The contradictory dynamics of the euro is somewhat alarming. Despite the unfavorable picture of the eurozone with pessimistic data and forecasts, where the cherry on the cake is the energy crisis, the single currency looks quite stable. Should we wait for lows at the level of 1.9000?

The German authorities reported unpleasant economic forecasts. A recession is expected in the country next year. The GDP of the European economy, according to the preliminary autumn estimates of the government, will decrease by 0.4% in 2023.

In addition, the growth forecast for 2022 was lowered to 1.4%. Inflation will be 7.9% this year and will reach 8% in 2023. The figures are not final, adjustments may be made next week, the government said in a statement.

Retail sales in the eurozone sank by 0.3% on a monthly basis in August against the expected 0.4%. On an annualized basis, the indicator fell by 2%, which is higher than the forecast value of 1.7%.

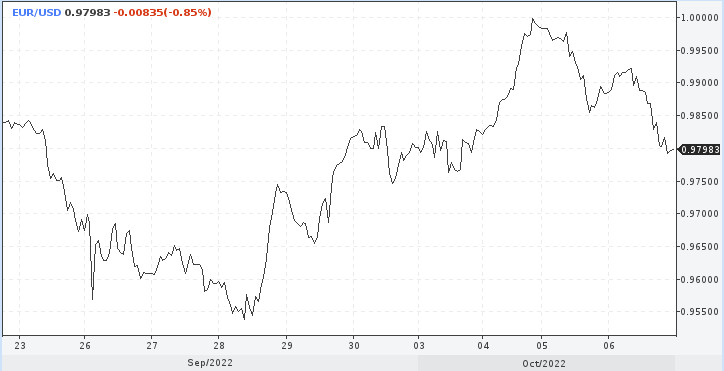

Both macroeconomic factors did not cause an immediate reaction in the euro, which continued to trade with small losses on Thursday. The decline of the EUR/USD pair intensified only in the US session amid a growing dollar index.

At the beginning of the week, there was a clear rebound from the lows as a result of the emerging risk appetite. Bulls on EUR/USD aiming to break through the parity upward. Everything seems to be logical, but... At this point, other currencies such as the Canadian, Australian, New Zealand dollars and even the Swiss franc could not recoup, that is, they almost did not rise against the dollar.

It turns out this way: when the dollar rose, the euro fell slower than other currencies, and when the dollar adjusted down, the euro grew most vigorously. Although the same Canadian dollar had a good factor for recovery in the form of a sharp rise in oil prices.

The behavior is strange, however, it does not change the overall picture for the euro. From the point of view of the trade balance, budget stability, the level of public debt to GDP and taking into account the high risks of recession, the euro still looks weaker than other currencies of developed countries.

If, as a result, the recovery in the markets resumes, the euro should not be ahead of everyone, but behind. The future of the bloc does not bode well for the single currency – a recession and a debt crisis are on the horizon.

Yes, the euro has recently received support due to harsh statements by representatives of the European Central Bank, but this phenomenon is temporary. It is not a fact that the central bank will decide to raise the rate by 75 bps at the October meeting. Maybe it will cost a step of only 50 bps.

If inflation does push the ECB to tighten policy more aggressively, then the question will arise about government debt yields. The national debt of Italy, as you know, is a time bomb that will explode according to the Greek scenario. Last week, yields on Italy's 10-year debt tested the peaks since 2013 at 4.8%. Then they rolled back, then went up again. The moral is that as a result it will be possible to see at least 5%.

If we turn to history, the euro's fall amid the debt crises has always been significant. Economists, analysts and strategists each time started talking about the possible collapse of the euro bloc. This was the case during the Greek crisis, when the euro collapsed from the area of 1.4000 to 1.2000.

Now everything starts in a new circle of the current Italian scenario. It is possible that once again they will begin to "bury" the eurozone, especially since Italian problems are much more dangerous than Greek or Spanish ones and occur at such a difficult time for the world as a whole.

The EUR/USD pair is highly likely to test the 0.9500 level, and even the growth of risk appetite is not an ally here.

The eurozone is on the verge of recession, the deepest recession is expected in the winter months, so the EUR/USD pair may well aim for the level of 0.9000.

"Three quarters of negative growth and the still hawkish position of the Fed is a strong bearish cocktail for EUR/USD," according to ING economists, who also adhere to the scenario of a drop in the quote in the area of 0.9000.

"The increase in gas prices this winter will put pressure on the trade balance of the eurozone. This could lead to the euro falling to the lower limit of the 0.9000-0.9500 range over the next three or six months," ING predicts.

A potential reversal is possible in 2023 if the Federal Reserve starts to stick to dovish rhetoric, and the eurozone comes out of recession.

QUICK LINKS