Since Tuesday, the euro has remained within the 1.0350 to 1.0458 range, as investors await today's release of U.S. employment data for January. During this period, the price has stayed above the MACD line, and the Marlin oscillator has been developing in positive territory, reflecting optimistic investor sentiment toward the euro. The forecast for Nonfarm Payrolls stands at 169,000, compared to 256,000 in December, while the unemployment rate is expected to remain steady at 4.1%.

We believe that the actual Nonfarm Payrolls data may slightly underperform expectations, as recent reports on jobless claims, job openings, and layoffs have worsened, often missing forecasts. There is also a possibility that the unemployment rate could rise to 4.2%. Notably, the Federal Reserve itself projects an average unemployment rate of 4.3% for the current year, indicating that, in its assessment, the labor market is nearing saturation.

As a result, we anticipate a breakout above 1.0458, with the euro potentially targeting the 1.0534 to 1.0575 range, which corresponds to the support zone from February to March 2023.

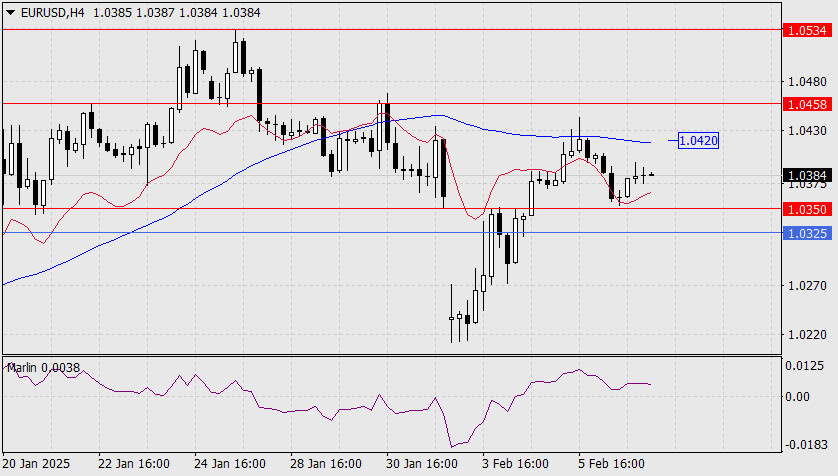

On the four-hour chart, the price is fluctuating between the 1.0350 support level and the MACD line at 1.0420. The Marlin oscillator is near the threshold of a downtrend zone. A breakout above the MACD line would pave the way to attack 1.0458. However, a move below 1.0350 would not immediately signal a further decline, as additional support comes from the daily MACD line at 1.0325. Bears would need to consolidate below this level.

QUICK LINKS