Bitcoin stabilized around $112,500, repeatedly bouncing back well from this level. Ethereum, on the other hand, showed a relatively strong rally yesterday, returning to $4,400. However, it is too early to get carried away with euphoria.

According to the latest data, the total open interest in ETH futures on the CME exchange has risen sharply and set a new record. This suggests that a large number of market participants are heavily positioned in long positions. Such an increase in open interest, especially in long positions, may indicate optimistic sentiment regarding the future of Ethereum. Institutional investors and major players trading on CME often have significant resources and conduct thorough market analysis before taking large positions. Therefore, the growth in longs may reflect their belief in the further rise of ETH's value.

However, it is also important to consider the risks associated with such a bias toward longs. In the event of unexpected negative news or a broader correction in the cryptocurrency market, mass liquidation of these positions could occur, leading to a sharp drop in ETH's price. The "crowd effect" may further amplify volatility and cause irrational market movements. Historically, such situations often resulted in sharp market corrections, as the market needed to "reset" before resuming its upward trajectory and eventually attempting to renew all-time highs.

As for the intraday strategy in the cryptocurrency market, I will continue to focus on any major pullbacks in Bitcoin and Ethereum, betting on the continuation of the bullish market in the medium term, which remains intact.

For short-term trading, the strategy and conditions are described below.

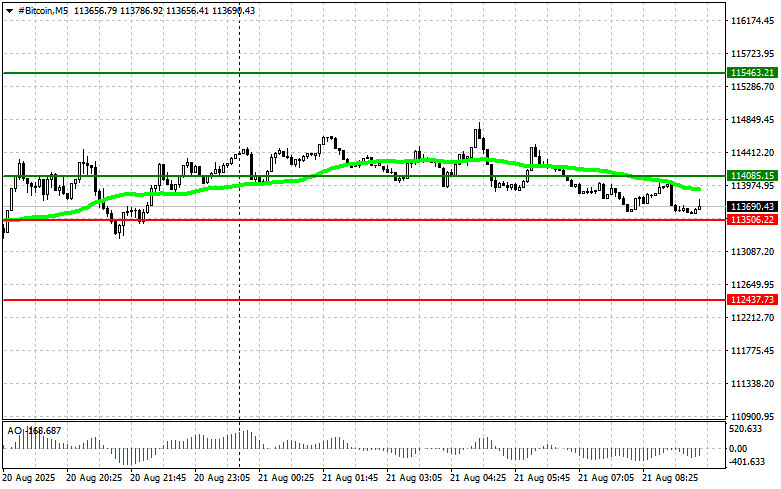

Scenario No. 1: I plan to buy Bitcoin today at the entry point around $114,000, targeting growth toward $115,400. Around $115,400, I plan to exit purchases and immediately sell on the rebound. Before buying on the breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is in the zone above zero.

Scenario No. 2: Bitcoin can also be bought from the lower boundary at $113,500 if there is no market reaction to its breakout, with an upward move toward $114,000 and $115,400.

Scenario No. 1: I plan to sell Bitcoin today at the entry point around $113,500, targeting a decline toward $112,400. Around $112,400, I plan to exit sales and immediately buy on the rebound. Before selling on the breakout, ensure the 50-day moving average is above the current price and the Awesome indicator is in the zone below zero.

Scenario No. 2: Bitcoin can also be sold from the upper boundary at $114,000 if there is no market reaction to its breakout, with a downward move toward $113,500 and $112,400.

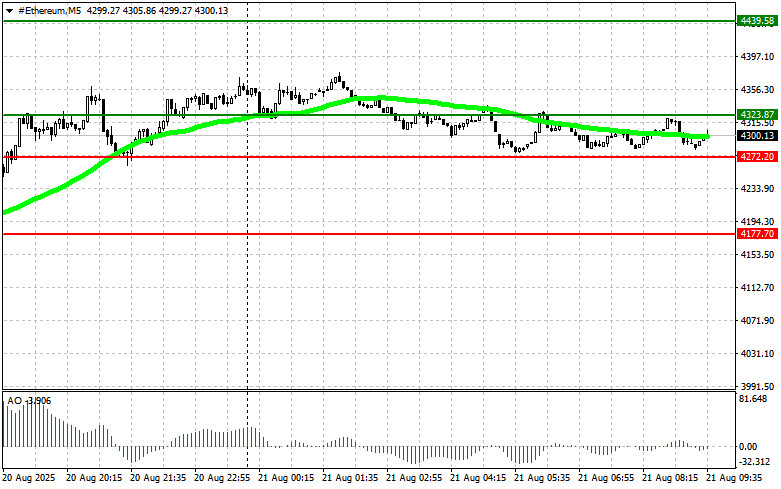

Scenario No. 1: I plan to buy Ethereum today at the entry point around $4,323, targeting growth toward $4,439. Around $4,439, I plan to exit purchases and immediately sell on the rebound. Before buying on the breakout, ensure the 50-day moving average is below the current price and the Awesome indicator is in the zone above zero.

Scenario No. 2: Ethereum can also be bought from the lower boundary at $4,272 if there is no market reaction to its breakout, with an upward move toward $4,323 and $4,439.

Scenario No. 1: I plan to sell Ethereum today at the entry point around $4,272, targeting a decline toward $4,177. Around $4,177, I plan to exit sales and immediately buy on the rebound. Before selling on the breakout, ensure the 50-day moving average is above the current price and the Awesome indicator is in the zone below zero.

Scenario No. 2: Ethereum can also be sold from the upper boundary at $4,323 if there is no market reaction to its breakout, with a downward move toward $4,272 and $4,177.

QUICK LINKS