Agentura Fitch Ratings upravila výhled ratingu společnosti TTM Technologies (NASDAQ:TTMI), Inc. a její dceřiné společnosti TTM Technologies China Limited na pozitivní ze stabilního a zároveň potvrdila jejich dlouhodobé ratingy (IDR) na stupni „BB“. Revize přichází proto, že agentura Fitch očekává, že pákový efekt společnosti TTM zůstane v nadcházejících letech pod 3,0x pozitivní ratingové citlivosti, a to navzdory potenciálním tarifním problémům.

Ratingová agentura rovněž potvrdila úvěr na bázi aktiv (ABL) společnosti TTM Technologies, Inc. na stupni „BBB-“ s ratingem návratnosti „RR1“, termínovaný úvěr s prvním zástavním právem na stupni „BB+“/„RR2“ a prioritní nezajištěný dluh na stupni „BB“/„RR4“. Rating nadřízeného zajištěného úvěru ABL společnosti TTM Technologies China Limited však byl snížen na „BB“/„RR4“, což odpovídá kritériím agentury Fitch pro zacházení s ratingy zotavení v jednotlivých zemích.

Společnosti TTM se daří zvyšovat prodeje na trzích s rostoucí poptávkou, dlouhými životními cykly výrobků a příležitostmi k diferenciaci nad rámec desek s plošnými spoji (PCB). Společnost se přeorientovala na činnosti s vyšší přidanou hodnotou dodáváním složitějších komponentů a konstrukčních schopností. Zvláštní pozornost věnovala koncovému trhu v oblasti letectví a obrany (A&D), který představoval 47 % tržeb ve fiskálním roce 2024.

Trade Analysis and Tips for the Euro

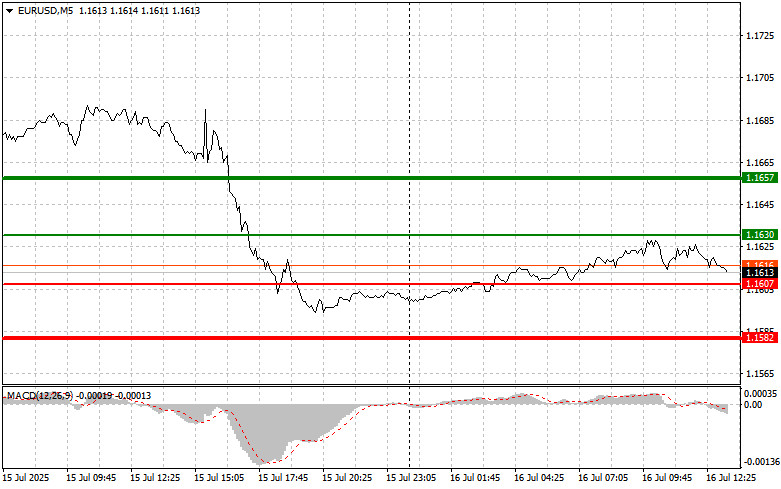

The first test of the 1.1627 level occurred when the MACD indicator had moved significantly above the zero line, limiting the pair's upward potential. For this reason, I didn't buy the euro. The second test of 1.1627, with the MACD in the overbought zone, triggered Sell Scenario #2, resulting in a 15-point decline in the euro.

The euro received little support from eurozone trade balance data and Italy's inflation report. A brief spike caused by these releases quickly faded, returning the market to prevailing bearish sentiment. The stability of the eurozone trade balance and signs of slowing inflation in Italy failed to shift the negative trend, as investors remain concerned about underlying problems in the European economy. Despite signs of easing, inflation remains well above the European Central Bank's target, leaving the ECB with the difficult task of curbing price growth without stalling economic activity. Overall, the outlook for the euro remains uncertain, especially as EU officials have yet to reach an agreement with the U.S. on trade tariffs.

In the second half of the day, key U.S. data will be released, including the Producer Price Index (PPI)—both overall and core (excluding food and energy)—and industrial production figures. These macroeconomic indicators reflect the state of the U.S. economy and inflation trends and may trigger significant volatility in financial markets. PPI serves as a leading indicator of consumer inflation by measuring changes in input prices. Meanwhile, industrial production data shows the level of activity in the U.S. manufacturing sector—an important driver of economic growth.

As for the intraday strategy, I'll continue to focus on executing Buy and Sell Scenarios #1 and #2.

Buy Signal

Scenario #1:Buy the euro today if the price reaches the 1.1630 level (green line on the chart) with the target set at 1.1657. I plan to exit at 1.1657 and sell in the opposite direction, aiming for a 30–35 point move from the entry point. A strong rally in the euro is possible only if U.S. inflation data shows a sharp decline.Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

Scenario #2:I also plan to buy the euro if there are two consecutive tests of the 1.1607 level while the MACD is in oversold territory. This would limit the pair's downward potential and trigger a reversal to the upside. Targets: 1.1630 and 1.1657.

Sell Signal

Scenario #1:Sell the euro after the price reaches 1.1607 (red line on the chart), with the target at 1.1582. I plan to exit there and open long positions in the opposite direction, expecting a 20–25 point rebound. Bearish pressure may return if U.S. price data surprises to the upside.Important: Before selling, make sure the MACD indicator is below the zero line and just starting to fall from it.

Scenario #2:I also plan to sell the euro if there are two consecutive tests of the 1.1630 level while the MACD is in the overbought zone. This would limit upward potential and lead to a downward reversal. Targets: 1.1607 and 1.1582.

Chart Legend:

Important:Beginner Forex traders must exercise caution when entering the market. It's best to stay out before major economic reports are released to avoid sharp volatility. If you choose to trade during news events, always use stop-loss orders to minimize potential losses. Trading without stops can quickly wipe out your entire deposit, especially if you ignore money management and trade large positions.

And remember, successful trading requires a clear trading plan—like the one outlined above. Making spontaneous trading decisions based on the current market mood is a losing strategy for intraday traders.

QUICK LINKS