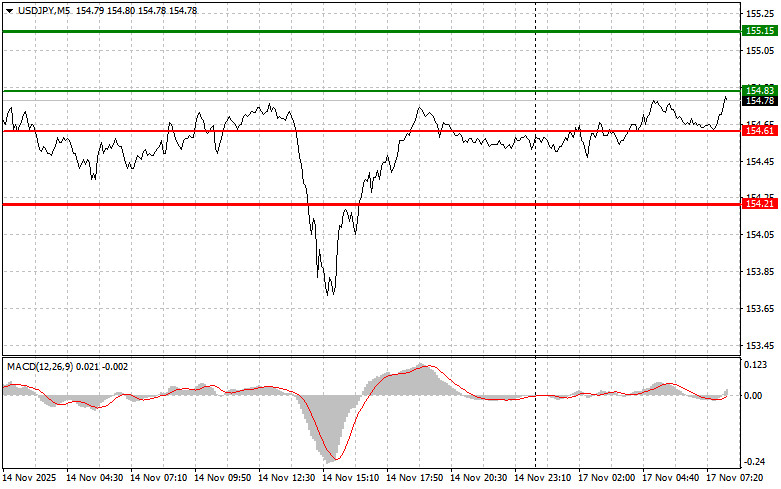

The price test at 154.61 coincided with the MACD indicator just beginning to turn downward from the zero mark, providing a good entry point to sell the dollar, which led to a decline of more than 100 pips for the pair.

Uncertainty regarding the Federal Reserve's future actions at the end of last week prompted investors to offload excess U.S. dollars against the Japanese yen. The inability to break above the significant resistance at the 155.00 level was also a reason for the pair's correction. The uncertainty with the Bank of Japan's policy and the new government's differing views on future fiscal policy continues to exert negative pressure on the Japanese yen. As a result, the market remains in a state of anticipation, contributing to increased volatility in the USD/JPY pair.

Regarding the intraday strategy, I will rely more on the implementation of scenarios #1 and #2.

Scenario #1: I plan to buy USD/JPY today when it reaches the entry point around 154.83 (green line on the chart), targeting a move to 155.15 (thicker green line on the chart). At 155.15, I plan to exit my long positions and open shorts in the opposite direction, expecting a move of 30-35 pips from the entry point. It's best to return to buying the pair on corrections and significant dips in USD/JPY. Important! Before buying, ensure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: I also plan to buy USD/JPY today if the price tests 154.61 twice and the MACD indicator is in the oversold area. This will limit the downside potential of the pair and result in a market reversal upwards. An increase towards the opposing levels of 154.83 and 155.15 can be expected.

Scenario #1: I plan to sell USD/JPY today only after the 154.61 level is updated (red line on the chart), which will trigger a swift decline in the pair. The key target for sellers will be the 154.21 level, where I intend to exit my shorts and buy immediately in the opposite direction, expecting a move of 20-25 pips from this level. It's best to sell as high as possible. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline from it.

Scenario #2: I also plan to sell USD/JPY today in the event of two consecutive tests of the price at 154.83 when the MACD indicator is in the overbought area. This will limit the upward potential of the pair and lead to a market reversal downwards. A decline towards the opposing levels of 154.61 and 154.21 can be expected.

Important: Beginner traders in the Forex market must be very cautious when making trading entry decisions. It is best to remain out of the market before the release of important fundamental reports to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade with large volumes.

And remember that successful trading requires having a clear trading plan, similar to the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

QUICK LINKS