NEW YORK (Reuters) – Řada zpráv o ziscích amerických maloobchodníků, které budou zveřejněny v příštím týdnu, by měla přinést více světla do ekonomických dopadů měnící se situace kolem cel a otestovat prudký vzestup akciového trhu.

Výsledky maloobchodníků, včetně Target, Home Depot (NYSE:HD) a Lowe’s (NYSE:LOW), přicházejí v době, kdy investoři již tolik nepociťují obavy, že cla zavedená americkým prezidentem Donaldem Trumpem uvrhnou ekonomiku do recese, zejména po nedávném uzavření obchodní dohody mezi dvěma největšími světovými ekonomikami, USA a Čínou.

The Biden administration has begun developing a contingency plan in case the U.S. Supreme Court overturns most of the trade tariffs imposed by Donald Trump. It is worth noting that two American courts (the Trade Court and the Appeals Court) have already ruled that Trump's tariffs are illegal and that his actions exceeded presidential authority. However, neither court has taken responsibility for the complete annulment of the tariffs. Local courts have decided to pass the burden of choice and responsibility to the highest authority—the Supreme Court. The first hearing on this matter has already taken place.

Interestingly, the initial session concluded with the Supreme Court expressing doubts about the legality of Trump's tariffs and finding no mention of the word "tariff" in the 1974 Emergency Act. It is difficult to determine what exactly "expressing doubt" means. Did they express doubt and decide to hold additional hearings in the hope of finding the term "tariff" in the law?

The White House hopes that the dispute will be resolved in its favor, and politicians close to the president state anonymously that tariffs will remain a key part of Trump's economic strategy. Consequently, the President of the United States does indeed need to develop a contingency plan in case the Supreme Court declares his actions illegal.

Resolving the issue could be relatively straightforward for the White House—the Trade Act allows Trump to impose tariffs. However, there are likely many "buts" and "ifs" in this law that are currently unknown. After all, why would Trump impose tariffs based on the Emergency Act if there is a much more appropriate Trade Act available?

In simple terms, if Trump loses the case, he will immediately reimpose the same tariffs based on other laws. After that, the plaintiffs can file new lawsuits, starting the process of tariff annulment all over again. This entire chain of events could repeat multiple times as long as Trump remains President of the United States. Legal proceedings are generally lengthy, especially when dealing with such global issues, particularly when the lawsuit is directed against the country's president. Thus, Trump will have the advantage of buying time while potentially violating U.S. laws. Therefore, the trade war is unlikely to conclude anytime soon, and the dollar will not have anything positive to gain from this situation.

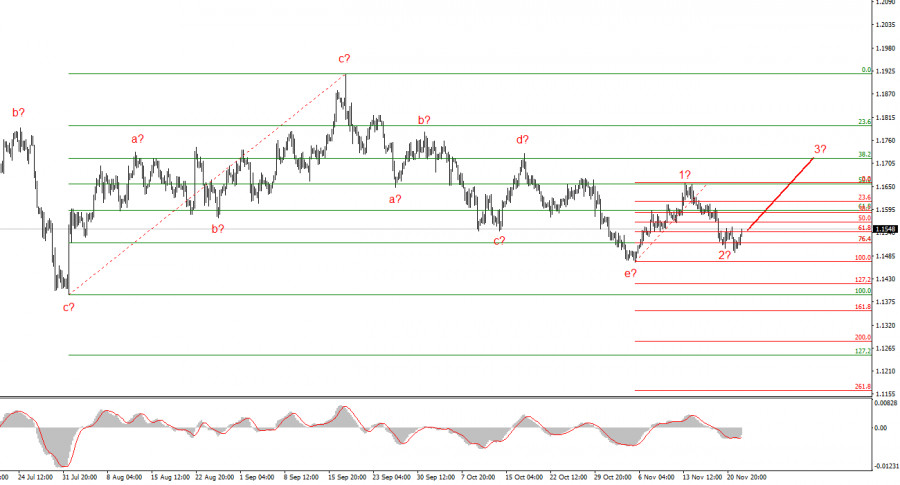

Based on the analysis conducted for EUR/USD, the instrument continues to build an upward section of the trend. In recent months, the market has paused, but Trump's policies and the Fed remain significant factors in the decline of the American currency in the future. The targets for the current trend section may extend up to the 25th figure. The formation of an upward wave set may continue. I expect that from current positions, the third wave of this set will begin, which could either be with or 3. At present, I remain in long positions, with targets around the 1.1740 mark, and an upward reversal of the MACD indicator provides slight confirmation of expectations.

The wave picture of the GBP/USD instrument has changed. We continue to deal with an upward, impulsive section of the trend, but its internal wave structure has become increasingly complex. The downward corrective structure a-b-c-d-e in c in 4 appears quite complete. If this is indeed the case, I expect the main trend section to resume its formation with initial targets around the 38 and 40 figures. In the short term, wave 3 or c is expected, with targets around 1.3280 and 1.3360, corresponding to 76.4% and 61.8% on the Fibonacci scale.

QUICK LINKS