Today, gold, approaching the 50-day simple moving average SMA, met with a new offer, attracting sellers and reversing the positive movement of the previous day.

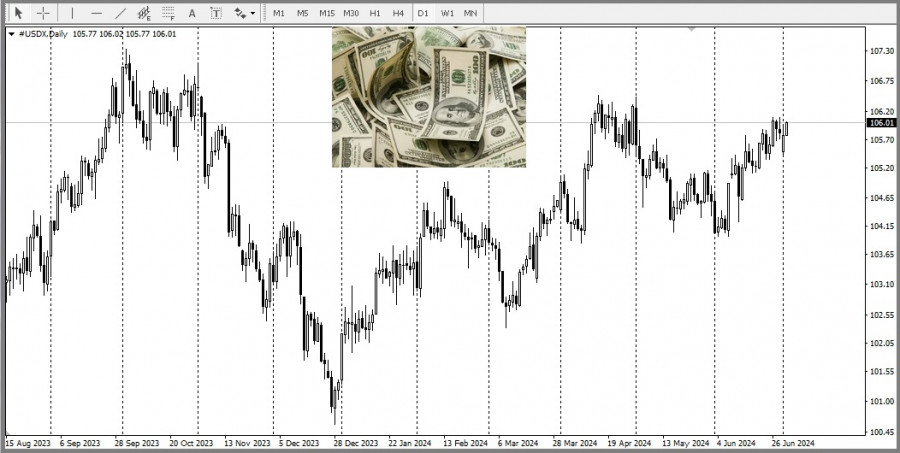

While investors are waiting for new signals about the path of the Federal Reserve's rate cuts, the US dollar is gaining additional strength, a key factor exerting downward pressure on commodities

And the positive tone in the stock markets further contributes to the outflow of funds from the precious metal.

Meanwhile, markets assess the high probability of a September and December Fed rate cut. Hopes for the likelihood of lower borrowing costs were reinforced by the US ISM PMI index published on Monday, which made it clear that June is the third month in a row when the manufacturing sector is shrinking. Prices paid by factories for raw materials fell to a six-month low. This, combined with a drop in US Treasury bond yields, may limit the growth of the US dollar. In addition, China's economic problems, geopolitical risks, and political uncertainty should support the precious metal.

From a technical point of view, the gold price is still trying to overcome the 50-day SMA, which is currently pegged to the $2,337 area and acts as a key reference point. A steady strengthening beyond it will pave the way to the next hurdle in the $2,360 supply zone. Subsequent purchases will allow the bulls to regain the round level of $2,400, aiming to overcome the historical maximum in the area of $2,450, reached in May.

On the other hand, weakness below the $2315 area may find support at the round level of $2300 before the horizontal level of $2285. Failure to defend these support levels will be seen as a new trigger for the bears, lowering the gold price to the 100-day SMA, currently in the $2,260 area. Ultimately, the downward trajectory may lead XAU/USD to the $2225-2220 area on the way to the round level of $2200.

QUICK LINKS