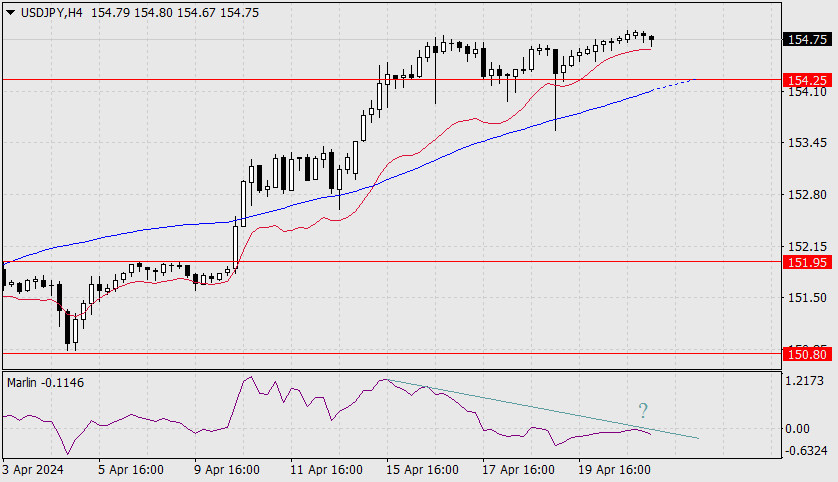

USD/JPY

Economic reports from Japan should have supported the yen, but speculative investor sentiment towards carry trades and the dollar's local strength continue to pull the Japanese currency to new lows against the dollar. Yesterday, the price settled above the price channel line on the daily time frame and this made the nearest target at 155.80.

To overcome such a trend, the Bank of Japan must intervene. They talked about it (at the central bank) when the pair was three figures lower. Perhaps the time has come. Or perhaps the pair may still reach the target of 155.80. The situation is extremely risky for the bulls. If the price consolidates below 154.25, the next target will be 151.95.

A divergence is forming on the 4-hour chart. Simultaneously, with it, the signal line of the oscillator is turning down from the zero line. Perhaps this is a false reversal signal, as they have become more frequent in the last month, but eventually, at some point the signal should turn out to be correct.

The MACD indicator line has already come very close to the target level of 154.25, which is already a sign that the price may forcefully break through the reinforced support and fall further. Intervention could happen as soon as tomorrow. If it doesn't happen then, we will continue to wait for it in the coming days.

QUICK LINKS