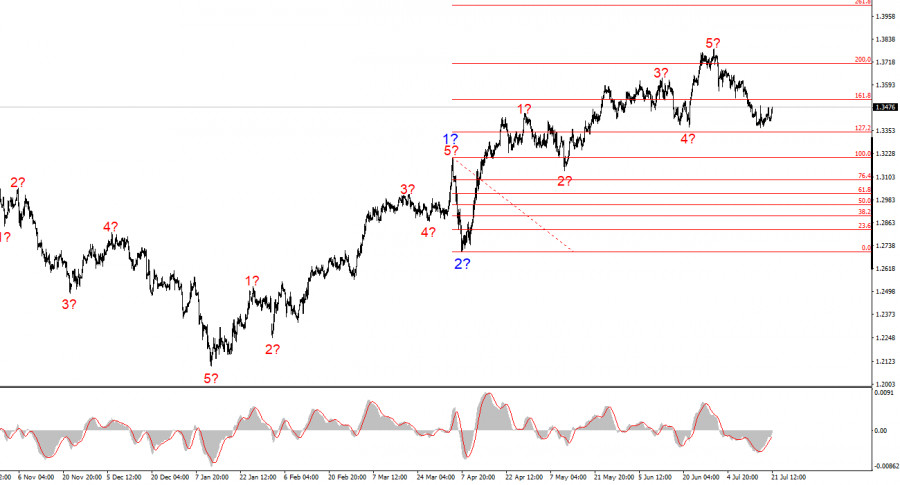

The wave pattern of the GBP/USD pair continues to indicate the formation of a bullish impulse wave pattern. The wave picture closely resembles that of the EUR/USD pair, as the U.S. dollar remains the sole driver behind the current market movement. Demand for the greenback is falling across the board, which is why many instruments are showing similar dynamics. Wave 2 of the upward trend segment has taken the form of a single wave. The presumed wave 3 has developed into a convincing and complete formation, so I am now expecting the construction of a corrective structure, with the first wave of that correction possibly already completed.

It is important to note that much of the current forex landscape is influenced by Donald Trump's policies—not just his trade policy. From time to time, we receive decent news out of the U.S., but the market remains fixated on the broader uncertainty, Trump's contradictory decisions and statements, and the White House's hostile and protectionist stance. As a result, the dollar must work very hard to convert even positive news into increased demand.

The GBP/USD pair rose by 70–80 basis points on Monday. There was no significant economic news background today, but Donald Trump continues to rage and has once again spoken of raising tariffs and of the approaching August 1 deadline—the end of the grace period he himself granted for negotiations. Once the market began to realize that no trade deals had been reached in the last three weeks and that the global trade war was still underway, demand for the U.S. dollar began to decline once again. Although in my view, the market never really entertained false hopes to begin with. Corrections are a natural part of any trend. Since we've already seen a clear five-wave pattern, a corrective wave sequence was the most expected scenario. This sequence could form a three- or even five-wave structure. If the market was able to push the pair down for three weeks, it could do so again—but the chances of that are now rather slim.

In my view, sellers (at least at this stage) have given all they could. Despite having no support from the news background (aside from the occasional positive U.S. report), they managed to push GBP/USD down by 400 basis points. Therefore, a pause is likely now.

But whether we'll see a third wave of the current corrective structure remains a big question. I remind you that only 10 days remain until Trump's next self-imposed deadline, and the U.S. president is already warning of new tariffs. Starting August 1, more than 20 countries will be subject to increased trade tariffs, and I have no doubt that Trump won't forget the remaining trade partners either (although calling them "partners" is already a stretch). This means we can expect a new round of escalation in the global trade war—and we all know how the market reacts to escalation.

The wave pattern of GBP/USD remains unchanged. We are dealing with an upward, impulsive segment of a trend. With Donald Trump, markets can expect many more shocks and reversals that may significantly affect the wave structure. However, the current working scenario remains intact. The target for the upward trend segment is now located around 1.4017, which corresponds to the 261.8% Fibonacci extension from the assumed global wave 2. At present, a corrective wave sequence is still unfolding. According to classical theory, it should consist of three waves—but the market may well settle for just one.

Core Principles of My Analysis:

QUICK LINKS