American businessman Robert Kiyosaki said it's time to use the aggressive stance of the Federal Reserve to buy more gold, silver and bitcoin. This is because further rate hikes will strengthen dollar, which will lead to lower prices for the three assets. And once the Fed shifts to a softer policy, prices will soar, giving huge profit.

Kiyosaki added that the strength of dollar is unlikely to last long, especially since it traded near 20-year highs for the entire third quarter.

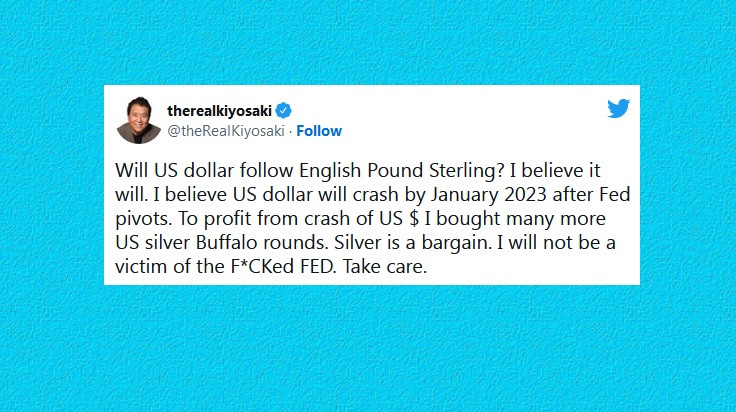

In fact, in his recent tweet, Kiyosaki wrote that dollar will collapse by January 2023 after the Fed's turnaround.

He also said that silver will jump to $100, then to $500 within this decade. The reason is that stocks, bonds, mutual funds, ETFs and real estate are crashing, which pushes silver to trade around $20, allowing everyone to afford the metal.

He mentioned the gold-to-silver ratio as well, stating that in the 20th century the ratio was 47:1, meaning that it took 47 ounces of silver to buy one ounce of gold. Now, this ratio is about 83:1.

With this, Kiyosaki explained that investors should protect their portfolios with hard assets, such as gold and silver, as the biggest crash in history unfolds.

QUICK LINKS