On Thursday, the long-awaited report was released, and market participants had high hopes for it while also understanding that it would have a minimal impact on the Federal Reserve's decision in December. Data on unemployment and the labor market have their own "expiration dates." No one will take the September report seriously in December. Even with the Bureau of Labor Statistics not publishing October reports, the relevance of the September data remains questionable. As a result, we observed a very weak reaction to Thursday's reports.

First, the reports contradicted each other; second, the data is outdated. However, we can still draw some conclusions. If the labor market began to recover in September (essentially before the resumption of the Fed's easing cycle) with the creation of over 100,000 new jobs, one could expect that the recovery would continue in October and November, given that the Fed's rate was already 50 basis points lower at that time. If this assumption holds true, the November report is likely to be quite strong. In this case, the Fed would not need to conduct a new round of easing not only in December but also at the beginning of next year.

If these assumptions are correct, it would be good news for the U.S. dollar. However, there is a caveat. Over the last month and a half, demand for the U.S. currency has grown, despite the "shutdown," the Fed's rate cuts, and the weakness in the labor market. Therefore, the market may have already priced in all the positive factors for the dollar. Consequently, even the Fed's refusal to implement a new rate cut may not allow the dollar to continue appreciating.

It's important to note that market participants often try to anticipate the news background in advance to position themselves at the most favorable rates. Given that the current wave pattern for both instruments remains bullish, I still expect a new rise. The wave structure over the past few months indicates we are dealing with corrective waves. Thus, we just need to wait for the trend movement to resume. However, this process is more complicated than I anticipated; I expected the correction to end a month ago. Nevertheless, the market is not yet ready for purchases.

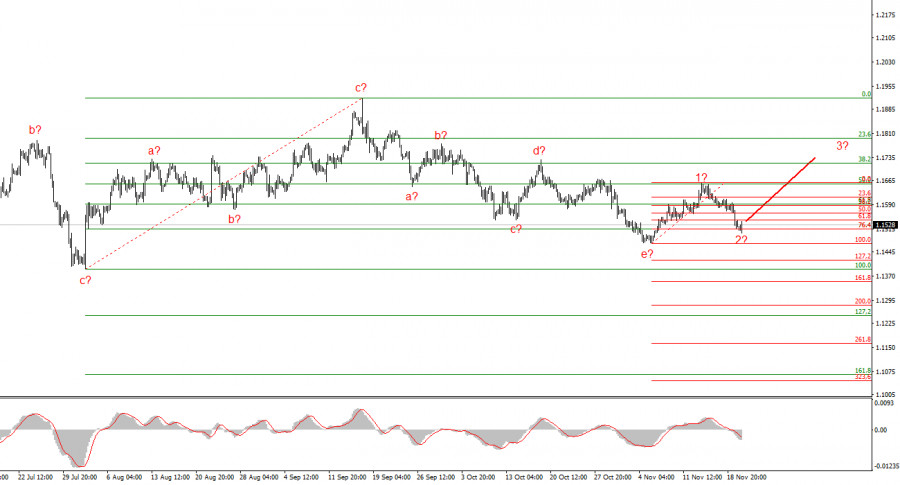

Based on the analysis conducted for EUR/USD, I conclude that the instrument continues to build an upward section of the trend. The market has paused in recent months, but Donald Trump's policy and the Fed remain significant factors influencing the U.S. dollar's future decline. The targets for the current section of the trend could reach the 25-figure mark. A third wave of this set may start forming from current positions, which could be either an impulsive or corrective wave. In the coming days, I anticipate buying opportunities with targets around 1.1740, and an upward reversal of the MACD indicator will confirm this signal.

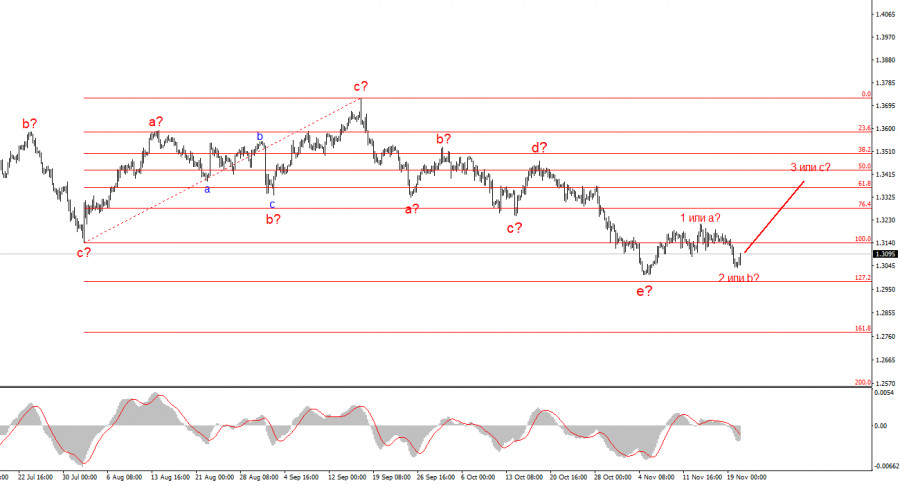

The wave picture for GBP/USD has changed. We continue to deal with a bullish, impulsive section of the trend, but its internal wave structure has become complex. Wave 4 has taken on a three-wave form, resulting in a very elongated structure. The downward corrective structure a-b-c-d-e in wave 4 looks quite complete. If this is indeed the case, I expect the main trend section to resume its formation with initial targets around the 38 and 40 figures. In the short term, we can expect wave 3 or c to form, with targets around 1.3280 and 1.3360.

QUICK LINKS