WASHINGTON (Reuters) – Americký ministr dopravy Sean Duffy ve čtvrtek vyzval Kongres, aby poskytl miliardy dolarů na výměnu zastaralého telekomunikačního vybavení a radarových systémů Federálního úřadu pro letectví, výstavbu nových věží a zlepšení bezpečnosti letištních drah.

Duffyho plán počítá s nahrazením měděných kabelů novými optickými, bezdrátovými a satelitními technologiemi, výměnou 618 radarů, zvýšením počtu letišť vybavených technologií pro sledování povrchu a výstavbou šesti nových center řízení letového provozu.

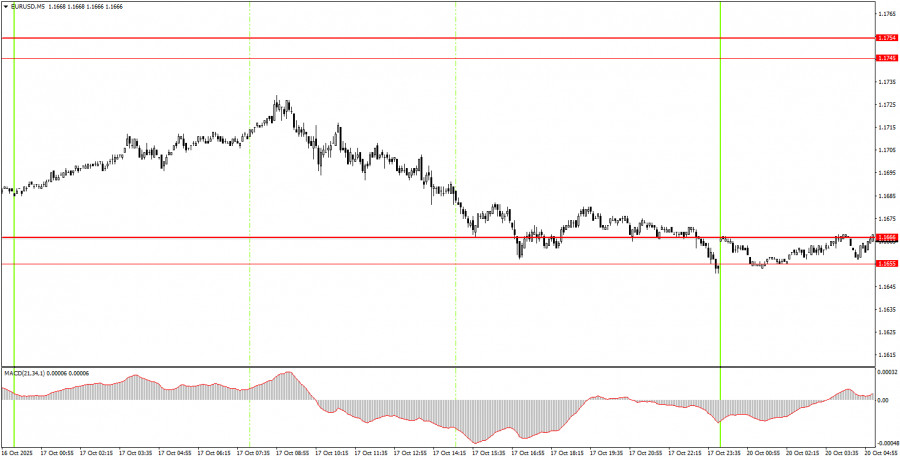

On Friday, the EUR/USD currency pair declined more than it rose. As a reminder, the technical trend turned bullish last week; therefore, traders are now fully justified in expecting the euro to rise. It's also worth noting that recently (in our view), the euro had few grounds for decline, and the U.S. dollar had little reason to strengthen. However, the daily timeframe remains flat, which is why we saw nearly three weeks of decline, raising many questions.

As for Friday itself, the inflation report in the Eurozone for September came in above both forecasts and the initial estimate. The higher the inflation rate, the less likely the European Central Bank is to lower interest rates further. In this way, higher inflation supports the euro. But as we can see, traders ignored the report, as expected. In the second half of the day, Donald Trump somewhat eased market tension by stating that an agreement with China was likely, and that increased tariffs would not be permanent. Based on this, the dollar may have strengthened slightly.

On the 5-minute timeframe during Friday's session, there were virtually no trading signals formed. As the evening approached, the price fell toward the 1.1655–1.1666 area, but by that time, most traders had already exited for the weekend. Today, the pair remains in this area, and no new trading signals have been formed yet.

On the hourly timeframe, the EUR/USD pair is finally showing signs of an uptrend. The descending trendline has once again been broken, and the overall fundamental and macroeconomic background remains unfavorable for the U.S. dollar. Thus, we continue to expect the resumption of the bullish trend of 2025.

On Monday, the EUR/USD pair could move in either direction, as there are almost no significant fundamental or macroeconomic events scheduled for the day. Novice traders may wait for a signal to form around the 1.1655–1.1666 area. However, overall price movements could be weak today.

On the 5-minute timeframe, the following levels should be considered:

1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527, 1.1571–1.1584, 1.1655–1.1666, 1.1745–1.1754, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. For Monday, there are no significant reports or events scheduled in either the Eurozone or the United States. Therefore, volatility may once again be very low, but the euro may continue its gradual upward movement, as all necessary grounds for that currently exist.

Important speeches and reports (always shown in the news calendar) can significantly impact currency pair movements. Therefore, during their release, it's best to trade with extreme caution or exit the market entirely to avoid sharp reversals against the preceding trend.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and using proper money management are key to long-term trading success.

QUICK LINKS