Akcie společnosti Charles River Laboratories International, Inc. (NYSE:CRL) dnes vzrostly o 19 %, poté co firma oznámila změny v řízení a strategické přezkoumání s cílem zvýšit dlouhodobou hodnotu pro akcionáře. K růstu akcií přispěly také lepší než očekávané výsledky za první čtvrtletí.

Společnost oznámila, že čtyři noví členové se připojí k představenstvu, zatímco čtyři stávající členové se nebudou ucházet o znovuzvolení na valné hromadě akcionářů plánované na 20. května 2025. Tato změna je součástí širší strategické revize, včetně dohody o spolupráci s Elliott Investment Management, největším akcionářem společnosti.

Charles River oznámila zisk na akcii za Q1 ve výši 2,34 USD, což je o 0,25 USD více než odhad analytiků (2,09 USD). Tržby za čtvrtletí činily 984,2 milionu USD, čímž překonaly konsenzus 941,47 milionu USD. Společnost rovněž poskytla výhled na celý fiskální rok 2025 – očekává zisk na akcii v rozmezí 9,30 až 9,80 USD, což odpovídá odhadům trhu (9,31 USD).

Předseda představenstva, prezident a generální ředitel James C. Foster uvedl, že společnost přijímá proaktivní kroky pro zvládnutí tržních podmínek a zaměřuje se na růst. Vyjádřil důvěru v přínos nových členů rady a poděkoval odcházejícím za jejich práci.

Elliott Investment Management podpořila změny a zdůraznila význam společnosti pro biomedicínský výzkum. Partner Elliottu Marc Steinberg uvedl, že vnímá velkou hodnotu a potenciál Charles River jako klíčového hráče v odvětví.

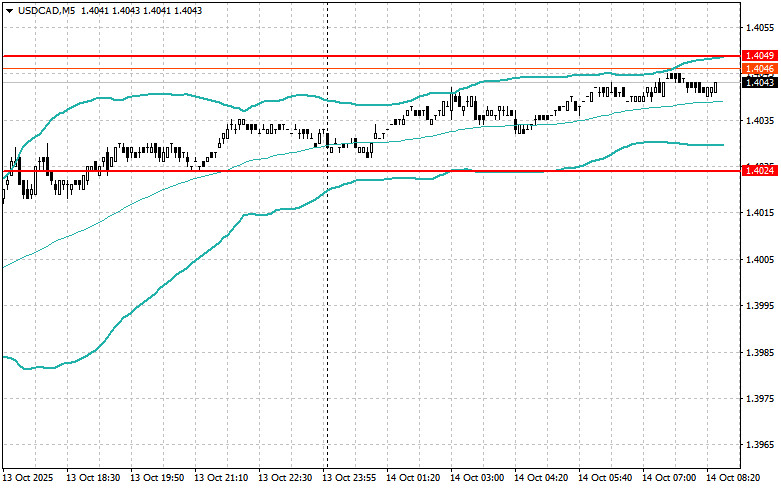

The U.S. dollar regained ground against the euro, the pound, and other assets, but failed to do so against the yen.

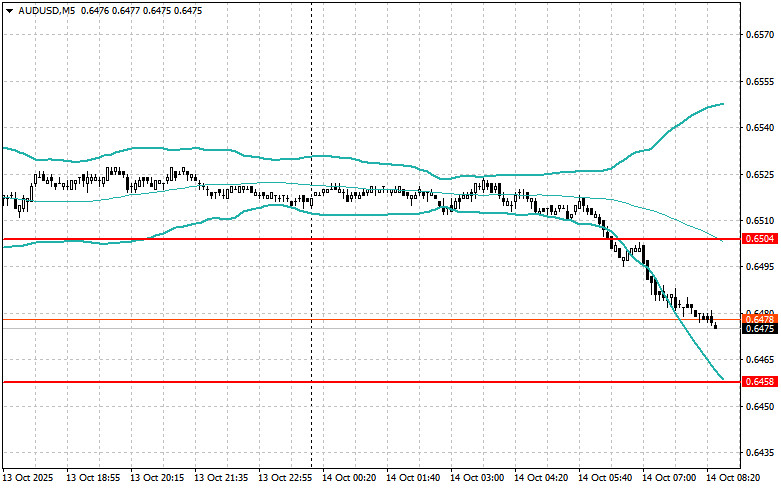

The continued deterioration in trade relations between the U.S. and China, particularly due to the risk of new tariffs, continues to pressure risk assets. Many traders and investors worry that further escalation could lead to a slowdown in global economic growth, negatively impacting many national economies.

Today, attention turns to several important reports in the first half of the day: the ZEW Economic Sentiment Index for the Eurozone and the German Consumer Price Index (CPI). These indicators could influence the euro in the short term, though their long-term impact on the FX market should not be overestimated.

The ZEW Economic Sentiment Index is an important leading indicator for the euro area. If the data exceed expectations, it may reflect improving business sentiment, supporting the euro. The German CPI is a key inflation measure in the Eurozone's largest economy. If it surprises to the upside, it will increase pressure on the European Central Bank (ECB), possibly leading to gains in the euro.

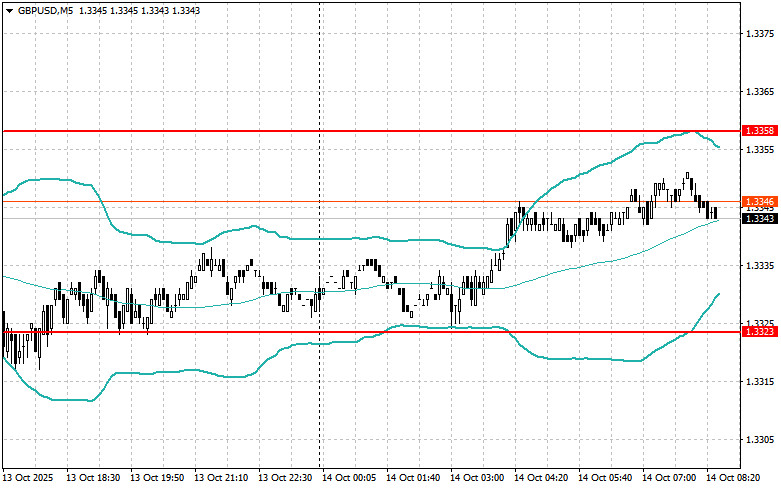

For the British pound, today's labor market data are critical in assessing the overall health of the UK economy. Unemployment figures reflect labor demand, while changes in wages directly impact inflation. Strong data showing a decline in unemployment and rising wages are typically seen as signals of economic strength and could support the pound.

The speech by Bank of England Governor Andrew Bailey is also of interest to traders. Bailey is expected to address the current UK economic outlook, inflation prospects, and monetary policy direction. Markets will be on alert for any clues regarding possible changes in interest rates.

If the data come in line with economists' expectations, traders should consider using a Mean Reversion strategy. If the data significantly exceeds or misses expectations, a Momentum strategy may be more effective.

QUICK LINKS