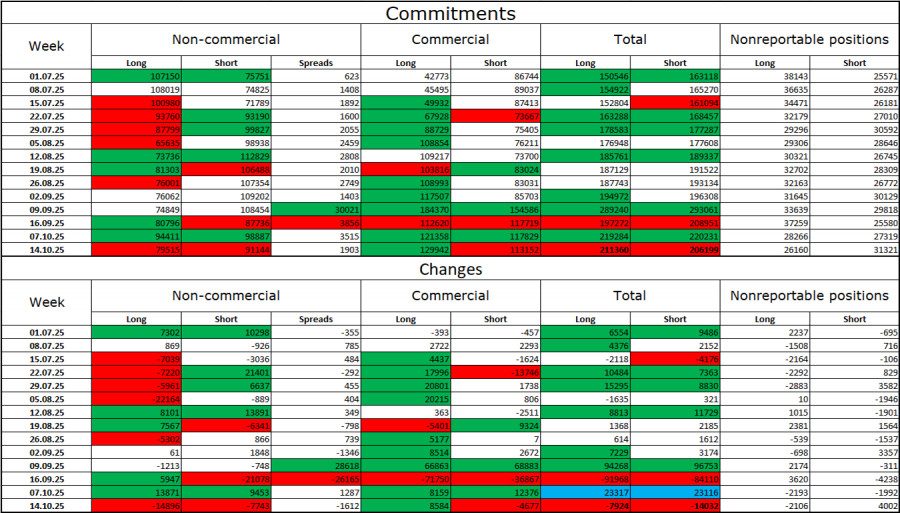

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category became less bullish during the last reporting week, but that reporting week was a month and a half ago—October 14. The number of long positions held by speculators decreased by 14,896, and the number of short positions decreased by 7,743. The gap between long and short positions now stands at approximately 79,000 vs. 91,000. However, these figures are as of mid-October.

In my view, the pound still appears less "risky" than the dollar. In the short term, the U.S. currency is in demand, but I consider this a temporary phenomenon. Donald Trump's policies have led to a sharp decline in the labor market, and the Fed is forced to ease monetary policy to stop rising unemployment and stimulate job creation. Thus, if the Bank of England may cut rates one more time, the FOMC could continue easing throughout 2026. The dollar weakened significantly in 2025, and 2026 may be no better for it.

News calendar for the U.S. and the UK:

On December 3, the economic calendar contains four entries, of which only the U.S. reports are of significant interest. The influence of the informational background on market sentiment will be present on Wednesday, but only in the second half of the day.

GBP/USD Forecast and Trader Recommendations:

I would not consider selling the pair today, as there is no clear rebound level. Buy positions could be opened upon a rebound on the hourly chart from the 1.3186–1.3214 level with a target of 1.3294. These trades can be kept open today.

Fibonacci grids are constructed using 1.3470–1.3010 on the hourly chart and 1.3431–1.2104 on the 4-hour chart.

QUICK LINKS