The euro again collapsed strongly, pulling down other risky assets, including the British pound.

In addition to yesterday's strong U.S. data, which supported the dollar, pressure on risk assets was triggered by new tariff-related tensions initiated by U.S. President Donald Trump's signing of an executive order imposing 25% tariffs on car imports, marking another escalation in the ongoing trade conflict, aimed at supporting American manufacturing. This measure is expected to deal a severe blow to European, Korean, and Japanese automakers. While unsurprising, the decision reinforced fears of a potential global economic slowdown. Expert opinions on the long-term consequences are divided: some believe U.S. protectionism will harm global trade and growth, while others view it as an opportunity to stimulate American industry and create jobs.

Europe has responded cautiously, but retaliatory measures against U.S. imports are expected. This could lead to further escalation of the conflict and additional challenges for the global economy.

Today, the FX market will focus on the eurozone monetary data. In particular, investors and analysts are closely watching changes in the M3 money supply aggregate. This metric reflects the total money in circulation and serves as a key indicator of the region's inflation trends and overall economic health. Changes in M3 can signal potential acceleration or slowdown in economic growth, affecting the European Central Bank's monetary policy decisions. In addition, eurozone private sector lending data will also be released, offering insights into business activity and consumer demand. An increase in private-sector lending typically indicates optimism among businesses and households, which boosts growth and can provide moderate support to the euro.

Market attention will also be focused on ECB President Christine Lagarde's speech. Her remarks may offer clues about the ECB's next monetary policy moves, especially in light of recent reports showing a slowdown in price pressures across the euro area.

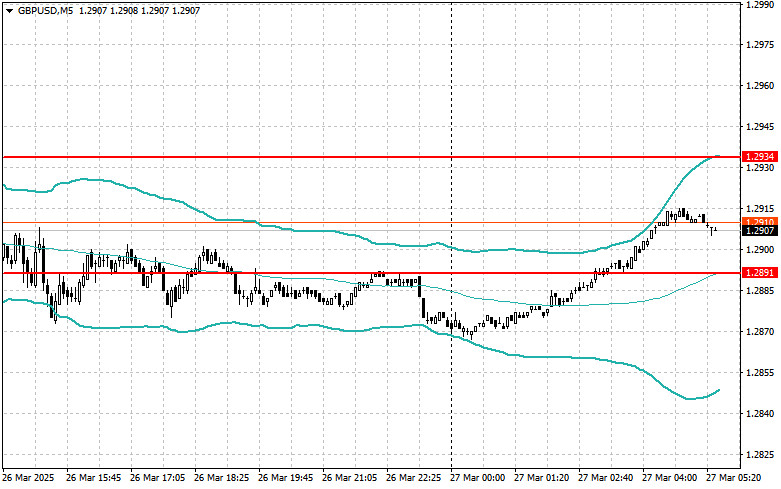

Today's only notable event for the British pound is a speech by Bank of England MPC member Swati Dhingra.

The Mean Reversion strategy is recommended if the data aligns with economists' expectations. If the figures deviate significantly (higher or lower) from expectations, the Momentum strategy is preferred.

Buying on a breakout above 1.0795 could lead to gains toward 1.0836 and 1.0852.

Selling on a breakout below 1.0770 could push the euro down to 1.0736 and 1.0700.

Buying on a breakout above 1.2920 could target 1.2950 and 1.2990.

Selling on a breakout below 1.2910 could drive the pound down to 1.2870 and 1.2841.

Buying on a breakout above 150.25 could push the dollar to 150.55 and 150.75.

Selling on a breakout below 150.00 could lead to declines toward 149.70 and 149.60.

Look to sell after a failed breakout above 1.0803, returning below that level.

Look to buy after a failed breakout below 1.0758, returning above it.

Look to sell after a failed breakout above 1.2934, returning below it.

Look to buy after a failed breakout below 1.2891, returning above it.

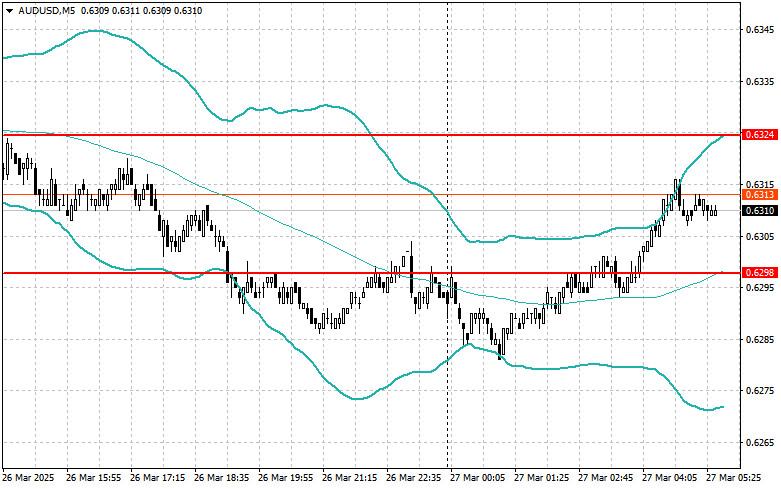

Look to sell after a failed breakout above 0.6324, returning below it.

Look to buy after a failed breakout below 0.6298, returning above it.

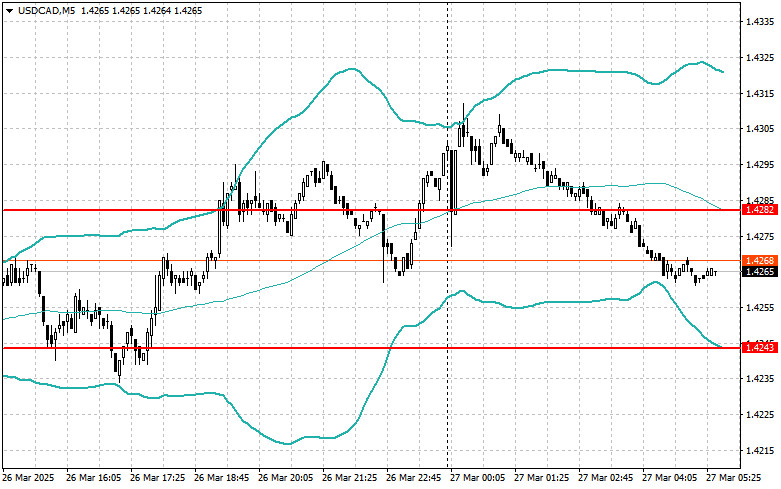

Look to sell after a failed breakout above 1.4282, returning below it.

Look to buy after a failed breakout below 1.4243, returning above it.

QUICK LINKS