Asijské měny oslabily v reakci na silnější dolar poté, co americký prezident Donald Trump potvrdil, že cla na dovoz z Mexika a Kanady budou pokračovat a vstoupí v platnost příští týden.

Dolarový index – který měří hodnotu zelené bankovky vůči několika hlavním světovým měnám – vzrostl o 0,12 % na 107,36, když investoři vzhledem k nejistotě ohledně dopadu cel vyhledávali bezpečnější aktiva.

Indonéská rupie oslabila o 0,78 % na nejslabší úroveň vůči dolaru od dubna 2020.

Jihokorejský won oslabil vůči zeleným bankovkám o 0,71 % na 1 460,6, zatímco indická rupie vůči zeleným bankovkám nepatrně oslabila na 87,351.

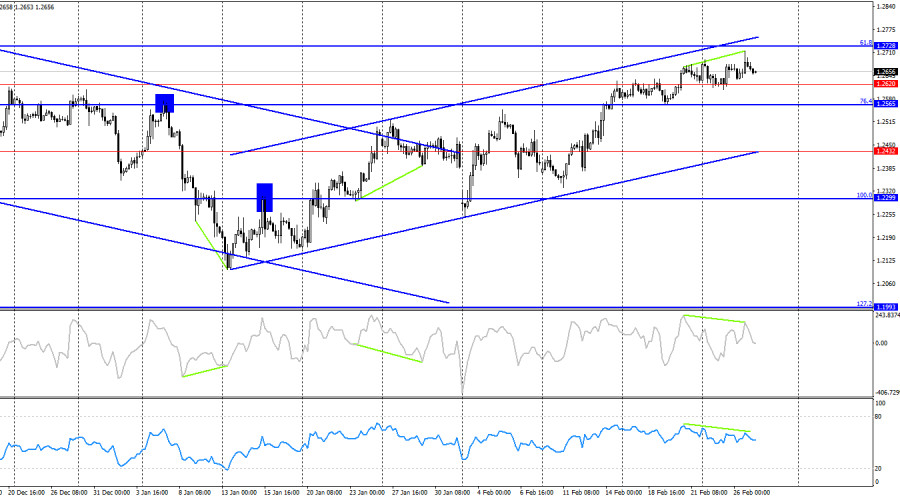

On the hourly chart, the GBP/USD pair rebounded from the 76.4% retracement level at 1.2642 on Wednesday and surged toward 1.2709. The move was executed perfectly, and a rejection from this level favored the U.S. dollar, leading to a decline back toward 1.2642, which is now almost reached. Another rebound from this level could once again trigger a rally toward 1.2709, while a firm break below the 1.2611–1.2620 support zone would signal a sharp decline in the British pound.

The wave structure remains clear. The last completed downward wave did not break the previous low, while the latest upward wave surpassed the previous peak. This suggests that the formation of a bullish trend is still ongoing. However, the waves have been significantly different in size, leading to multiple possible scenarios. At this point, I am not fully convinced that the current bullish trend will persist for another few weeks, but at the same time, the strong recent rally in the pound cannot be ignored.

There was no significant news on Wednesday, but Thursday promises to be a highly eventful day. Overnight, reports surfaced that Donald Trump intends to impose 25% tariffs on all imports from the European Union—and although the UK is not directly targeted, it will be indirectly affected. This sent both the euro and the pound plummeting in sync.

Later today, the U.S. GDP report for Q4 and durable goods orders data will be released. Both reports are considered highly influential, and better-than-expected results could finally allow bears to take full control of the market. The British pound has built a strong defense in the 1.2611–1.2620 zone, meaning bears will need significant effort and strong fundamental support to break through. Trump has already given them a boost with new tariffs, and now it's up to U.S. economic data to determine whether the dollar can maintain its momentum.

On the four-hour chart, the GBP/USD pair continues its upward trajectory, successfully breaking above the 1.2565–1.2620 resistance zone. The next upside target lies at the 61.8% Fibonacci level at 1.2728. The ascending trend channel confirms that bullish sentiment remains intact, although a bearish divergence suggests a possible pullback within the channel.

A decisive break below the trend channel would be the first real signal of a potential pound sell-off.

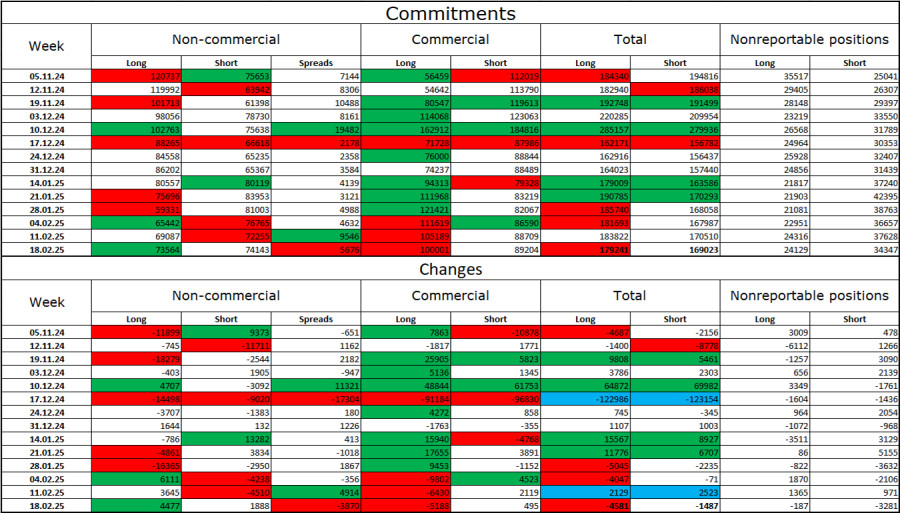

The latest COT data shows that speculative traders have become less bearish. Long positions increased by 4,477, while short positions increased by 1,888.

Bulls lost their market dominance, but bears have also struggled to increase selling pressure. Currently, there is no clear imbalance, with 73,000 long positions vs. 74,000 short positions.

Despite this, I still believe the pound has downside potential, and COT data suggests a slow but steady increase in bearish sentiment. Over the past three months, the number of long contracts has decreased from 120,000 to 73,000, while the number of short contracts has remained relatively stable (from 75,000 to 74,000).

These U.S. reports are among the most important catalysts for today's session, potentially influencing market sentiment for the rest of the week.

Short positions can be considered if the pair breaks below the 1.2611–1.2620 zone on the hourly chart, with a downward target at 1.2538. Yesterday's short opportunities were triggered by a rejection from 1.2709. Long positions are not advisable at the moment, although another bounce from 1.2642 could justify new buying opportunities.

QUICK LINKS